Supply@ME Capital (LSE:SYME) is a digitally native supply chain financing company. Any mention of supply chain financing rings alarm bells for me. Greensill Capital went bankrupt in March of this year; it provided supply chain financing. Before that, there was the collapse of Carillion. That time it was the company getting supply chain financing that ran into difficulties.

That does not mean Supply@ME is destined for the same fate. Supply chain finance in itself was not the problem in either of these high profile bankruptcies. However, Supply@ME has a complicated business model and is financing unsold inventory, where traditional supply chain financing deals with invoiced sales. Supply@ME is also new to the stock market, having listed by way of a reverse takeover in April 2020. The UK’s financial regulator has only just allowed Supply@Me shares to trade again and seemingly given it a clean bill of health. But, I am still approaching the stock with a high degree of caution.

How does Supply@ME make money?

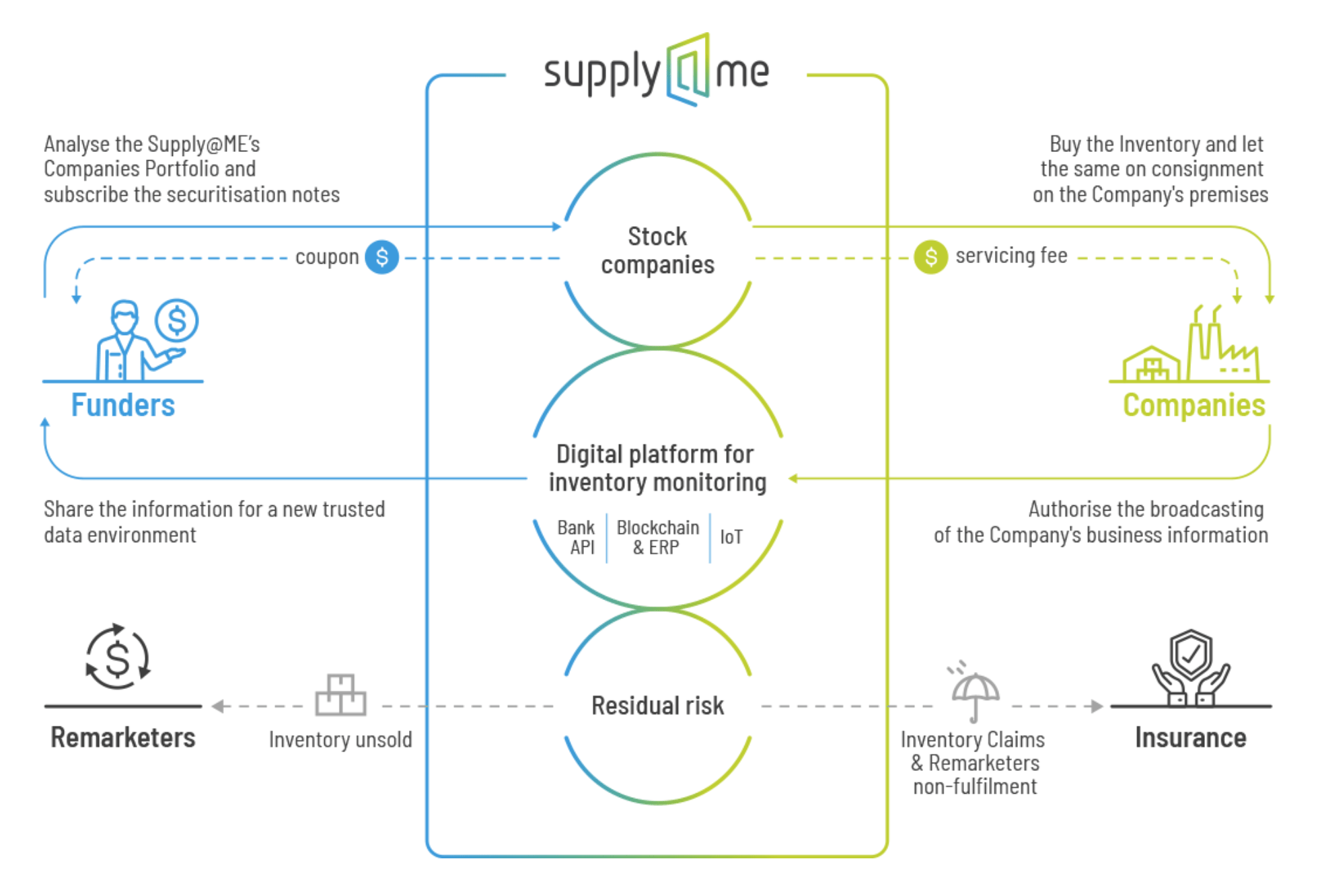

It isn’t easy to get a handle on what Supply@ME does, but here is what I have been able to ascertain. Supply@ME owns shell companies that buy unsold inventory, be it raw materials or finished goods. Supply@ME packages the inventory purchases into securitised notes which it then sells to funders. The inventory sellers lease back the inventory, so it remains on their premises.

Source: Supply@ME Annual Report

The companies that sold the inventory to Supply@ME can repurchase it slowly, with a markup, presumably to make an actual sale to a customer themselves. Remarketers will be used if inventory remains unsold, presumably on behalf of Supply@ME. Insurance claims will be relied upon if the remarketers fail.

If this all sounds complicated, it’s because it is. And it’s going to get more complex.

Supply@ME share price

Supply@ME has acquired TradeFlow Capital Management. This Singapore-based outfit uses a fund type structure to provide non-credit financing to commodities companies with goods in transit or storage.

The acquisition was a cash and stock deal. A £5.6m issue of convertible loan notes in June 2021 covered the cash part. The creation of around 1.48bn new Supply@ME capital shares, or around 5% of its existing share count, covered the stock part. There is the possibility of nine further tranches of notes being issued, which suggests the company is not done on the acquisition front.

Supply@ME is still loss-making — 2,964m in 2020 — but revenue grew sharply from £4m in 2019 to £1,147m in 2020. The number of client companies has more than doubled. But, one single company seems to be responsible for 6% of the total amount of inventory sales which is a worry.

I don’t doubt there is demand out there for monetising unsold inventory, which Supply@ME will continue to tap. But I do not think the Supply@ME share price is a bargain. Its business model is tough to get to grips with. The design seems to be intended to prevent Supply@ME and its customers from being in a creditor-creditee relationship. Maybe that’s the point, but it leaves me unsure who is liable if inventory remains unsold and it cannot be insured, which is possible. I can see the possibility of financial difficulties and perhaps legal wrangles. I will not be buying this stock for my Stocks and Shares ISA.