Income stocks are widely recognised as one of the greatest ways to add value to your ISA. However, the number of FTSE companies paying a decent dividend is dropping as companies try to conserve cash for operations.

In fact, 32 FTSE 100 companies have recently announced a cut, suspension, or a deferred dividend for shareholders. Moreover, only a small handful of firms will be paying the majority of the dividend payments that remain. Indeed, the top 20 dividend payers make up 84% of the whole index.

I think this is really risky for income investors. But if you can find a good firm, going cheap, and with one of the more reliable dividends, your ISA could be in for a long-term gain. And there are such firms on the FTSE 100 right now.

Income stock investors look to mining

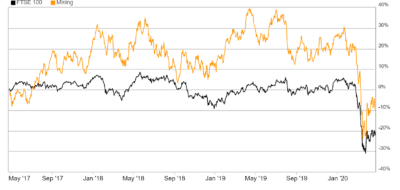

On of the sectors supporting the rising FTSE 100 is mining. In fact, the mining sector is closely associated with the index. If miners are doing well, chances are that the footsie is too.

Source: London Stock Exchange

So, the recent rise of the FTSE 100 looks good for mining stocks, and in particular, Anglo-American (LSE:AAL) and Rio Tinto (LSE: RIO).

These companies have benefitted from a combination of a high price for iron ore and financial belt-tightening. Iron ore is central to the production plans of both miners.

China is a major buyer of iron ore, where it is used in steel production. China is responding to the US trade tariffs by chucking money into road, rail, and construction projects. But economic stimulus like this becomes less effective over time. It’s likely that the coronavirus shut-down will also reduce demand in the short-term which may impact profitability.

However, these income-producing mining firms have solid steel balance sheets that should help them through a slow down.

Sustainable dividends for investors

These companies were originally fairly cyclical, but are now cash-rich. Some analysts think of them as ‘boring dividend payers’.

But what may be ‘boring’ for them, I consider to be pretty exciting right now. A sustainable dividend payer is exactly what my ISA needs to improve my passive income.

Both Anglo-American and Rio Tinto are top-20 FTSE 100 dividend payers. Rio Tinto, in particular, is noted for its excellent yield, currently at 6.6%, compared with Anglo’s 5.4%.

And both are pretty safe. Rio Tinto can cover its dividend 1.6 times over but Anglo-American’s 2.49 times is even more impressive. And longer term, Anglo-American’s orientation towards consumption-driven commodities, such as platinum, may stand it in good stead for China’s potential future slow-down.

However, Rio has higher asset values relative to its peers, meaning it is able to keep profiting through commodity cycles. This is a big pull for me.

Rio Tinto and Anglo-American are currently trading on price-to-earnings ratios of 9.2 and 5.9 respectively. These are below the usual double-figure average. The mining sector as a whole is far cheaper now than it was in 2019, when I think it was overpriced. Both companies are cash-rich, dependable dividend payers at attractive prices. This is what my ISA needs right now. I’m in.