Ocado (LSE:OCDO) shares have had a wonderful time this year, ever since the beginning of the pandemic. And they’re still in rally mode despite the easing of lockdowns.

The lockdown easing

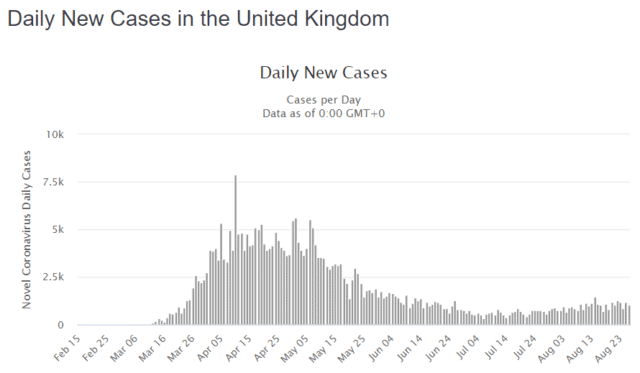

On 14 August, the UK government announced that it would cancel some of the Covid-19-related restrictions. That included reopening theatres, restaurants, and pubs. This was due to the fact that infection rates had stabilised somewhat.

Source: Worldometer

It is, indeed, a positive for businesses operating in these fields. However, one might think that it’s quite a risk factor for companies like Ocado. Demand for food delivery services surged to record highs because of the lockdown. Even people who never ordered food online started doing so. But, if there is no coronavirus fear, what’s the point of ordering food?

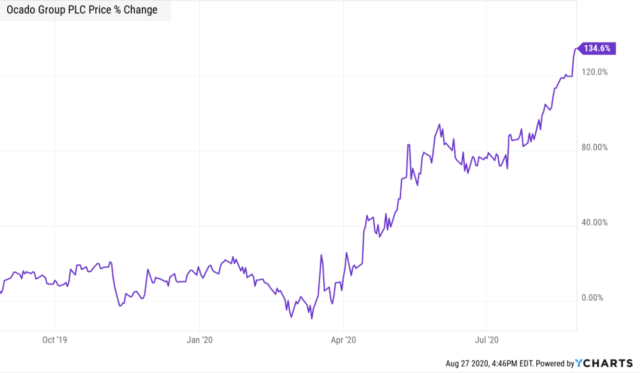

Ocado shares

Source: YCharts

Well, the share price performance doesn’t reflect this logic at all.

As you can see from the graph above, the rally has carried on in spite of the lockdown easing. There are several reasons for this. First, according to the company’s management, the demand for food deliveries will continue to grow. Many clients accustomed to ordering food online during the lockdown will still do this for the sake of convenience. Secondly, the online delivery services are becoming fashionable among young people. Finally, we don’t know if the coronavirus situation will improve further. Unfortunately, it is even likely there’ll be another coronavirus wave. If so, it would give a bigger boost to Ocado shares.

Are Ocado shares worth buying?

My colleague Roland wrote about the problem of overvaluation. It is quite evident when we talk about Ocado stock. What’s more, the company hasn’t demonstrated any meaningful history of rising sales revenues and profits. But let us look at the company’s financial position. The company is rated as B2 by Moody’s. This is ‘highly speculative‘ or junk. The agency is positive on the company’s strategic partnership with Marks & Spencer and other international grocers. This allowed Ocado to increase its cash balance. But the firm has a high debt load. Even worse is the fact that Ocado heavily spends capital. This will lead to its cash level falling significantly.

The truth is that even Amazon didn’t become profitable in its first days of operations. But the thing is that Ocado has been existing since 2000, which looks like plenty of time to become profitable.

During the rise of Amazon, many other companies went bankrupt. At the time of the dot.com bubble, new loss-making companies traded at demanding valuations. Their managements spoke with great enthusiasm of their ‘great future‘ and the ‘internet age‘. And so did some analysts. Unfortunately, many shareholders lost a lot of their money when this bubble burst.

I personally don’t know what will happen to Ocado. It may well be that the company will greatly improve its earnings and financial position. It might expand too. But I wouldn’t buy their shares just yet. What’s more, I’d recommend risk-averse investors to look elsewhere.