Investing your first £1,000 can be a daunting experience. With thousands of stocks and funds to choose from, where do you even start?

The best strategy for novice investors, in my view, is to invest in a fund. That way, your money will be spread out over a whole portfolio of stocks, meaning your risk is reduced significantly.

There are several different types of funds available today, including mutual funds, investment trusts and exchange-traded funds (ETFs). I explained the differences recently here. Today, I’m looking at two investment trusts that I believe are strongly suited to those just starting out. Both can be bought and sold just like regular stocks through an online broker.

The City of London Investment Trust

The City of London Investment Trust (LSE: CTY) is a perfect investment trust for beginners, in my opinion. It’s a diversified portfolio of around 120 stocks that aims to provide long-term growth in income and capital.

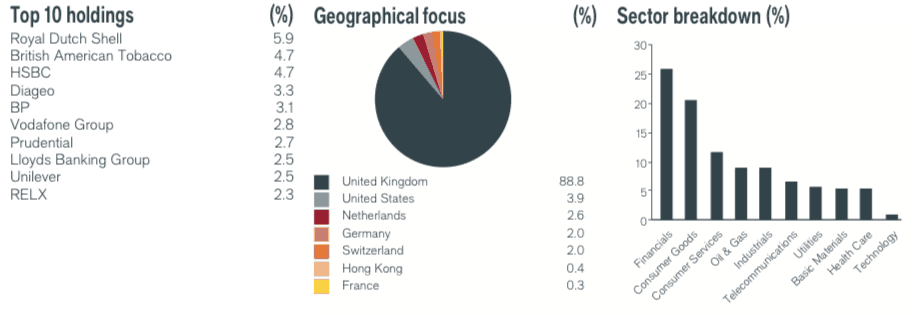

The reason this is suited to beginners is that it is managed in a very conservative fashion. It generally invests in well-known blue-chip companies such as Royal Dutch Shell, HSBC Holdings and Unilever and therefore offers a strong degree of stability. The top 10 holdings are shown below:

Source: janushenderson.com. Data as of 31/12/17.

For the five years to the end of December, the net asset value (NAV) of the trust increased 73%, comfortably beating the return of the FTSE All-Share index, which was 63%.

Furthermore, CTY has an excellent dividend track record, having increased its payout every year for over 50 years now. The current yield is just under 4% and shareholders receive their dividends on a quarterly basis. Management fees are also low at just 0.37%.

I hold CTY in my own portfolio, and I plan to keep holding it for a while to come, enjoying the steady stream of dividends. To my mind, it’s a fantastic core holding.

Temple Bar Investment Trust

Another very similar investment trust, also well suited to beginners, is the Temple Bar Investment Trust (LSE: TMPL).

Launched in 1926, this one aims to provide growth in income and capital, with the portfolio manager specifically targeting undervalued, out-of-favour companies that have strong balance sheets.

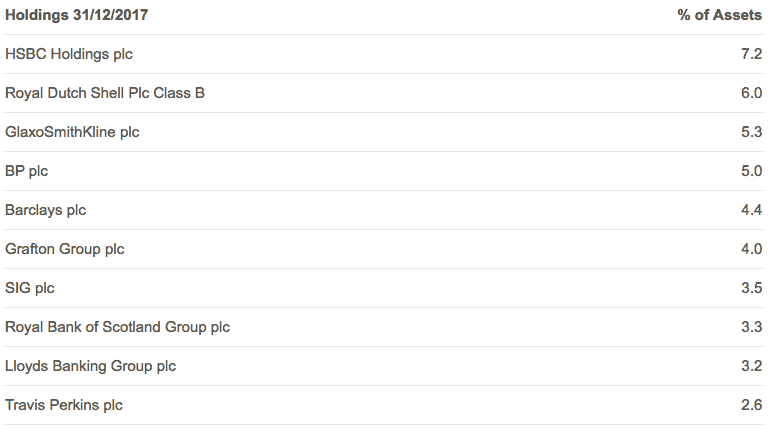

TMPL mainly invests in blue-chip companies, and currently has large positions in HSBC Holdings, Royal Dutch Shell, and GlaxoSmithKline. The top 10 holdings are shown below.

Source: templebarinvestments.co.uk. Data as of 31/12/17.

This trust could also appeal to dividend seekers, as it pays its dividends on a quarterly basis as well. The payout has been increased for 33 consecutive years now, although the yield is a little lower than CTY’s, at 3.1%.

The long-term performance of the trust is solid, with the NAV increasing approximately 70% for the five years to the end of December. Ongoing charges are 0.51%.

Given its successful long-term track record, the Temple Bar Investment Trust looks to be an excellent fund for those investing their first £1,000.