The new Marcus savings account from Goldman Sachs, which was launched in the UK in late September and offers an interest rate of 1.5% AER, has taken the nation by storm. In the space of just over 40 days, Marcus has already racked up over 100,000 customers, with a new account being opened every 35 seconds, according to Finextra.

Clearly, after years of sub-1% interest rates being offered by the UK’s banks, domestic cash savers are excited by Marcus’ interest rate of 1.5%, and they’re rushing to open an account with the challenger bank. Do I think you should join them?

Good in the short term

The answer to that question, in my view, depends on what you’re trying to achieve with your cash savings.

When saving for short-term goals, such as a house deposit, a holiday, or a wedding, saving money in an easy-access savings account such as a Marcus, makes sense. An interest rate of 1.5% isn’t exactly going to turbocharge your savings, but it may help you achieve your goals a little sooner. Importantly though, your savings are not going to fluctuate in value, like they would if they were invested in the stock market, so there’s no risk of losing money.

Another good use of a Marcus account is for emergency money (an ‘emergency fund’). The thing about life is that it tends to be full of financial surprises, such as unexpected medical bills or house/car/phone repairs, and you never when you’re going to need access to a little extra money. You could even lose your job suddenly and find yourself without any money coming in. For this reason, experts recommend having enough money on standby to cover at least three months’ worth of living expenses. For an emergency fund, the Marcus account could be a good choice, as it lets you easily access your savings.

Not so good in the long term

However, if your savings goals are more long-term oriented (e.g. saving for your retirement in 20 years), holding cash in a Marcus probably isn’t such a good idea. There’s one key reason for that – inflation.

Inflation refers to the increases in prices of goods and services over time. You don’t notice it on a day-to-day basis, but over a period of 10 or 20 years, it can have a devastating effect on your wealth if you’re not protected from it, because goods and services will cost you more in the future.

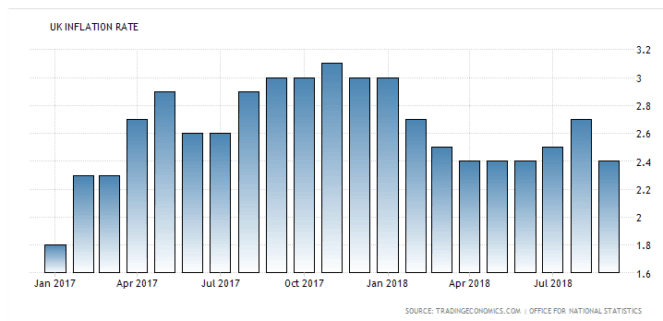

Currently, the Bank of England has an inflation target of 2% per year. Yet look at the chart below.

Clearly, inflation has been above 2% per year for a while now. In other words, the prices of goods and services are rising by more than 2% every year. What that means is that any money earning 1.5% per year is actually losing purchasing power over time.

To beat inflation, your money has to grow at a rate that’s higher than it. That’s why, here at The Motley Fool, we’re big fans of investing in the stock market, because, over the long run, stocks tend to produce returns of around 7-10% per year, which is far higher than inflation. Cash savings are important, sure, but for long-term investing, stocks are usually a better bet.