Yesterday the Dow Jones Industrial Average closed above 30,000 for the first time. That is a remarkable turnaround, given that the Dow slumped to under 19,000 in March this year. From its March low of under 2,250, the S&P 500 index has risen to over 3,600.

Both the S&P 500 and the Dow are back above their pre-market crash highs. Meanwhile, the FTSE 100, while still well over 1,000 points above its market crash lows, is well shy of its pre-crash highs.

And it’s not just the FTSE 100. Both the French CAC 40 and the German DAX also sit below their pre-crash highs and lag their American counterparts.

Why is the S&P 500 outperforming?

In the US, unemployment benefits were increased in light of the coronavirus pandemic. In the UK and Europe, firms were given support to pay wages to furloughed staff. One theory is that allowing people to lose their jobs in the US means they can, over time, move into more profitable parts of the economy. In Europe and the UK, furloughing staff in otherwise unprofitable areas of the economy, and keeping ailing firms alive, might hold up the creation of more productive jobs and place a drag on the economy.

The spectre of Brexit is still hanging over the UK and Europe. Uncertainty around the future relationship between the UK and Europe will be a headache for businesses looking to plan for the future on both sides of the channel. Investors might also be lacking confidence. This is not positive for the FTSE 100 and European stock markets.

A weakening US dollar, against both the pound and euro, is also favourable for profits of American firms and its stock markets. A weaker dollar means foreign profits converted back to dollars are increased. That’s good for US markets. However, since the dollar is weaker, the pound and euro are stronger, so any US profits will shrink in pound and euro terms. That isn’t good for European markets.

FTSE 100 lacking tech stocks

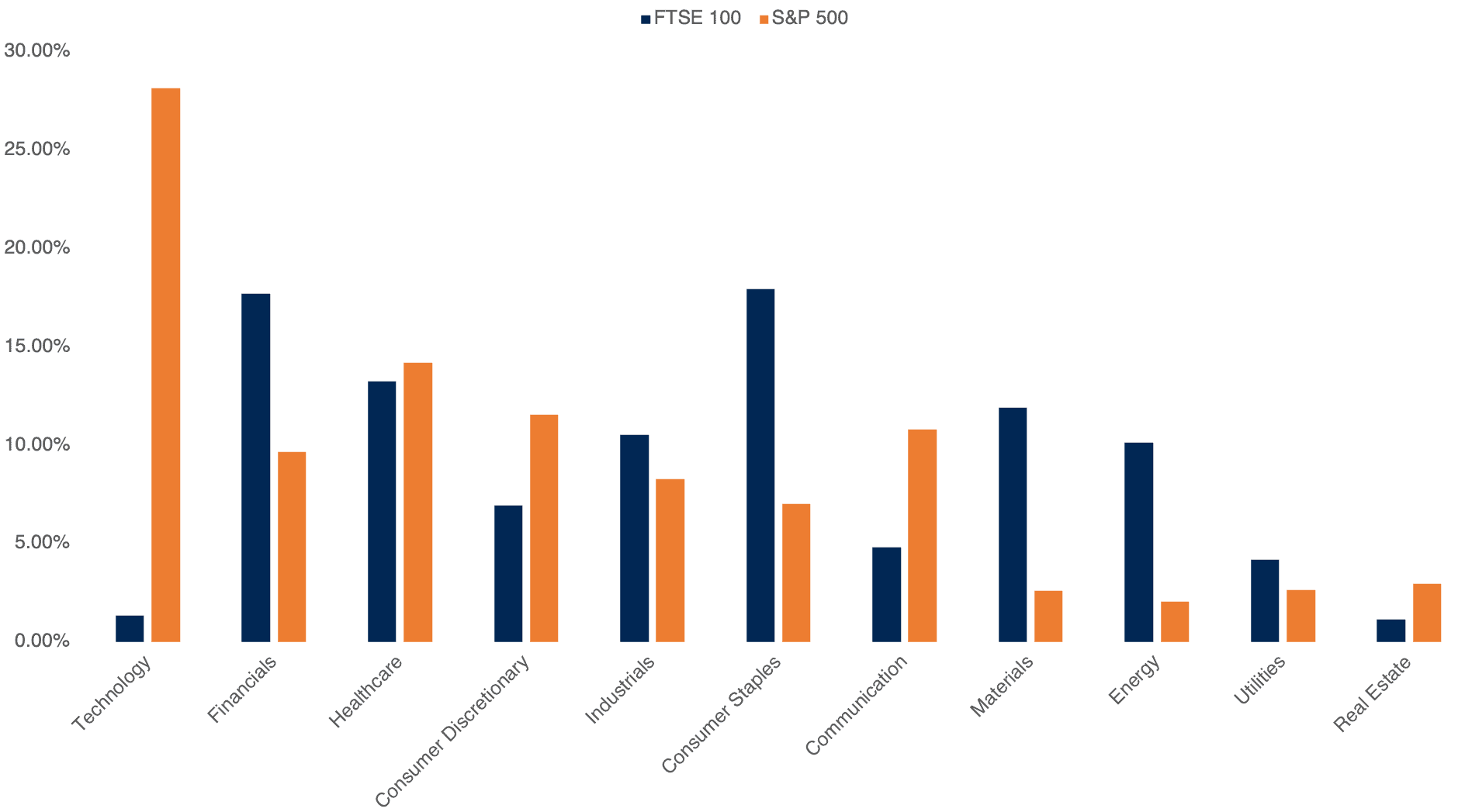

I think the main reason the FTSE 100 lags both the S&P 500 and the Dow is down to the type of stocks in it. In the chart below, the sector weightings of the FTSE 100 and the S&P 500 are compared. The S&P 500 has significantly more tech exposure than the FTSE 100. The FTSE 100 has much more exposure to energy (including oil and gas stocks) and financials (which includes banks).

Source: Author’s own calculations

Tech stocks have been on a tear this year. Banks and oil majors have suffered. Of all the reasons offered, I think the fact that the FTSE 100 is underexposed to the best performing sectors and overexposed to the worst explains its underperformance best. The Dow, although often considered stodgy and old economy-focused, has the likes of Microsoft and Apple in it.

Unless the structure of the FTSE 100 changes, then it will likely continue to underperform the S&P 500. However, that does not mean all FTSE 100 stocks are laggards. Some, like Ocado and Scottish Mortgage Investment Trust, are up 90% over a year. So, picking the right stocks can make a huge difference to returns. And let’s not forget that over the last 10 years, the FTSE 100’s dividend yield has been a little under around 4% on average. The S&P 500’s average yield is closer to 2%. So, income investors might find the FTSE 100 a fertile hunting ground.