Legal & General (LSE: LGEN) is a popular income stock and it’s easy to see why. In recent years, it’s been an absolute cash cow. Can investors expect a big payout for 2024? Let’s take a look at the dividend forecast.

Image source: Getty Images

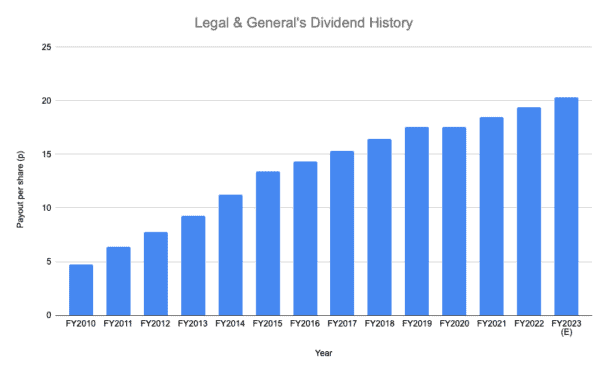

Legal & General’s dividend history

Before we look at the forecast for 2024, it’s worth touching on Legal & General’s recent dividend track record. Because it’s impressive.

Indeed, since FY2010, Legal & General has either maintained or increased its payout every year. And in that time, the distribution has risen considerably.

Back in FY2010, the total payout was just 4.75p per share. For FY2022, however, it was 19.37p per share. That represents growth of 308%, or 12.4% a year on an annualised basis.

It’s worth noting that, as a result of its dividend track record, Legal & General is part of the S&P UK High Yield Dividend Aristocrats Index. This features high-yielding UK stocks that have managed to maintain or increase their dividends for at least seven consecutive years.

Given its inclusion in this exclusive group, I think management is likely to do everything it can to maintain the excellent dividend track record in the years ahead.

2024 forecast

As for the forecast for 2024, the consensus estimate is currently 21.4p per share.

That’s another big payout. At today’s share price of 251p, that equates to a yield of around 8.5%.

Note however, that Legal & General typically pays its dividends in June and September. The June payout is the final one from the previous year , whereas the September distribution is the interim payout for the current year.

So the distribution for FY2024 is likely to be paid in September and then June 2025.

No guarantees

Now, it’s worth stressing that analysts’ forecasts aren’t always accurate.

So there’s no guarantee Legal & General will actually pay out 21.4p per share for FY2024.

One risk to be aware of here is that the financial services company has a new CEO. And he could decide to change the capital allocation policy.

I’d be surprised if the new chief exec did opt for a cut. Because as I said earlier, companies usually like to preserve their track records.

But we can’t rule one out. Especially when dividend coverage (the ratio of earnings per share to dividends per share) is low. For 2024, the dividend coverage ratio is only forecast to be around 1.25.

An attractive stock today

It’s worth pointing out that the big dividend isn’t the only attraction of this stock.

Another appealing feature is its low valuation. Currently, it trades on a forward-looking P/E ratio of around 9.4 – well below the UK market average.

Given that it has both a low valuation and a high yield, I think there’s a lot to like about the stock today.

As always though, diversification is important when investing in stocks like Legal & General. Because there’s always the chance it could underperform.