Cash ISAs can have their place in an investment plan, but banking on them to build wealth for retirement could be a mistake. A Cash ISA could be ideal for depositing money that may be needed at a moment’s notice, and the nominal value of the investment will not go down. But they offer little in the way of growth potential, and may not keep pace with inflation.

Betting on a Cash ISA to fund a comfortable retirement could leave an investor very disappointed. Because of the current low-interest-rate environment, Cash ISAs are struggling to beat inflation. That means the money in a Cash ISA can lose purchasing power.

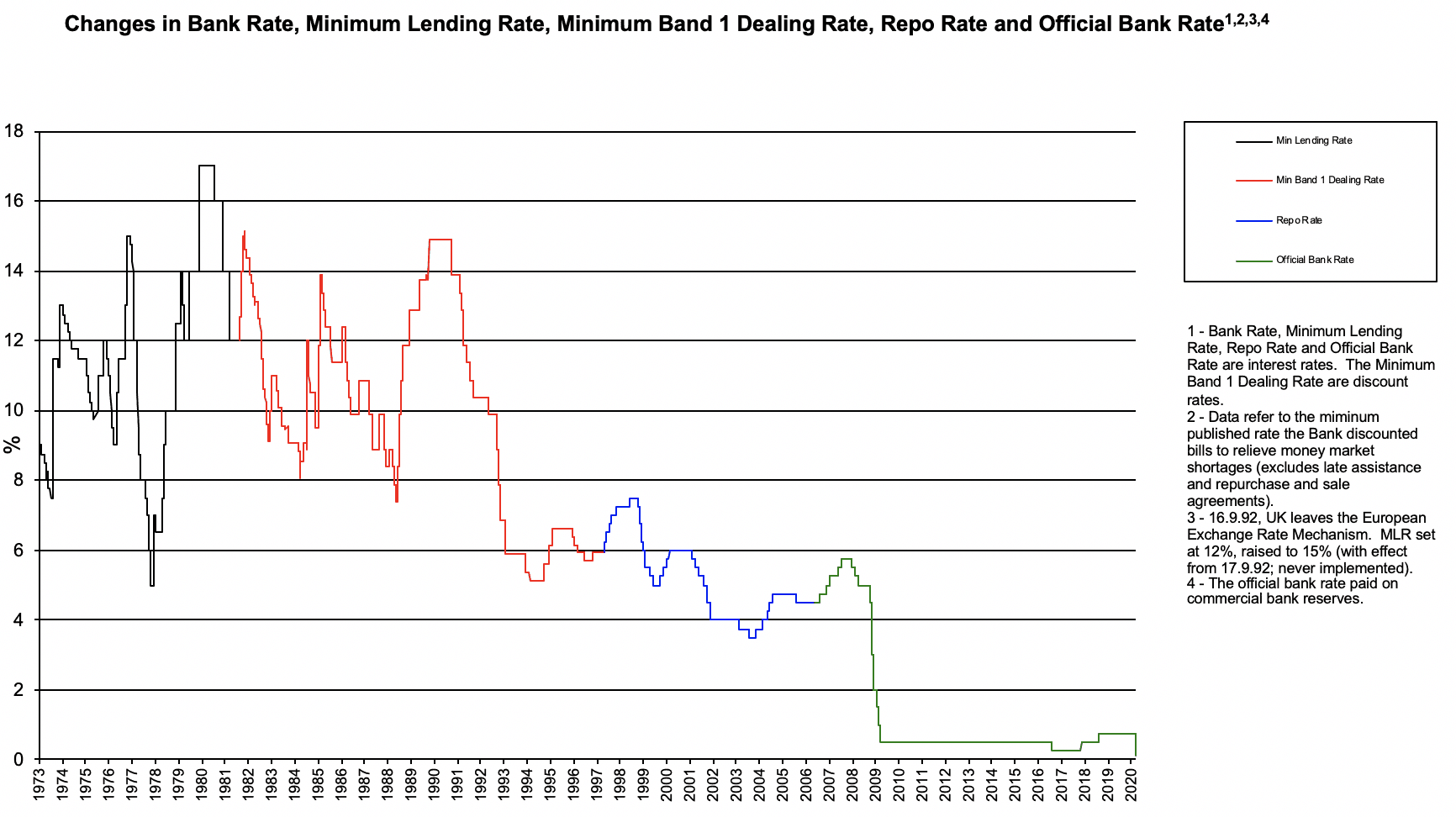

It has been suggested that the low-interest rates faced today are a result of the financial crisis of 2007–09, and that, eventually, interest rates should begin to return to ‘normal’.

The chart above was produced by the Bank of England.

The financial crisis did prompt rate slashing, but interest rates had been declining for decades before that. There is no requirement for rates to be above inflation and no reason to suggest that today’s low rates are not the new normal.

Market growth

Investing in the stock market is a cornerstone of retirement planning. Stocks and shares have historically delivered significantly higher returns than Cash ISAs when the investment horizon is long enough.

As I said earlier, Cash ISAs would be ideal for ensuring that the £1,000 put in today is still there in a year or two. Investing in the stock market, via a Stocks and Shares ISA or a SIPP is not without risk. This is particularly true for short-term investments.

Money put to work in the stock market needs to be left alone for perhaps 10 year. Saving for retirement is a great case for stock market investing.

The FTSE All-Share index represents at least 98% of the stock market capitalisation of all UK companies. The index also had an average dividend yield of 3.4% between 1995 and 2020. Investing £1,000 in this index for 10 years at a time between 1995 and 2020 had a 98.9% success rate.

To beat inflation, assumed to be 2% per year, a £1,000 investment needs to grow to at least £1,219 over 10 years. On average, a £1,000 10-year investment made between 1995 and 2020 would have grown to £1,881. Investing in the FTSE All-Share index would have beaten inflation 92% of the time.

The 1.1% of 10-year investments that were losers began around the 1999 market peak and ended in the depths of the financial crisis. It is comforting to know that extending the investment horizon by a year or two did reverse the losses.

Cashing out

For those trying to build serious wealth for retirement, investing in the stock market is a sensible choice. Right now, the stock markets are in a slump but don’t let this put you off. As we have seen, investing when the market is peaking is something to avoid. This latest crash is an opportunity to increase the odds of long-term success. It will always be a mistake to rely on a Cash ISA to build retirement wealth.