Marks & Spencer (LSE:MKS) has been suffering during the coronavirus pandemic just like many other retailers. It even had to cut 950 jobs to minimise its costs. But is there light at the end of the tunnel? In other words, is it a great bargain or a value trap?

M&S is an iconic brand, for sure. The business was started up in 1884. But the question is how effective and efficient is it now? And what kind of future does it have, given how the pandemic has affected the retail sector?

Reasons why Marks & Spencer is a bargain

As I’ve mentioned before, M&S is a well-established brand. But it is still suffering just like its competitors due to the Covid-19. In plain terms, very few people want to go shopping to physical stores to buy garments. The company launched its M&S.com app to make the shopping process accessible. There have been about 700,000 downloads of the app since the beginning of the lockdown.

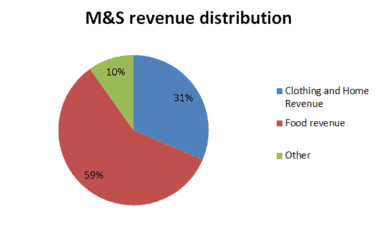

But we all know that the company doesn’t just sell clothes. It also has a large food business. As can be seen from the graph below, the food division is far more important for Marks & Spencer than its clothing and home department.

Source: M&S

You might think that all this is already reflected in the share prices. Indeed, at a price of about 100p, the stock seems to be a bargain compared to the 200p it traded for in January.

What is more, the company is trying to re-establish itself as a “modern” food business. It started offering food deliveries and quite an attractive menu to choose from.

And yet investors shouldn’t forget that the company’s problems started long before the pandemic.

Reasons why the company could be a value trap

One of the problems with M&S is its lack of stylishness. It sells boring clothes and doesn’t target a particular customer group. You can buy many types of outfit, targeted at older men and women, young people, and children. So, there isn’t any clear marketing message, which is a problem for sales growth.

And how about financials? Let’s look at the price-to-earnings (P/E) ratio. If we divide the recent share price of 98p by the adjusted earnings-per-share (EPS) of 16.7p, we’ll get the P/E of 5.87. This doesn’t seem to be high. Please note that I took the figure adjusted for any new stock issues and one-off items. The basic earnings per share were 1.3p. This looks oddly low to me. What is more, the earnings reported on 28 March 2020 fell by 48% compared to the figure reported a year ago. M&S even had to cut its dividends from 13.3p to 3.9p.

Although it’s a worrying sign to its shareholders, Moody’s, a credit rating agency, approved of this decision. The thing is that M&S was quite recently downgraded to Ba1, a junk credit rating. So, the dividend cut, just like the company’s decision to make 950 workers redundant, would help Marks & Spencer conserve some cash.

This is what I’d do

Just like my colleague Tezcan I consider this company to be a value trap. Although patient investors might get rewarded, I’d need M&S to improve its fundamentals first.