There’s a broad range of things for prospective (and existing) landlords to consider when deciding where to buy. The property’s proximity to local amenities; the quality of transport in the area; the closeness of the property to the owner’s existing locality, and so on.

In a more unique assessment of the most lucrative places for landlords to buy in, VeriSmart has considered the best places to invest in respect of the first numbers and letters that comprise their postcodes, and the average weekly rent levels that these codes currently command.

The numbers (and letters) crunched…

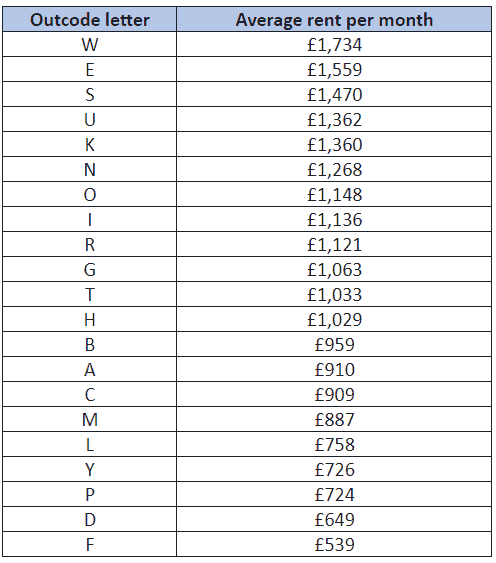

What the results showed was that postcodes with an outcode — i.e. the first half of a postcode — that begin with a ‘W’ tend to command the highest weekly rent in Britain, with an average price of £1,734.

Places with such a postcode include classically-prestigious areas in London like Westminster, so its ranking may not come as a surprise. It’s worth remembering, however, that ‘W’ outcodes also cover areas in the England which are much less profitable like Watford, Wigan and Wolverhampton.

Codes featuring at least some exposure to London boroughs comprise the first six entries on the list. The highest-ranking outcode letter without exposure to The Big Smoke was ‘O,’ an outcode initial which covers most of Oxfordshire as well as the less-affluent areas of Oldham.

Bringing up the rear? Outcodes starting with ‘F’ with an average rent of £539 per week. Properties in this area can be found in the Falkirk region of Scotland and around the seaside resort of Blackpool.

Bingo vs lottery?

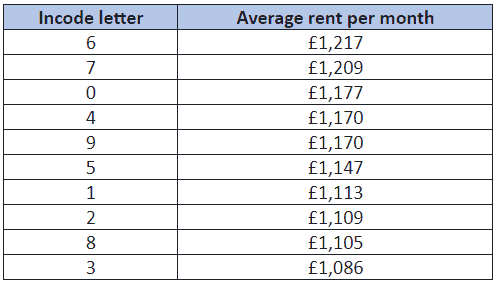

While there is clearly some correlation between outcodes and average rents, given the places that these codes tend to cover, no such pattern can be found concerning incodes, i.e. the second part of a postcode, which have no connection to area nor indeed any other influential or specific factor.

What VeriSmart’s study suggests, though, is that the best buy-to-let bingo postcode for those seeking the highest rental yield would be Wxx 6xx. Conversely the least-lucrative would be a combination like Fxx 3xx.

A little luck is involved when trying to achieve the best yields on your investment based purely on postcode, though with some research it’s clearly possible to influence the returns that you can expect to receive from buy-to-let by investing in the right areas.

The same cannot be said for using your cash to play the National Lottery, though. Whatever strategy you adopt when picking numbers, whether it be random choices to selecting the most-popular (or conversely, most-overdue) numbers, to using favourite numbers or ones that corresponding to important dates etc, ultimately you have absolutely NO control over whether or not you’ll actually make any money. And let’s not forget: the odds of actually making any meaningful returns are pitifully low.

So which would I choose? Buy-to-let or buying stacks of lottery tickets? Neither, actually. I’d much rather put my money to good use by participating in the stock market, an arena in which it really is very possible to make a million (or more).