Passive income of £5,000 a month sounds like a distant dream, but it’s a surprisingly useful way to frame long-term investing goals. And when we’re investing, we should always have a goal in mind, otherwise it can feel like a slog.

At £60,000 a year, this level of income would comfortably exceed the UK’s average salary, while benefitting from the tax shelter of an ISA. It’s a great goal, but one that will undoubtedly take time to achieve.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Where to start?

The maths is the natural place to start. If an investor targets a sustainable 5% annual return from a diversified portfolio — combining dividends, interest, and some capital growth — generating £60,000 a year would require an ISA valued at around £1.2m.

Using a more cautious 4% assumption, the figure rises to £1.5m. These numbers may look intimidating, but they’re not unrealistic over a multi-decade timeframe.

Now, the average Stocks and Shares ISA in the UK is valued at over £65,000. With that in mind, average Brits would need to continue contributing and investing for a while.

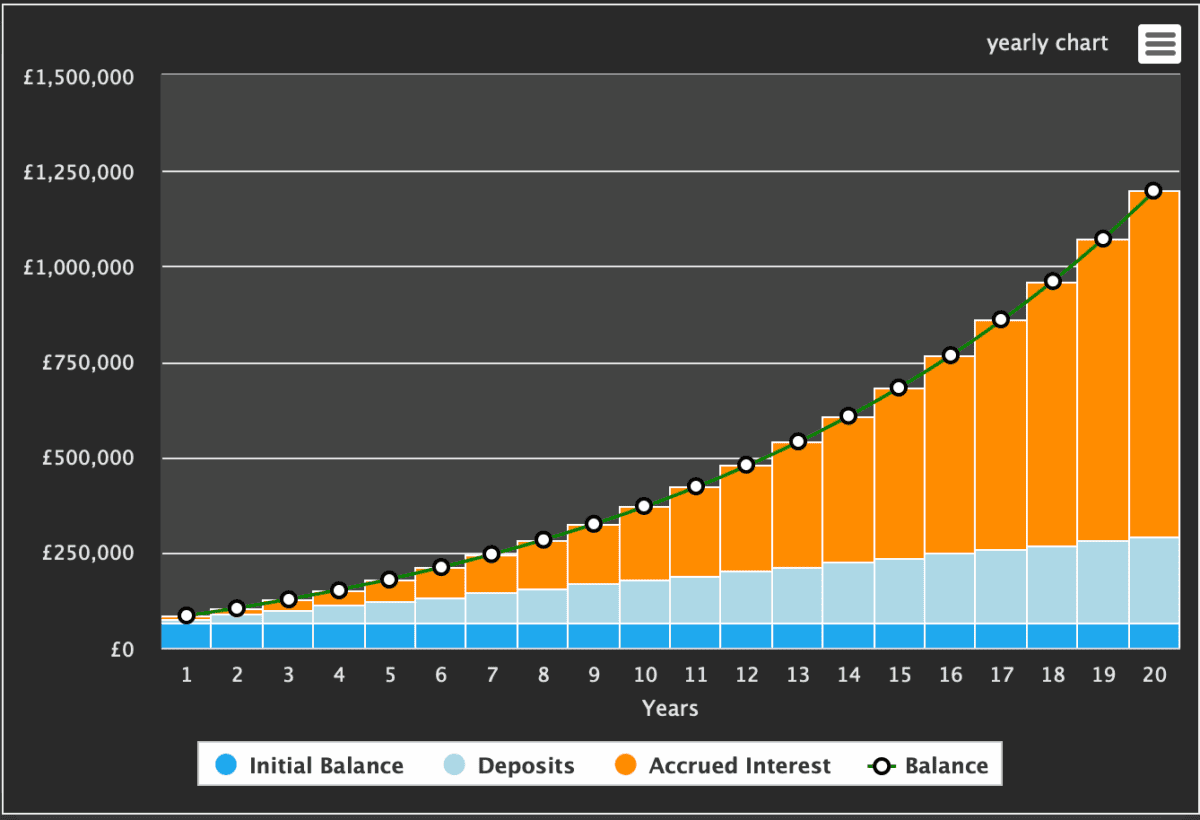

There are lots of hypothetical ways to turn savings into £1.2m, but one involves contributing £950 a month over 20 years, assuming a 10% annualised return. Interestingly, the average ISA return in recent years has been around 9.6%, although that can’t be guaranteed.

As we can see from the graph, over time, compounding does much of the heavy lifting, as returns themselves begin to generate further returns. Regular contributions, annual ISA allowances, and reinvestment can materially reduce the reliance on headline yields alone.

What’s more, compared with buy-to-let property, a stocks and shares ISA offers greater liquidity, far lower hassle, and none of the tax or regulatory creep that landlords have faced in recent years.

Invest poor, lose money

Of course, as with anything, do it badly and you could lose money.

That’s why I used a numbers-driven approach to investing. It’s not about hunches, it’s about what the numbers tell me — especially the valuation metrics.

So, which stocks do I think are worth considering today?

Well, one that stands out is Sanmina Corporation (NASDAQ:SANM). Sanmina manufactures complex electronic systems and, following its acquisition of ZT Systems’ manufacturing arm, now competes directly in cloud and AI server infrastructure. Following the takeover, there are plenty of similarities with one of my previous favourite Celestica, which I’ve held from the bottom to the top.

What do I like so much about it? Well, it’s currently trading at 13.3 times forward earnings. That’s less than half the average for the Nasdaq. What’s more, it’s one of the fastest-growing companies out there with average earnings growth for the next two years set to be around 57%.

On a growth-adjusted basis, it’s trading at around 25% of Celestica’s valuation. And that makes me very bullish, especially when we look at the below table.

| Year | Company | Revenue Forecast | Non-GAAP Op. Margin | Non-GAAP Net Income (Est.) |

| 2026 (F) | Sanmina | $14bn – $14.5bn | 5.7% – 6.2% | $810m – $860m |

| Celestica | $17bn – $17.4bn | 7.8% – 8% | $1.05bn – $1.15bn | |

| 2027 (F) | Sanmina | $16bn+ | 6% – 6.5% | $1bn+ |

| Celestica | $21bn – $22bn | 8% – 8.5% | $1.4bn – $1.5bn |

However, there are still risks to consider. Margins are still a little thin compared to its peers and investors will want to see more evidence that the company has successfully incorporated ZT Systems. But I still think it’s worth a look.