I became a Microsoft (NASDAQ: MSFT) shareholder in November 2020. Although I bought after the stock had dropped about 10% below its all-time high, which it hit in September, I missed out on the incredible gains made after the market crash, and indeed before it. However, I believe Microsoft stock still has a lot to offer, and here is why.

Reason 1: Microsoft stock’s track record

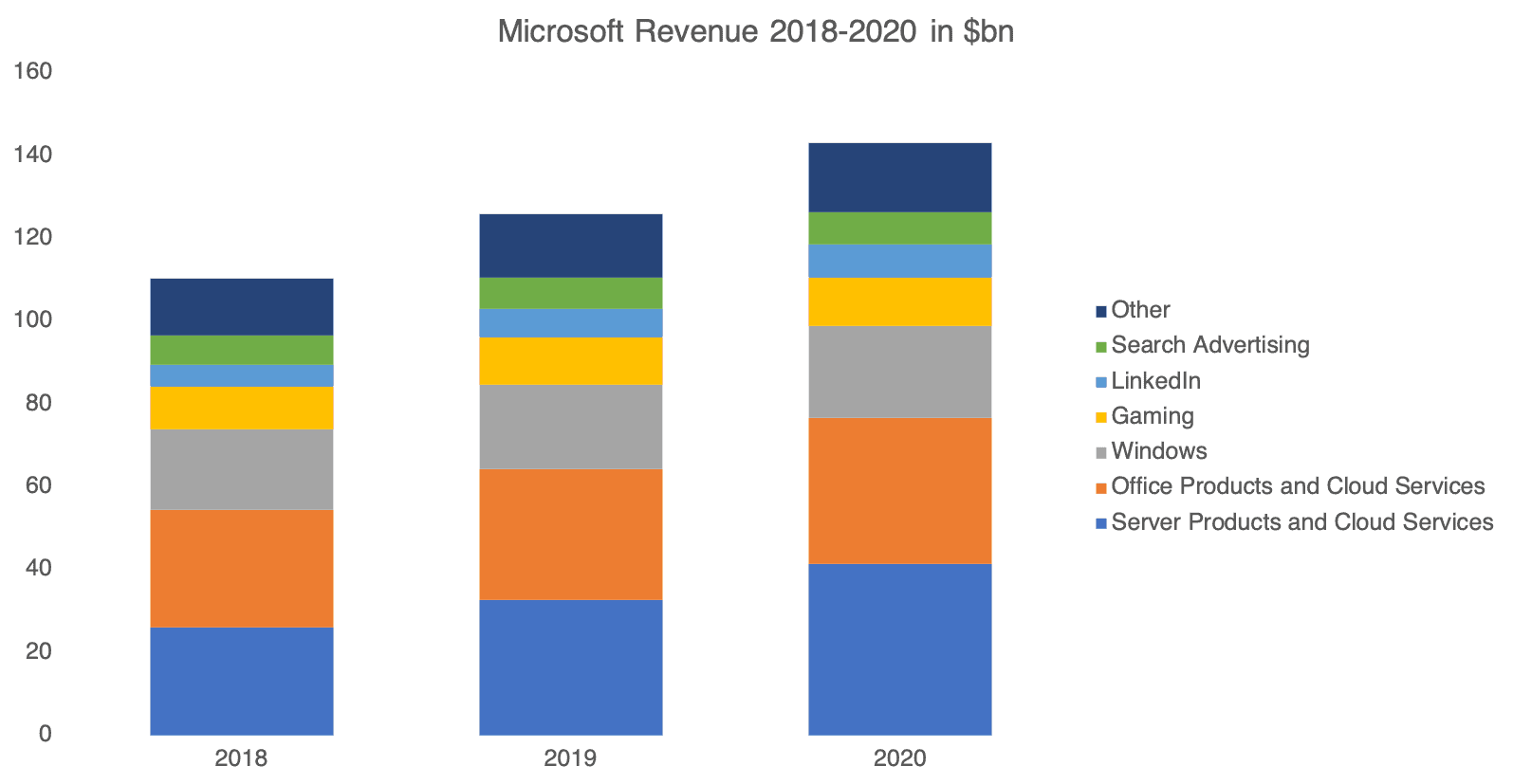

In 2018 Microsoft reported revenues of $110bn. Microsoft’s reported revenue grew to $143bn in 2020. Revenue growth has averaged 13.98% per year over the last three fiscal years. That is impressive for a company that has been around as long as Microsoft has.

Source: Microsoft data and author’s own calculations

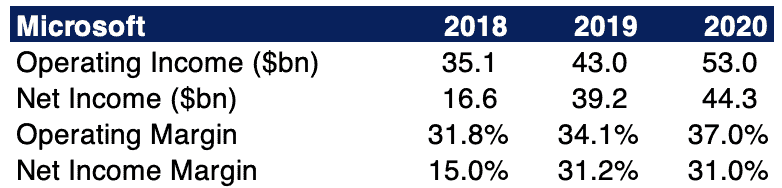

Microsoft’s operating and net income has also been growing healthily from $35.1bn and $16.6bn in 2018 to $53bn and 44.3bn in 2020 respectively. Operating margins have increased from 31.8% in 2018 to 37% in 2020. Net income margin, aside from 2017 in which it suffered from exceptional charges, has held steady at 31% over the last couple of years.

Source: Microsoft data and author’s own calculations

These margins are impressive. They hint indirectly at Microsoft’s impressive return on invested capital (ROIC). A high ROIC combined with healthy revenue growth is a recipe for creating shareholder value. To keep ROIC high Microsoft needs to be able to maintain its competitive advantage and I think it will.

Reason 2: Microsoft’s competitive strength

Software like Microsoft Excel gets more valuable to users as the number of other users increases, as it makes exchanging and sharing files easier. What’s more, Microsoft can deliver its software products at a meagre marginal cost. A product or service that gets more valuable to users, while at the same time becoming cheaper to deliver, is a good example of network effects, or increasing returns to scale.

This also applies to Mircosoft Windows platform, which is the most popular licensed operating system for personal computers. Customers get locked into Microsoft’s products as it takes time and money to switch. Also, Microsoft bundles different software solutions into subscription packages, and steady revenue streams are always a good thing.

After a slow start, Microsoft has put together a dedicated cloud computing service. This has the second biggest market share (and it’s increasing) after Amazon’s offering. I see market share for Microsoft’s cloud service increasing further because it can bundle it and all its other software offerings together into a one-stop solution for businesses.

Microsoft’s competitive edge looks sound across all its business divisions.

Reason 3: Total shareholder returns

It’s easy to forget that Microsoft has paid a quarterly dividend since the fourth quarter of 2004. The dividend yield on Microsoft shares is currently around 1%. That’s not at all high, but Microsoft has been increasing its dividend by 14% per year on average. If that continues then a share bought today could be yielding over 4% in a decade.

The total return on Microsoft shares, including dividend reinvestment, stands at 24.3% per year on average over the last decade. With Microsoft’s track record and continuing competitive edge, I expect total shareholder returns to hold up well over the next decade. Microsoft is a large-cap growth stock, that’s in the tech business, and also pays a dividend. It’s a popular investment for a reason: there are not many stocks quite like it.