Last week, the Bank of England (BoE) hiked the UK’s interest rates to 1%. The central bank also forecast that the UK economy will contract later this year, as disposable income decreases. With uncertainty surrounding the future of the UK’s economy, here are two stocks I’m avoiding for my Stocks and Shares ISA, and one I’m planning on buying.

Losing interest

In theory, banks such as Lloyds (LSE: LLOY) usually stand to benefit from higher interest rates. This is because banks can charge more for loans. Moreover, the rapid increase in house prices has brought a healthy stream of revenue to Lloyds. Nonetheless, the Lloyds share price is down 10% this year.

I’m avoiding this stock as I’m worried the bank’s profit might take a considerable hit from lower borrowing numbers and a slew of potential bad debts. With the BoE set to continue increasing interest rates in the coming months, Lloyds’ best-case scenario seems unlikely to happen at this point. Why? Well, the bank rate could rise further, which would be a plus for the group. But the BoE predicts inflation to peak at 10% later this year, much higher than the 7.6% upper level Lloyds would like to see. And hoped-for house price growth of 5.3% is dubious, as Nationwide and Halifax predict a slowdown in the market.

| Conditions To Be Met For Stock Upside | 2022 (%) |

|---|---|

| GDP | 3.6 |

| UK Bank Rate | 1.39 |

| Unemployment Rate | 3.3 |

| House Price Growth | 5.3 |

| Commercial Real Estate Price Growth | 9.1 |

| CPI Inflation | 7.6 |

Grocery wars

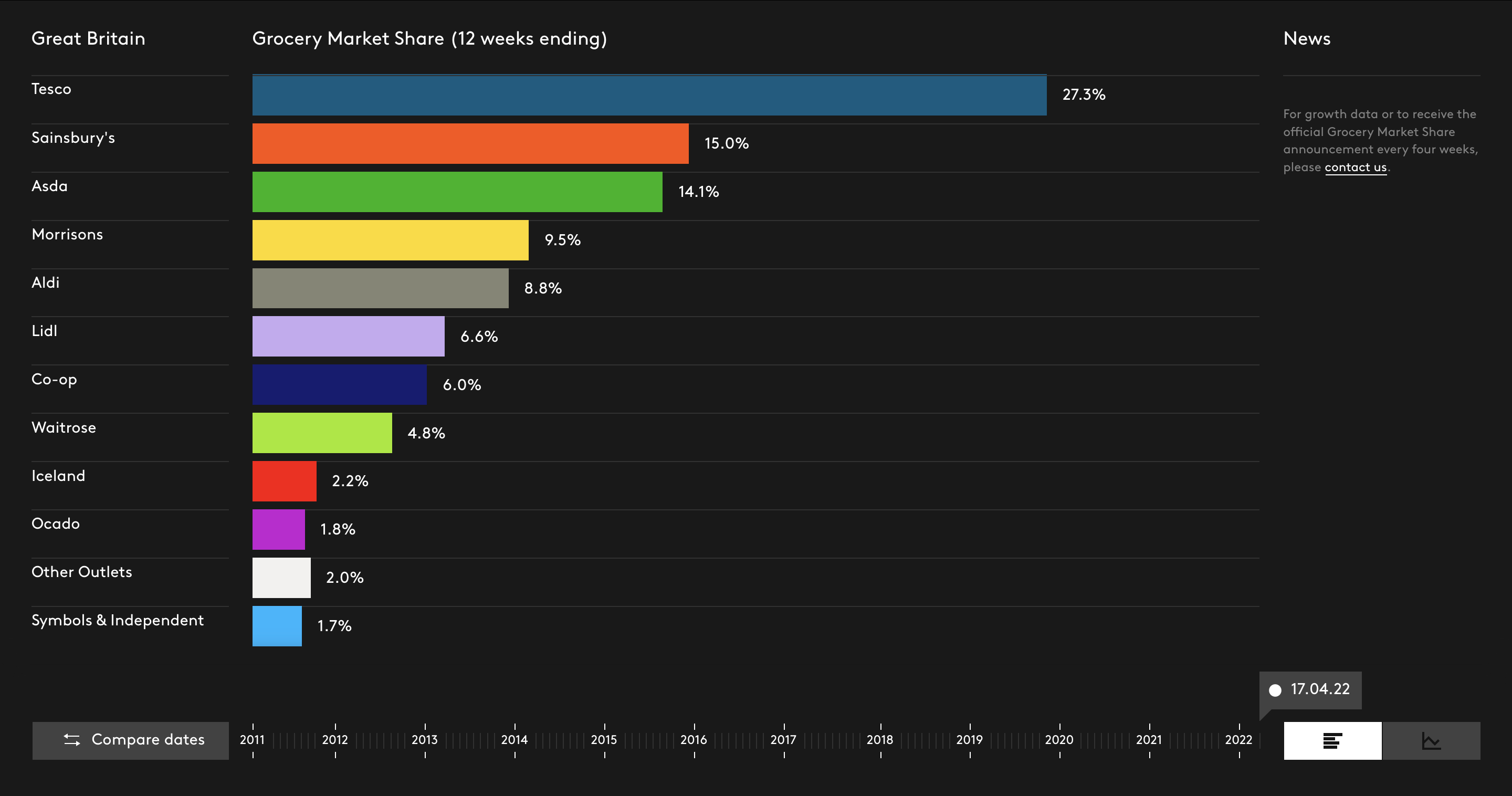

The other stock I’m avoiding is J Sainsbury (LSE: SBRY). Despite being the second largest supermarket in the UK, the orange grocer has been losing a substantial portion of its market share to Aldi and Lidl. Its most recent trading update provided a rather gloomy outlook as well. Management cited, “Significant external pressures and uncertainties, including higher operating cost inflation”. This sent its stock price lower to £2.27.

Prior to the current cost of living crisis, Sainsbury’s was already operating on slim profit margins (2.3%). Now with pressure to keep prices low in order to avoid losing more market share, the retailer could very well see its margins contracting. Ultimately, Sainsbury’s will have to perform a balancing act of maintaining margins and holding its market share. Having already such low margins, this is one stock I’m unwilling to gamble with.

An ETF to stock up on

But there’s a stock I believe can add value to my Stocks and Shares ISA. It’s an ETF — Vanguard’s S&P 500 UCITS ETF (LSE: VUSA). The ETF tracks the USA’s top 500 listed companies, and averages a return of approximately 10% per year. Research has shown that almost 80% of fund managers underperform Warren Buffett’s favourite index. Therefore, while I generally like to pick my own stocks, I’m unwilling to gamble on professional managers’ stock-picking to beat the market. Although the heavyweight index is almost 15% down this year, it has a solid record of recovering from crashes.

Even better, Vanguard’s fund has outperformed the S&P 500 by 10%. This is due to its ability to hedge against the British pound by using the strength of the US dollar. On that basis, I think this is the best stock I can invest in to generate meaningful returns over a long period.