UK dividend shares remain a great way to target an early retirement, in my view. Through a combination of share price gains and passive income, high-yield companies have delivered an average annual return of 14.4% since early 2021.

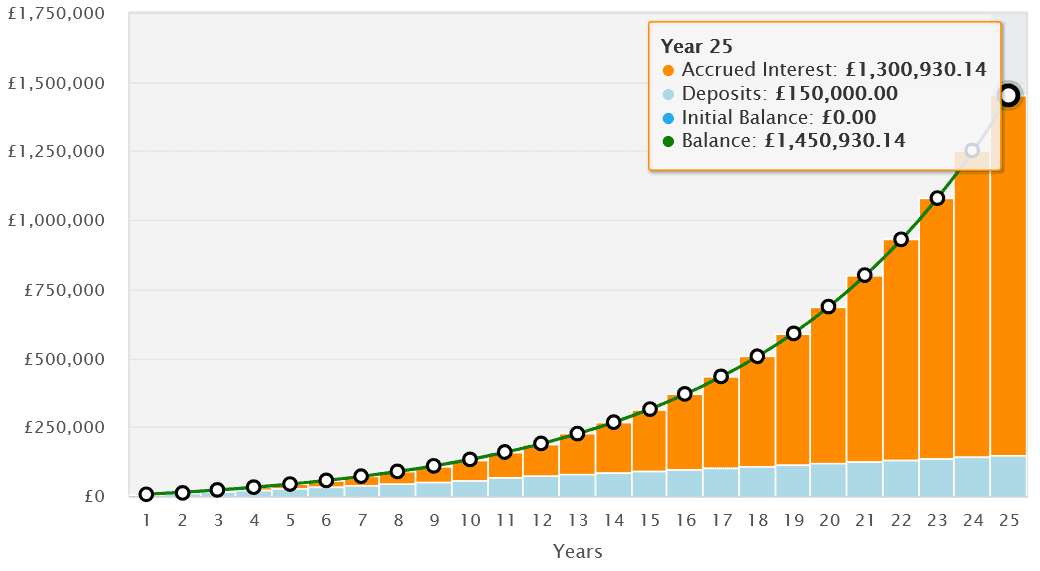

If that return continued, unchanged, then someone investing £500 a month into the high-yield FTSE UK Dividend+ index for 25 years would have £1.5m at the end of their journey. That’s the kind of sum that — especially when combined with the State Pension — would likely fund a very comfortable retirement, or even help share investors quit work earlier than planned.

But there are a few ‘cheat codes’ individuals may need to use to hit this target…

Use ISAs and SIPPs

Paying tax on share price gains and dividend income can be wealth destroying. In the UK, investors can find themselves paying capital gains and dividend tax of 24% and 39.35% respectively.

This can leave people with far fewer pounds to invest, reducing the compounding effect and resulting in a far smaller portfolio over time.

This is why using a tax-efficient Stocks and Shares ISA is important. The Self-Invested Personal Pension (SIPP) carries the same tax benefits, though there are rules on the timing and taxing of withdrawals here.

My own portfolio is spread across both ISAs and SIPPs. By protecting myself from the HMRC, I’ve been able to build far higher wealth than I would have otherwise.

ISA DISCLAIMER

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Reinvest income

The idea of receiving a regular extra cash income is an appealing one. And especially in inflationary times like these when the cost of living is sharply increasing.

However, reinvesting this juicy passive income instead of spending it can be crucial in building long-term wealth. As with tax savings, having more money to put in the stock market supercharges the compounding effect. And especially when we’re talking about huge returns like that 14.4% from high-yield dividend shares.

As I said, £500 a month invested in the FTSE UK Dividend+ would turn into £1.5m after 25 years, assuming the return doesn’t change. That also assumes dividends are reinvested. Without reinvesting that income, the same strategy would generate something closer to £570,000, based on the 5.2% annual dividend yield.

Diversify across dividend stocks

The final strategy to consider is investing in a wide range of dividend-paying shares. This way, a well-crafted portfolio can still deliver solid returns even if one of two companies perform poorly.

There are lots of great income stocks with yields of 5.2% of above to choose from today. Phoenix Group (LSE:PHNX) is one such stock that deserves serious attention — its forward dividend yield is 7.7%.

Dividends at the FTSE 100 company have risen every year for a decade. City analysts expect this to continue until the end of 2027 at least. These bullish forecasts are supported by Phoenix’s massive cash pile. Its Solvency II capital ratio was 175% as of June.

But can Phoenix keep delivering over the longer term? Fierce competition from rivals in the UK and larger global operators is a clear risk. Still, its market-leading positions in growing segments (like pensions and life insurance) give me confidence it can keep delivering impressive growth and dividends for investors.