Tesla shares surged almost 1,000% in the last 12 months. And I understand UK investors as well as from other countries wonder if they’re still a buy.

I have quite a special relationship with this company. Although I’ve never owned a single share of this car maker, I was recommended to buy some about a year ago. A trader and friend of mine told me it was “the company of the future“. It was end of May 2019. The firm’s shares cost less than $200 a piece. But Tesla’s sales were falling rapidly and the company was forced to close some of its factories. The competition was rising too. And I considered investing in Tesla shares to be highly risky at the time when the price was less than $200. But let me explain why I don’t regret my decision.

UK investors to buy Tesla?

I perfectly understand people who like to spread their risks. It might, indeed, be a good idea to invest some of your savings in other currencies and overseas companies. After all, in the UK the risks of a no-deal Brexit are quite high and the national economy contracted by almost a quarter as a result of the Covid-19. But it’s essential to choose carefully before buying shares in individual companies. In case of doubt, it would probably be best for UK investors to put some of their savings in a foreign stock index fund.

Tesla shares and their fundamentals

The stock surge was impressive, indeed. As I’ve mentioned earlier on, the shares traded way below $200 a piece last June. But the all-time high of $1,794.99 was reached this Monday. So, investing $10,000 would’ve turned your money into $100,000 in a little bit over a year.

But let us look at the fundamentals. In the first quarter of 2020, the company managed to break even. In fact, it even reported a net profit of $16m. Quite low for a company with a capitalisation of almost $300bn! The fall in revenue in the first quarter totaled 19%. All this might be quite understandable since all automakers suffered from plunging sales due to Covid-19. But the company doesn’t offer any stability of earnings. Actually, Tesla only managed to make a profit in the third quarter of 2019. Remember that in the first half of 2019 there was no pandemic whatsoever. But the company still struggled.

On 22 July, Tesla will report earnings. Most analysts expect the company to report a loss. Well, if it does, it won’t be included in the S&P 500, as some investors are hoping. This means that many index-tracking funds won’t include Tesla shares in their portfolios.

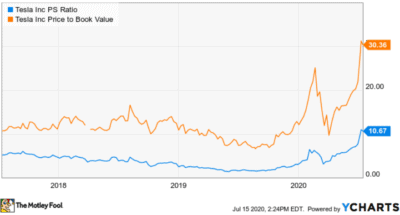

Let’s talk a bit about valuation. I was not even able to generate a price-to-earnings (P/E) ratio history graph because Tesla was loss-making over a large period of time. But the price-to-book (P/B) ratio is really inflated. It’s now about 30, whereas a normal P/B ratio is usually between 1 and 3.

The whole situation with Tesla shares reminds me of the dot.com bubble. People bought Internet stocks of loss-making firms at extremely high prices due to the ‘bright Internet future’. As concerns Tesla, this popularity is due to environmental consciousness. Many people consider electric vehicles to be very green. Indeed, Tesla is a pioneer in the area. But don’t forget that many other car makers have also started producing. So, Tesla is facing rising competition.