The Peloton (NASDAQ:PTON) stock price is down 77% from its December 2020 all-time high. Over the last two years, the company has lost about $35bn in market capitalisation. The recent poor performance of Peloton might come as a surprise, as it was, at least initially, a pandemic success story.

Figure 1. Interactive Peloton Stock Price Chart

Peloton supplies high-end stationary bikes and treadmills. A monthly household subscription, which costs $39, transforms the equipment into an interactive fitness platform. Subscribers access live classes to fit their schedule, activity tracking, leaderboard competitions, and connection with other members. No Peloton hardware is required to subscribe to the Peloton app for $12.99 per month, but the features are less extensive.

Pelotons bikes and treadmills cost anywhere between $1,745 and $2,845, including delivery and set-up. This also includes a recent price hike, which the company blamed on inflation and supply-chain issues. At those costs, I was sceptical. However, during 2020, as gyms closed, Peloton bikes flew off the shelves. Revenues doubled in the 2020 fiscal year and more than doubled the year after.

Table 1. Selected annual income statement items (in USD) and ratios for Peloton.

| 29/06/2018 | 29/06/2019 | 29/06/2020 | 29/06/2021 | |

| Total Revenue | 435,000 | 915,000 | 1,825,900 | 4,021,900 |

| Gross Profit | 189,000 | 383,600 | 836,700 | 1,452,000 |

| Operating Income | (47,600) | (202,200) | (917,600) | (187,900) |

| Net Income | (47,900) | (195,600) | (71,600) | (189,000) |

| Gross Profit Margin | 43.4% | 41.9% | 45.8% | 36.1% |

| Operating Profit Margin | -10.9% | -22.1% | -50.3% | -4.7% |

| Net Income Margin | -11.0% | -21.4 | -3.9% | -4.7% |

Source: Peloton 10-K forms

As a percentage of revenue, operating and net income losses narrowed in 2021. Peloton continued to add subscriptions throughout the 2021 fiscal year, bettering its 2020 performance on this metric. It appears existing customers are sticking with the monthly subscription even as gyms reopen. Peloton products are expensive. That might motivate people to keep using them. Peloton has been clever with its marketing in placing bikes and treadmills as centrepieces in the home. They are high-quality items that people want to display and not stick in the garage.

Post-pandemic Peloton

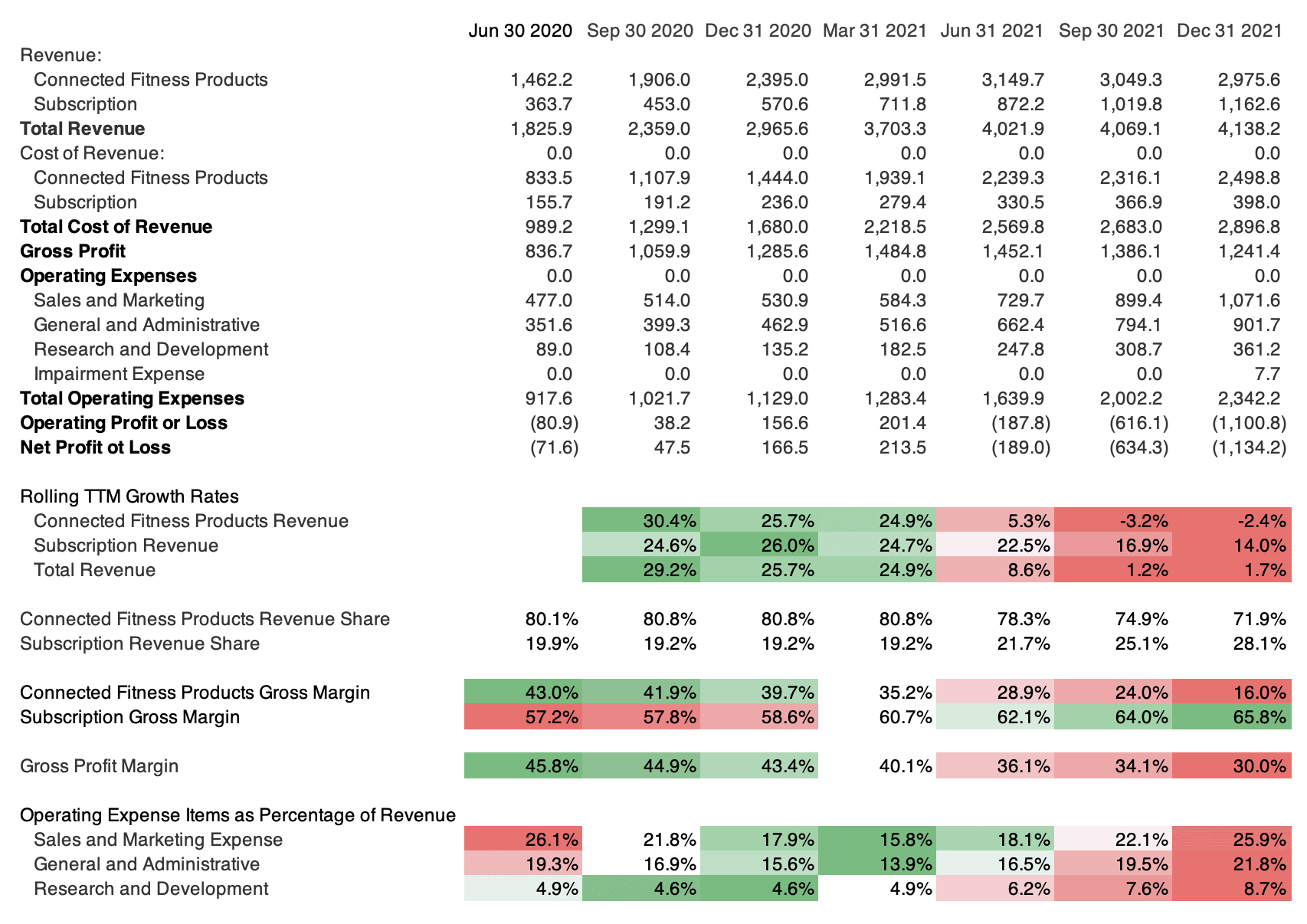

Choosing Peloton when other options are unavailable is one thing. The company is marketing to the converted. When gyms are open, a different strategy has to be employed. It would appear that Peloton management failed to notice this. A scathing presentation by Blackwells Capital lays the blame at the door of Peloton’s CEO. Looking at rolling trailing 12-month income statements reveals that Peloton’s financial performance started to deteriorate in early 2021. People spent less time and money on Pelton’s equipment as the world began to open up. However, the company was forecasting increasing demand, and inventories were building even as growth rates slowed. There were also product recalls after reports of serious incidents caused by Peloton equipment, which the company handled poorly.

Table 2. Rolling Trailing 12-Month Income Statements for Peloton (all figures in millions of USD)

Source: Peloton 10-Q forms

Last week, Peloton’s under-fire CEO was replaced, although he will remain as executive chairman. At the same time, the company rolled back its forecasts for the 2022 fiscal year and laid off 2,800 staff, which is consistent with an outfit that had scaled its operations and expectations too far.

Existing shareholders seem satisfied with the change of direction as the share price rose to 25% in response. Will it rise more? Well, Amazon and Nike are suggested to be interested in acquiring the business. Any offer would likely move the Peloton stock price higher. Aside from an acquisition, the company and its new CEO will have to get revenue growing again. After all, Peloton is priced for growth, so investors will want to see it.