I bought shares in Open Orphan (LSE:ORPH) in my Stocks and Shares ISA when it traded as Venn Life Sciences. Venn was once a stand-alone integrated drug development consultancy. But it was struggling to attract customers. A strategic collaboration with then stand-alone Open Orphan, which focused on rare and orphan drugs, in 2018 made sense. Orphan drugs are for conditions that are so rare that it is often not profitable to develop them without assistance, typically government financing and outsourcing to service companies like Venn.

In 2019, Open Orphan bought Venn. Then Open Orphan completed a reverse takeover of hVIVO, a pioneer in viral challenge studies. These types of studies can help accelerate the development of drug and vaccines for respiratory and infectious diseases. Open Orphan now provided, in the words of its CEO:

…early clinical development services, clinical trial delivery expertise and virology-related challenge studies, with a particular focus on rare and emerging diseases…our 24-bed quarantine facilities in the UK are best in class for vaccine and virus-related development…

The reverse takeover of hVIVO completed in January 2020, about the same time as the coronavirus pandemic started to sweep across the world.

Covid-19 impact

It was, for want of a better word, luck that Open Orphan had a unique set of services that suddenly saw increased demand as the pandemic broke. But, Open Orphan’s management did seize the opportunity. A slew of work on not just Covid-19 but other respiratory infections has come Open Orphan’s way in 2020 and into 2021. In the last quarter of 2020, the company became operationally profitable.

Over the last year, the Open Orphan share price has rocketed by 429%. As an Open Orphan shareholder, I am delighted. But, I am not going to cash in just yet. I think there are further price rises to come. The Covid-19 pandemic has woken the world up to the threat of emerging viral diseases and the burden of existing ones. The study and production of vaccines and treatments for these types of diseases will continue indefinitely.

Open Orphan is now focused on testing vaccines and antivirals using human challenge study clinical trials. It has built expertise and reputation in this area that it can leverage in the future. Its facilities are booked until the end of 2021, and its new patented data platform of various biomarkers might be of interest to big tech, wearables, and traditional biopharma industry companies.

Open Orphan demerger

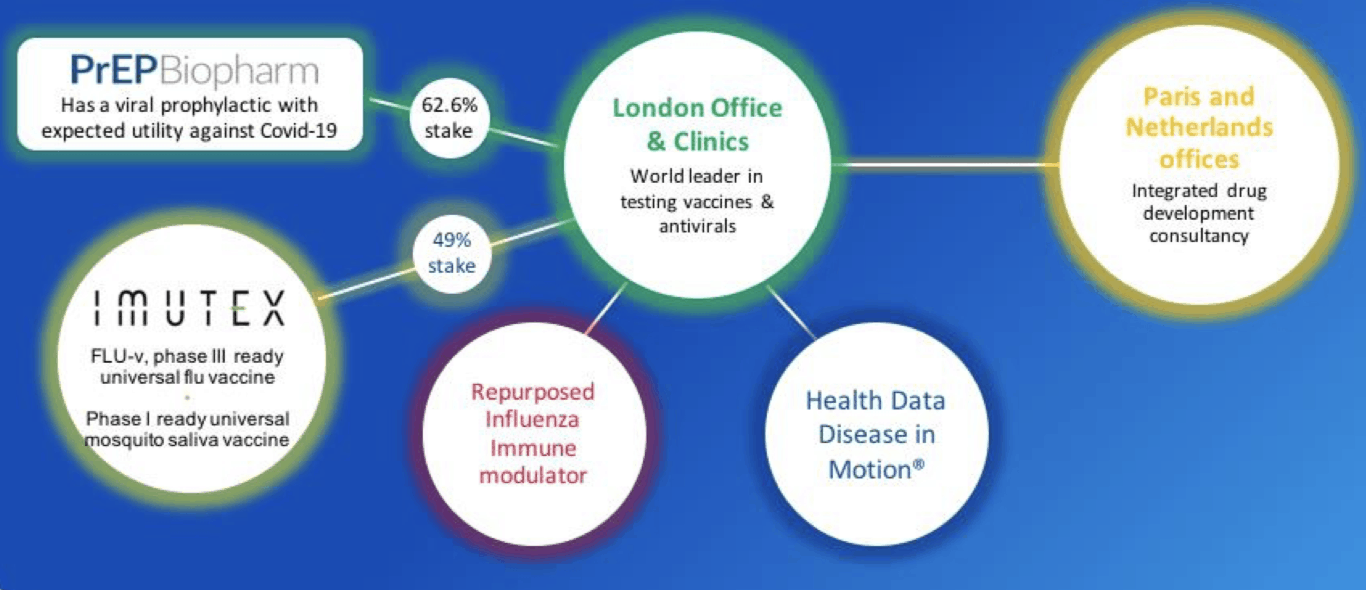

Open Orphan is a life science service company. It has acquired, through the hVIVO deal, wholly-owned intellectual property for developmental treatments. Open Orphan is planning to spin off these developmental assets into a separate company. The company will retain equity stakes in two developmental businesses. As a shareholder, I will vote in favour of the move in the general meeting on 29 April 2021.

Source: company presentation

If the motion is passed at the general meeting, and I think it will be, I will end up with two sets of shares. I want the Open Orphan shares, but I don’t want the shares in the developmental asset company. It looks like I will have to wait for up to nine months before I can sell those unwanted shares. Therefore, I will not be buying any more Open Orphan shares before the planned demerger. But, after it completes, I will.