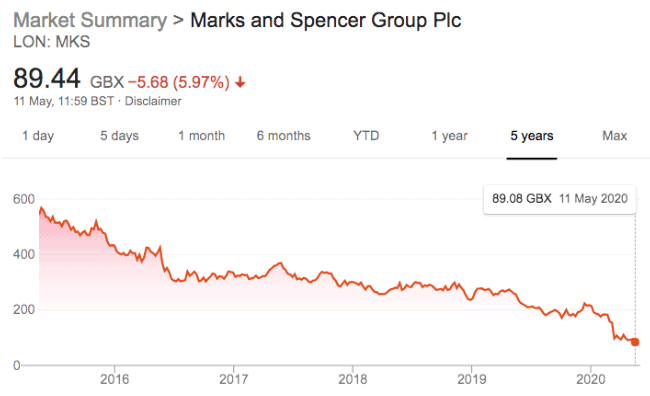

I’m not much of a chartist, but even I can see the price share graph for Marks and Spencer (LSE: MKS) has been appalling over the past five years:

Source: Google Finance

Just since the start of 2020, shares in the High Street retailer are down another 59%. That’s against a FTSE 100 that’s fallen 22%. Investors apparently fear that the Covid-19 pandemic that has cruelly taken so many elderly lives before their time could do the same for this venerable retailer.

There’s a grim twist in that comparison. Since the turn of the century, Marks and Spencer has struggled to get younger shoppers into its stores. Once upon a time M&S clothing was the epitome of affordable fashion, but that’s a fairy tale today. Even where it has improved its wares, it has struggled to gain sales.

Over the ten years to 2019, revenues at M&S inched up by just 15%. All the growth came from its food unit. Clothing and home revenues actually declined.

Note again, this data is up until last year – so the collapse in revenues with the near-cessation of in-store clothing sales due to the lockdown isn’t even a factor.

All about the earnings

Marks and Spencer is not the only established retailer to have found life hard in recent years, of course.

Sometime market darling Next (LSE: NXT) only grew its revenues by 20% over the same period, too.

However Next had no food offering to bolster the top-line. All its sales growth was in the clothing and homeware categories where M&S has continued to slide.

What’s more, Next is either a better run business or came it into this ten-year period better set-up for the fast-changing reality of retail. Or both.

You see, operating income at Next rose 75% over the ten years. At Marks it fell 20%. I believe Next had better products, and thanks to its established catalogue and online sales, it had a better distribution channel, too.

The comparison gets even worse for M&S when we reach the bottom line.

Earnings per share nearly tripled at Next, thanks to skillful capital allocation.

Earnings per share at Marks and Spencer fell 94%!

Overdue order for online

Next was a better business over the past decade. It wasn’t a blockbuster business, but it grew sales and profits and bought back its own shares.

Marks and Spencer barely grew sales, barely made money, and issued equity.

Needless to say Next has been hit for six by Covid-19, too – and its shares are down 32% since 1 January. Last month it downgraded its already downgraded hopes for 2020. Next now expects the pain to continue for the rest of the year, with full-price, full-year sales as much as 40% lower in its worst-case scenario.

That’s grim, no doubt. But this pandemic will pass. When it does, Next at least looks like a business that’s meeting a need. It also has a decent online business that can potentially grow market share at its rivals’ expense right now. In 2019, Next sold nearly as much online as it sold in-store, so it already knows how to profitably reach its customers.

It’s hard to say the same thing about Marks and Spencer.

M&S will roll out a new food delivery partnership with Ocado in September, which should overall boost food sales. But the obvious casualty could be foot traffic to its larger stores. Meanwhile online clothing and homeware sales made up just 22% of the total for M&S in 2019. It could be too late to get that growing.

Next!

M&S stores dot the British Isles like relics of a former era – retail castles on the point of falling into abeyance. My local M&S has three floors, and most weekdays it’s hard to find more than a dozen customers shopping above ground level. I often get the impression there are more staff around.

Right now there’s nobody above the food floor. The clothes are gathering dust, and surely even many M&S customers have turned online. Are they going to Marks and Spencer’s website, or to its myriad of equally accessible rivals?

Many of us have a soft spot for M&S, especially its food. That seems to have helped it limp along for as long as I’ve been following the stock market.

But unless it can become much more like Next – and fast – I fear it will eventually be another victim of this wretched virus.