Tesco’s (LSE: TSCO) share price has held up pretty well this year. Year to date, Tesco shares are only down 11%. Compared to other popular FTSE 100 stocks such as Royal Dutch Shell (-36%), BT Group (-38%) and Lloyds Bank (-43%), that’s a relatively good performance.

It’s not hard to understand why Tesco shares have outperformed many other FTSE 100 stocks. No matter what’s happening with the global economy, we still need food. So, Tesco has ‘defensive’ qualities. Is the stock worth buying now though? Here’s my view on the investment case for Tesco shares.

A defensive stock

In the current environment, I do see some appeal in Tesco shares due to the company’s defensive attributes. Supermarkets, of course, are an essential service.

Interestingly, while other companies have been hit hard by the coronavirus, and still face plenty of uncertainty going forward, supermarkets appear to have actually benefited. Indeed, for the 12-week period to 17 May, UK grocery sales grew by 14.3% – the highest rate of growth in the 26 years since records have been kept.

Over that period, sales at Tesco rose a healthy 12.7%.

Ocado is smashing Tesco

However, I’ll point out that other supermarkets grew faster than Tesco over that 12-week period. Much faster, in fact.

For example, Ocado – which has benefitted from the shift to online shopping – enjoyed sales growth of 32.5%. Meanwhile, sales at Iceland and Lidl jumped 28.6% and 16.5% respectively.

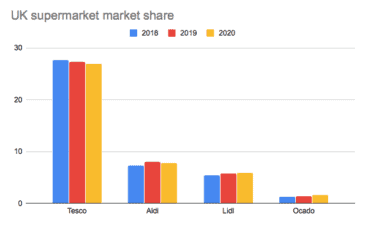

Ultimately, this pattern of growth leads me to believe that Tesco could continue to lose market share to other competitors. This is a trend that we have seen for years now.

UK supermarket market share – 12 weeks to 17 May (%)

|

Data: Kantar. 2018: 12 weeks to 20 May 2018. 2019: 12 weeks to 19 May 2019. 2020: 12 weeks to 17 May

Would Warren Buffett buy Tesco shares?

And that brings me to my biggest concern in relation to Tesco shares. In my view, the company just doesn’t have a strong competitive advantage, or ‘economic moat’ as Warren Buffett likes to say.

The problem with Tesco is that there’s absolutely nothing to stop consumers shopping at a rival. This means it’s hard for the company to protect its sales and profits. And that’s not what you want as an investor. An economic moat is one of the first things that Buffett looks for when he invests in a stock.

Is Tesco’s share price a bargain?

What about Tesco’s valuation? Is the FTSE 100 stock cheap? Well, analysts currently expect Tesco to generate earnings of 14.8p per share this year. So, at the current share price of 228p, that puts Tesco on a forward-looking P/E ratio of 15.4.

That’s not overly expensive, but it’s not super cheap either.

Tesco shares: I think you can do better

Look, Tesco is certainly not the worst stock to own in the current environment. If economic conditions deteriorate further, Tesco shares could offer some protection.

However, all things considered, I think you can do better. Right now, I’d be looking for resilient, Buffett-type companies with strong competitive advantages that are poised for solid growth in the years ahead. No matter what happens to the global economy.

There are plenty of these types of companies if you know where to look.