Exchange-traded funds (ETFs) can be a great way to gain exposure to the stock market. Through one ETF, you can potentially get access to hundreds of stocks, at a very low cost.

However, it pays to be selective when it comes to investing in ETFs. Some are likely to provide much stronger returns over the long run than others. With that in mind, here’s a look at three of my top picks available to UK investors.

The best ETFs to invest in

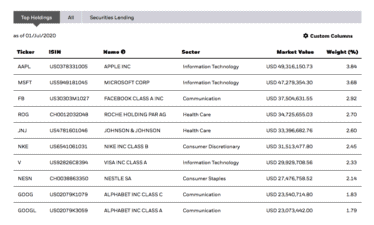

One of my favourite ETFs is the iShares Edge MSCI World Quality Factor UCITS ETF. This is a global equity product that provides exposure to 300 companies within the MSCI World index.

What’s unique about this particular exchange-traded fund is that instead of just tracking a regular stock market index such as the FTSE 100, it provides exposure to a selection of high-quality companies listed around the world. Specifically, it invests in companies that:

-

Demonstrate strong and stable earnings

-

Have low debt levels

-

Allocate a high percentage of company earnings to shareholders

This is an excellent investment strategy, in my view. In theory, the strategy should provide an element of protection in the event of a market downturn.

This fund is listed on the London Stock Exchange under tickers IWQU (USD) and IWFQ (GBP). Its ongoing charge is 0.30% per year. I think it’s one of the best ETFs to buy for broad global equity exposure.

Source: iShares.com

A sustainable investing ETF

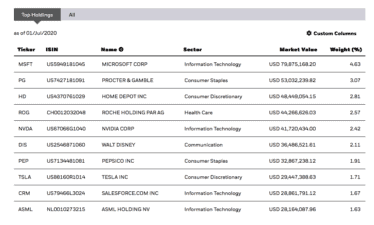

Sustainable investing has become increasingly popular in recent years and it’s not hard to see why. This form of investing seeks to deliver a healthy financial return while also considering environmental, social, and governance (ESG) factors.

One ETF I hold in high regard in this area is the iShares MSCI World SRI UCITS ETF (ticker SUWS). This product aims to provide access to the global markets through companies with outstanding ESG ratings and minimal controversies. Specifically, it screens out companies involved in the oil & gas, weapons, tobacco, firearms, alcohol, and gambling industries.

This fund was only launched in October 2017, so it hasn’t been around for that long. However, in that time, it’s delivered very solid returns. I think it has a lot of potential in a world that’s increasingly focusing on sustainability. Ongoing charges are 0.20% per year.

Source: iShares.com

An exchange-traded fund for the digital revolution

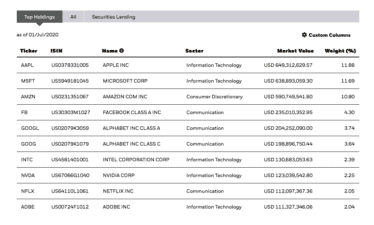

Finally, I think it’s smart to have a decent level of exposure to the technology sector. Technology companies are having a huge impact on the world at the moment, and look set for big growth in the years ahead.

One of the best ways to invest in technology, in my view, is through a simple NASDAQ 100 tracker, such as the iShares NASDAQ 100 UCITS ETF. This will provide exposure to all the major players listed on the technology-focused NASDAQ stock exchange, such as Apple, Amazon, and Alphabet (Google).

You can find this particular ETF on the London Stock Exchange under ticker CNDX. Ongoing charges are 0.33% per year.

I’ll point out that technology stocks have had a great run recently. Some areas of the technology sector do look a little overheated. I’d be looking to buy this fund when we next see a market pullback.

Source: iShares.com