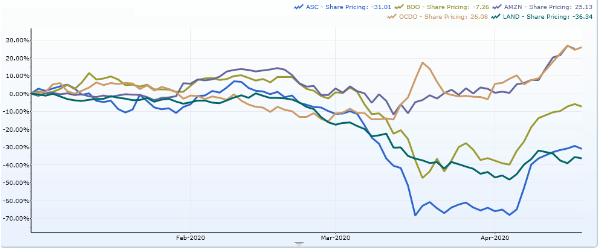

If you’re unsure what impact the Covid-19 pandemic will have on the listed online retailers, you’ve plenty of company. The whole market seems to have pitched from optimism to despair and mostly back again in just three months!

In the early stages of the crisis, online retail shares barely wobbled. Investors no doubt appreciated that social distancing isn’t much of a handicap when you’re shopping from your sofa.

However as we rolled into March, two developments muddied this consensus.

Firstly, the potential economic hit from Covid-19 dawned on us all. Pundits began to use the word recession. Customers began to worry about their jobs.

None of that is good for retailers. Rising unemployment and fewer pounds in the average person’s pocket isn’t recipe for booming sales, virus or no virus.

Secondly, I think investors began to realise the scale of any lockdown – first touted, later implemented – meant that even online retailers would be impacted, either because the government wouldn’t allow them to operate warehouses or send goods out for delivery, or because rising illness and self-isolation would seriously disrupt their operations and those of their logistical partners anyway.

The fashion shop Next had to close its online operation in late March, for example, after workers protested at being asked to work in its warehouses and to return to its (shuttered) stores for stock.

Similar concerns sank the shares of ASOS and BooHoo and we even saw a wobble in Ocado.

Kerching!

It’s often said, rather crassly, that you should buy shares when there’s blood on the streets – when fear is at its height.

And while the FTSE 100 is still far from its highs and so are the share prices of many online retailers, being brave in March as the lockdown was imposed and snapping up their shares looks in hindsight like a remarkable opportunity to turn around a portfolio battered by the mayhem of 2020.

ASOS shares have almost doubled since mid-March, for instance, after the company reassured investors and secured additional funding.

Maybe that was a catalyst for BooHoo and Ocado to climb, too. The former is up 75% since its March lows, and the latter some 50% higher.

These are huge gains to book in barely a month, especially considering how obviously favourable the environment always looked for online retail.

While there was uncertainty in the transition into lockdown, you didn’t need to be Warren Buffett to see how retailers that don’t need shops could prosper when those rival shops were shutdown.

Bricks-and-mortar slaughter

Indeed, like the $1 trillion gorilla in the room – the US giant Amazon – online shopping purist Ocado is one of the few stock market winners this year.

Its shares are more than 25% ahead in 2020, I believe due to the market deciding that more grocers and other retailers are going to be buying its online logistical technology in the months and years to come, even when this pandemic abates.

You see, Covid-19 seems to have accelerated a retail evolution that was already well underway on High Streets across Britain and in malls around the world.

For a sorry counter-example, consider the commercial property titan Landsec.

I believe it is one of the best operators in the sector, yet Landsec’s shares are trading at just half the value of the property on its books as investors fret about whether shopping and work will ever go back to normal.

2020 has been a rollercoaster for even the best-placed retailers. Source: S&P Capital IQ

When every night is Netflix and chill night

This same ‘lockdown trade’ is playing out in multiple sectors across the market.

Investors are favouring companies that are built for self-isolation, and punishing those that require us to return to a pre-pandemic world to make profits again.

Netflix is up while Cineworld has cratered. Domino’s Pizza is flying. Restaurant Group looks priced as if it might go bust.

We’ve never seen a market divided like this.

Of course, we’re used to riskier shares being hit harder in a bear market or defensive companies doing well when consumers’ wallets are squeezed.

But nobody was talking about viruses when they wrote the investing textbooks.

This means that when it comes to picking our way through the lockdown-battered stock market, we’re all on our own. Appropriately enough…