Rio Tinto (LSE:RIO) shares have had a great time since the March stock market crash. But in May, the world’s largest iron ore miner ruined sacred Aboriginal sites in Western Australia. The resulting scandal limited the stock’s growth.

The details of the scandal

While Rio Tinto’s actions were legal, the local community described the destruction as a ‘devastating blow‘ to their culture. Chair Simon Thompson apologised for the site’s destruction, saying it went against Rio Tinto’s core principle of respecting the local communities. In the aftermath, the company cut bonuses to senior executives. It seems to have been bad for the company’s reputation. But how did it affect the company’s stock?

Rio Tinto shares

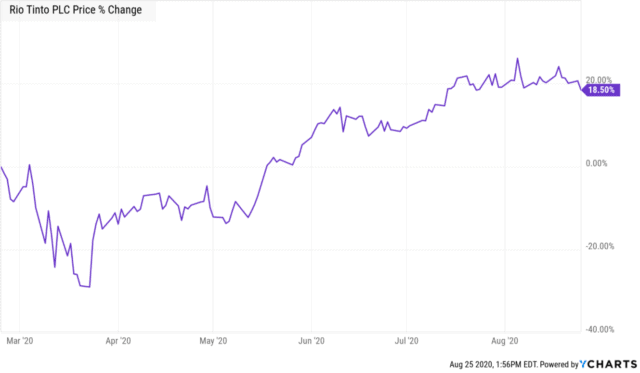

If you look at the graph below, you’ll see that the shares failed to grow in May. One of the likely reasons is the scandal. But the stock later rallied, reaching its peak in the very beginning of August. Now, Rio’s stock price isn’t far from its 52-week high of 4,991p. Investors might be wondering what will happen to Rio Tinto shares in the future.

Source: YCharts

The scandal didn’t have any obvious immediate effect on the company’s financial position. But in the future it might have an indirect negative effect due to the damage to its reputation.

But there are other factors that seem to be much more important to me. I fully agree with my colleague Stuart, who noted that demand for industrials metals is likely to be suppressed in a recession. This may have an impact on a company specialises in industrial metals. But let us look at the matter in a bit more detail.

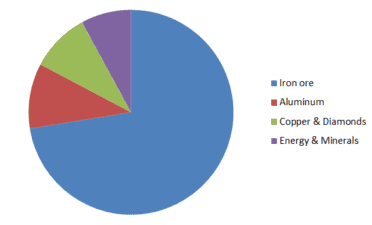

Rio Tinto’s EBITDA* breakdown – 2019

Source: Rio Tinto

*EBITDA: Earnings before interest, taxes, depreciation, and amortisation.

As you can see, most of the company’s earnings are from iron ore. The metal is mostly used in manufacturing. The demand for it is highest when macroeconomic fundamentals are sound and the economy is booming. Right now that doesn’t seem to be the case at all. How well do the company’s fundamentals and the share price valuation reflect the situation we are in?

Fundamentals and valuation

To start with, Rio Tinto is a dividend king with its 6% yield. It also raised its dividends from 232.78p in 2018 to 300.79p in 2019.

Rio Tinto’s fundamentals

Source: Shares Magazine

From what we can see here, the price-to-earnings (P/E) and the price-to-book (P/B) ratios are still quite low. According to the 2019 annual report, its net debt fell. The financial position is reasonable too, given that it has a good investment-grade credit rating. What I don’t like is the fact that Rio Tinto shares have soared in spite of the more than uncertain future. Overall, Rio doesn’t seem to be a bad investment. But I’d prefer the share price to fall before I’d jump in.