In today’s turbulent economic climate, domestically-focused FTSE 250 stocks are looking more appealing than ever. With 10%-25% US tariffs threatening exporters and geopolitical conflicts rattling global supply chains, foreign business is at risk.

But stocks on the UK’s mid-cap index typically serve more UK consumers in sterling, partly shielding them from currency swings and trade wars. While FTSE 100 blue-chips grab headlines, the FTSE 250 offers significant growth potential for patient investors.

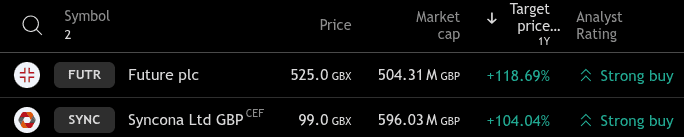

Currently, two stocks stand out, with analysts predicting growth of over 100% in the coming year. They are Future (LSE: FUTR) and Syncona (LSE: SYNC).

But what’s the chance that these forecasts come true?

Future

Future publishes special-interest magazines and websites like PC Gamer and Cycling Weekly, earning revenue from digital subscriptions. After a challenging 2025 that saw AI impact e-commerce growth, it’s now trading at a low valuation. Now, eight out of nine analysts studying the stock give it a Buy rating, with an average price target of 1,148p — a 118.7% gain.

The recent acquisition of SheerLuxe helps strengthen its luxury lifestyle portfolio, targeting affluent UK audiences with cash to spare. With largely domestically-derived revenue, it’s better shielded from foreign upsets. Earnings per share (EPS) are forecast to reach £1.33 in 2026, up from £1.23 last year. But the core attraction here is the dividend story. With a 3.2% yield that’s well-covered by cash earnings, it offers a rare mix of growth and income potential.

However, the ongoing threat of AI can’t be ignored. Even though Future has done well to implement cost discipline and buyback initiatives, AI remains a persistent risk to the company’s core ad-driven revenue stream.

Syncona

Syncona invests in early-to-mid-stage biotech, with over £1bn in assets like gene therapies and oncology platforms. Despite a net loss of £25.4m in H1 2025, analysts remain bullish. The average 12-month price target implies a 104% increase, supported by asset growth, successful clinical trials, and lucrative partnerships.

Its balance sheet looks healthy, with minimal debt and £30m in free cash flow helping fund late-stage investments amid biotech recovery. Still, it’s a speculative and evolving industry, leaving significant risk of losses if things go south. Upcoming venture capital firms are notoriously volatile, so investors should keep this in mind.

On the plus side, its UK-focused portfolio helps avoid tariff threats and thrives on global M&A waves. Although unprofitable for now, sales of assets like Freeline could unlock billions. It’s your typical high-risk/high-reward pick, so an ideal allocation shouldn’t exceed 5% of a portfolio.

Realistic targets?

Analysts update targets regularly, so no forecast at one point in time can be taken as a guarantee.

Future’s 118.7% target feels achievable if digital subs rebound, but with ad cyclicality, a 70-80% gain may be more rational. Syncona’s growth hinges on several biotech catalysts coming together, but VC-style losses threaten volatility. A 100%+ gain requires flawless execution in an already turbulent market.

For income-growth balance, Future looks worthy of consideration albeit as a small allocation. Syncona, on the other hand, should only be considered by investors with a high risk tolerance. As always, a diversified portfolio including a mix of stocks adds necessary defensiveness against economic shocks.