One UK stock that’s had a huge bounce recently is Amigo Holdings (LSE: AMGO). Over the last month, its share price has more than doubled to 13.75p. However, over 12 months, it’s still down about 45%.

Is this a stock I should consider for my own portfolio? Let’s take a look at the investment case.

Amigo Holdings: business description

Amigo Holdings is a UK-based guarantor loan company that allows people to borrow between £2,000 and £10,000 with a guarantor (someone, usually a friend or family member, who agrees to back up the borrower and step in to make repayments if they don’t). Amigo’s aim is to give people the chance to borrow even if they don’t have a great credit score.

Amigo listed on the London Stock Exchange back in 2018 at an Initial Public Offering (IPO) price of 275p. Since then, the stock has underperformed badly, falling to near 5p in June last year. At its current share price, its market capitalisation is about £62m.

Recently, the company has appointed a new leadership team in an effort to turn itself around. “We are a new leadership team that wants to correct past mistakes in a way that is fair and equitable to all our customers – including our 700,000 past borrowers and guarantors,” Amigo said in a statement.

It’s worth noting that a couple of directors have purchased a small amount of shares recently, which could indicate they expect Amigo’s share price to rise.

Amigo’s Q3 results

Looking at Amigo’s recent third-quarter results for the period ended 31 December, the company appears to be struggling.

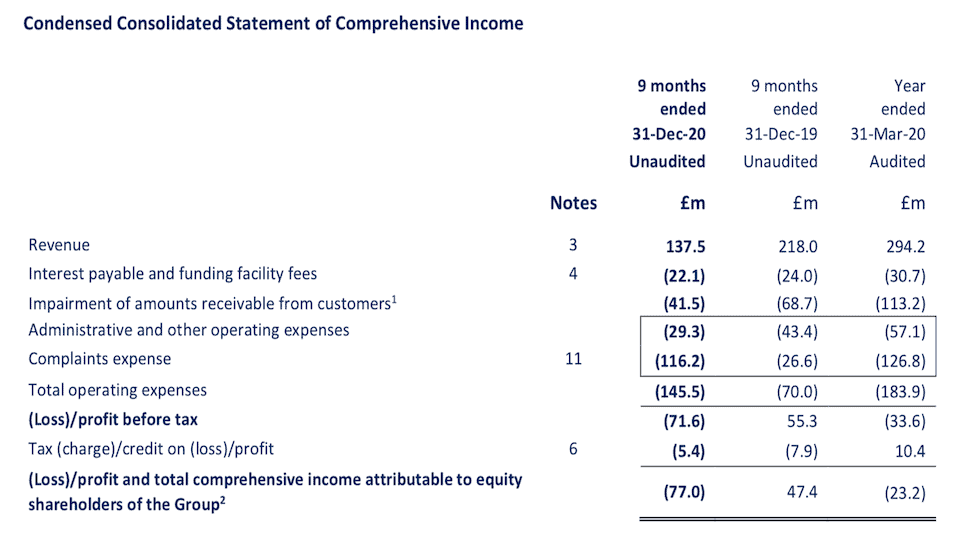

For the nine-month period, revenue also came in at £137.5m, down from £218m in the same period in 2019. This drop in revenue was driven by a pause in all new lending and the loss arising from Covid-19-related payment holidays (62,000 customers had been granted payment holidays as at 31 December). Meanwhile, the company generated a loss before tax of £71.6m, compared to a pre-tax profit of £55.3m in the year before.

What stands out to me here is the ‘complaints expense’. This surged to £116.2m for the period, up from £26.6m in the year before.

Source: Amigo Holdings

Looking ahead, analysts expect full-year (ending 31 March) revenue of £176m. For the following year, the consensus revenue forecast is £128m.

Turning to the balance sheet, the company reported non-current liabilities of £344.1m at 31 December. Equity on the balance sheet was £153m, giving a long-term debt-to-equity ratio of a high 2.2.

Complaints risks

Going back to the complaints issue, this appears to be a big problem for Amigo. According to the Financial Ombudsman Service, complaints about guarantor loans soared last year. Between October and December, there were more than 10,000 related complaints, up from just over 300 in the same period a year before.

Many of the complaints – which ranged from borrowers saying their lender shouldn’t have given them a loan because they couldn’t afford it, to family members claiming they didn’t agree to be a guarantor – were about Amigo. This issue adds risk to the investment case.

My view on Amigo shares

Putting this all together, Amigo isn’t a stock I want to buy right now. It just looks too risky. There are lots of other stocks I’d rather buy that are a better fit for my portfolio.