This year overall was very tough for the Cineworld (LSE:CINE) share price. But in one week, the stock has managed to rise by 23%. For shareholders, is this worth celebrating?

Cineworld share price surge

My colleague Jonathan was probably right in saying that the lockdown easing might have been behind the rally in Cineworld stock. Many restrictions were lifted in the UK on 15 August. Some cinemas only started reopening on 21 August, but Cineworld had reopened its UK sites on 31 July. Indeed, it looks like the situation with cinema visits has improved overall compared to April. In theory, there should be a boost to the company’s revenue.

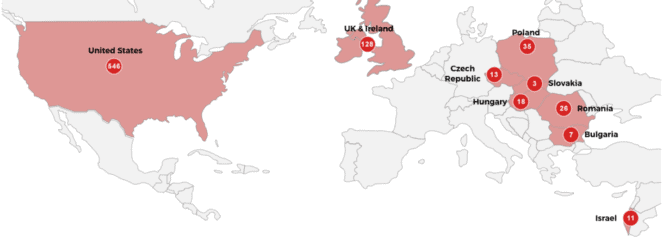

But let us not forget that Cineworld is an international cinema chain. This means it is reliant on many countries’ regulations. Of its locations, 70% are located in the US. The UK market is important for the company too, with 128 cinemas operating here. The map below shows just how important each country is for the firm’s revenue.

Source: Cineworld

In the US, the cinema chain started reopening a week ago. Cineworld reopened a third of its theatres on 21 August. Another third resumed operations on Tuesday, with the final third reopening on Friday. As concerns Europe, most EU countries have reopened cinemas long ago.

All that sounds very positive for the Cineworld share price and the company’s cash inflows. But is it too early for the shareholders to drink Champagne?

Coronavirus fears

Although the lockdown easing rally is quite pleasing, the coronavirus fears are here to stay, I think. In spite of all the safety measures in place, many customers are still unwilling to go out. What’s more, social distancing and all the extra precautions might in fact discourage people from going to cinemas. They may simply not feel comfortable and relaxed, while following these regulations.

But most importantly there’s the possibility of a second lockdown both in the UK and the US. Although the infection rates have stabilised somewhat, it is quite likely that there’ll be another Covid-19 wave. So, the possibility remains that governments might have to ban indoor public gatherings.

As concerns the Cineworld’s financial position, it is not perfect. The company’s credit rating is B3, which is speculative or high risk. That’s mainly because of the high debt level. At the same time, ratings agency Moody’s considers the company’s cash balance to be sound because of the money it has borrowed. What’s more, the company is also now leaner and fitter because of its cost-cutting initiatives.

But the key question here is when will the pandemic be over. There’s plenty of uncertainty here but I personally believe that it might last for a while. Obviously, the longer it lasts, the worse it is for the company.

Will the Cineworld stock rally continue?

Technically, the rally can continue for a while. The 52-week high reached by the Cineworld share price was 244.70p. Now the stock is trading at around 60p per share. So, it seems that there is some potential for growth. At the same time, I still think that there’s not enough clarity right now. Overall, I think it’s too early for the shareholders to celebrate. The Cineworld stock might be an attractive investment for people willing to accept some additional risks. Otherwise, I’d recommend conservative investors to look elsewhere.