Against a backdrop of slumping rental yields and stagnating property price growth, we’ve long suspected that the majority of buy-to-let activity is now occurring outside the capital, and recent data released by Hamptons International proves this without a doubt.

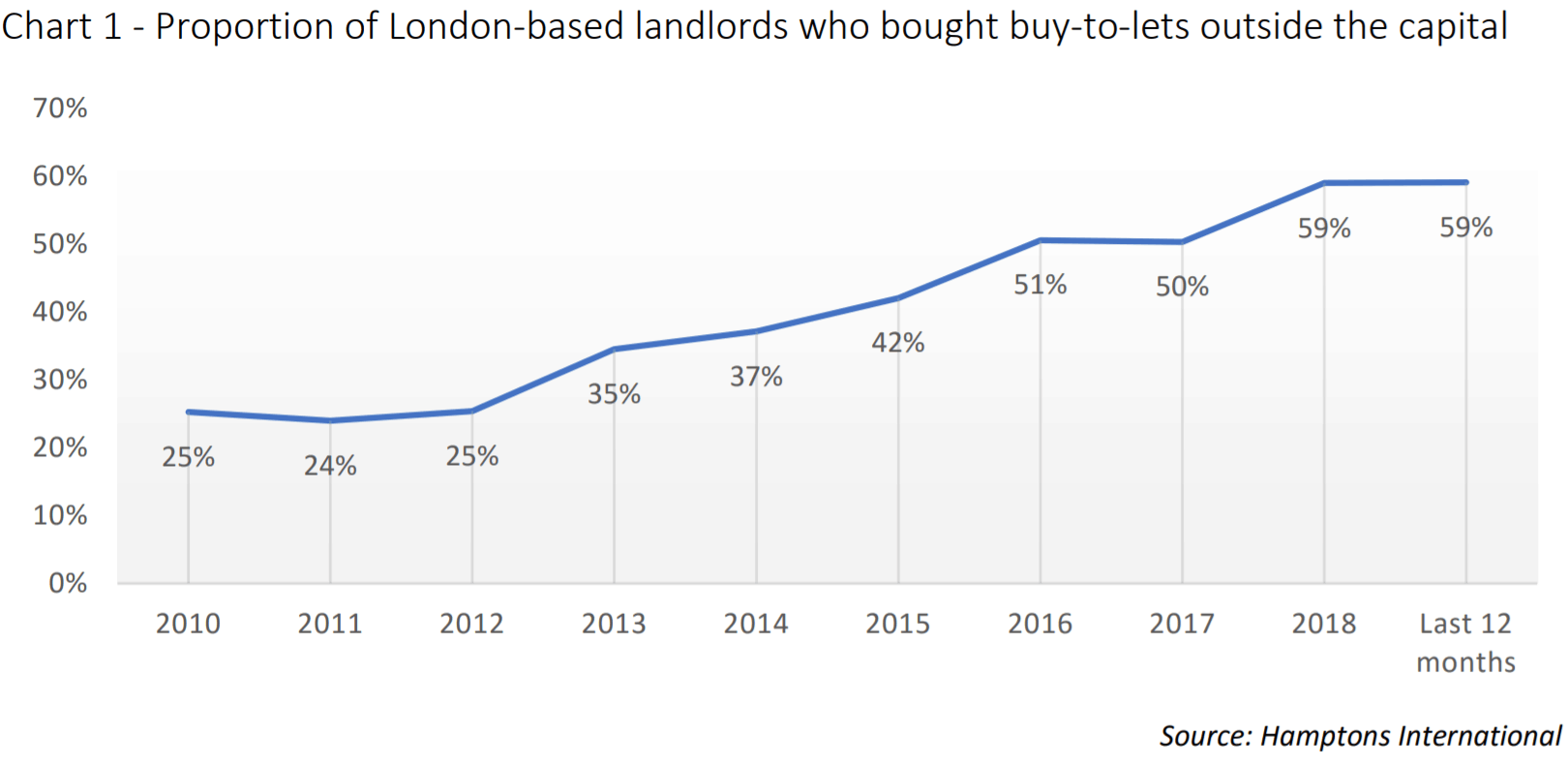

According to the estate agency nearly three in five London-based landlords — or 59%, to be precise — have purchased rental properties outside the city during the first 12 months, surging from 25% in 2010.

“Due to high house price growth and a clampdown on landlord taxation, more London-based landlords have chosen to invest further afield in search of higher yields and lower stamp duty bills,” Hamptons said.

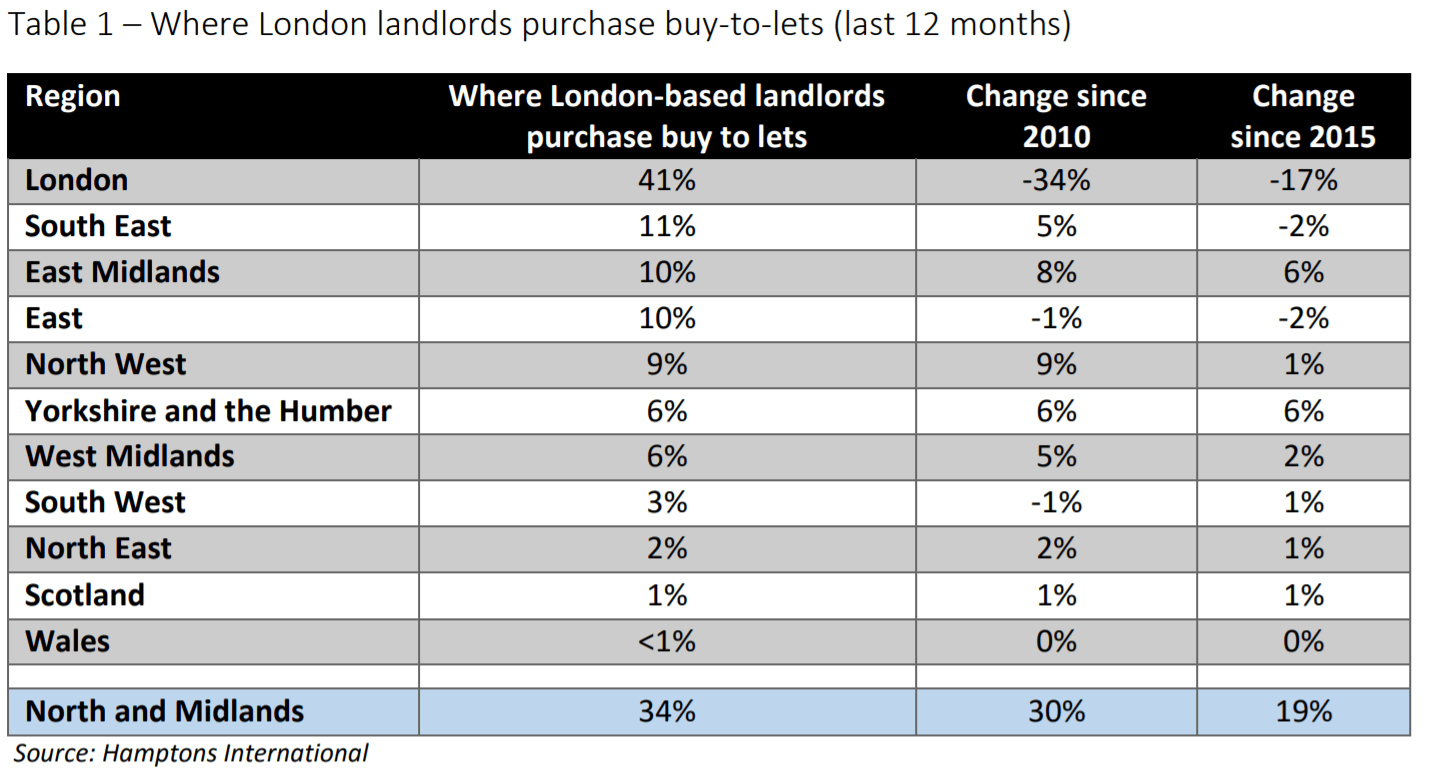

Buy-to-let investors are increasingly migrating northwards, the company’s data shows, with 34% of London landlords snapping up property in the Midlands or the North of England over the past year. This compares with just 14% in 2015 and 4% at the start of the decade.

That said, London remains by far the most popular buy-to-let destination for the city’s landlords, with 41% of purchases happening there.

Stamp duty rises. But so do rents…

Hamptons claimed that rising demand for homes outside The Big Smoke is chiefly because of the stamp duty surcharge introduced in April 2016, a change which has caused the number of Londoners taking on buy-to-let properties in their home city to fall by 17% since 2015.

To illustrate the impact of these stamp duty hikes for those purchasing second homes, Hamptons suggested that buy-to-let owners in London have faced an average bill of £24,600 over the past year. By comparison, an individual buying outside the capital has been forced to cough up a much-more-agreeable £5,330 in stamp duty.

It’s not all bad for landlords in the capital, though. According to the estate agency, rental growth in Greater London in March climbed by an average 3.7% year-on-year to £1,737 per month, the highest level on record.

This figure eclipses the 1.9% annual rise in rents on a nationwide basis, the average monthly rent in Great Britain hitting a figure of £969.

So what should you do?

Whether you live inside or outside the capital, there’s a lot to consider when you’re taking the plunge in the buy-to-let market. Some would even argue — and I count myself within this group — that the headaches are becoming far too numerous and severe, and that stamp duty isn’t the only thing to beware of. Just this week the government took steps to curb the power of landlords concerning the issue of tenant evictions, making the business of becoming a landlord even more troublesome.

So why bother with the hassle and the increasing expense of the rentals market? It’s not as if there are no opportunities to make a fortune by investing your money elsewhere, and particularly in the stock market. In fact, the booming number of ISA millionaires suggests that now’s a great time to pull your money from buy-to-let and to plough it into shares instead. And there’s plenty of help from websites like The Motley Fool to assist you in reaching your investment goals, whatever they may be.