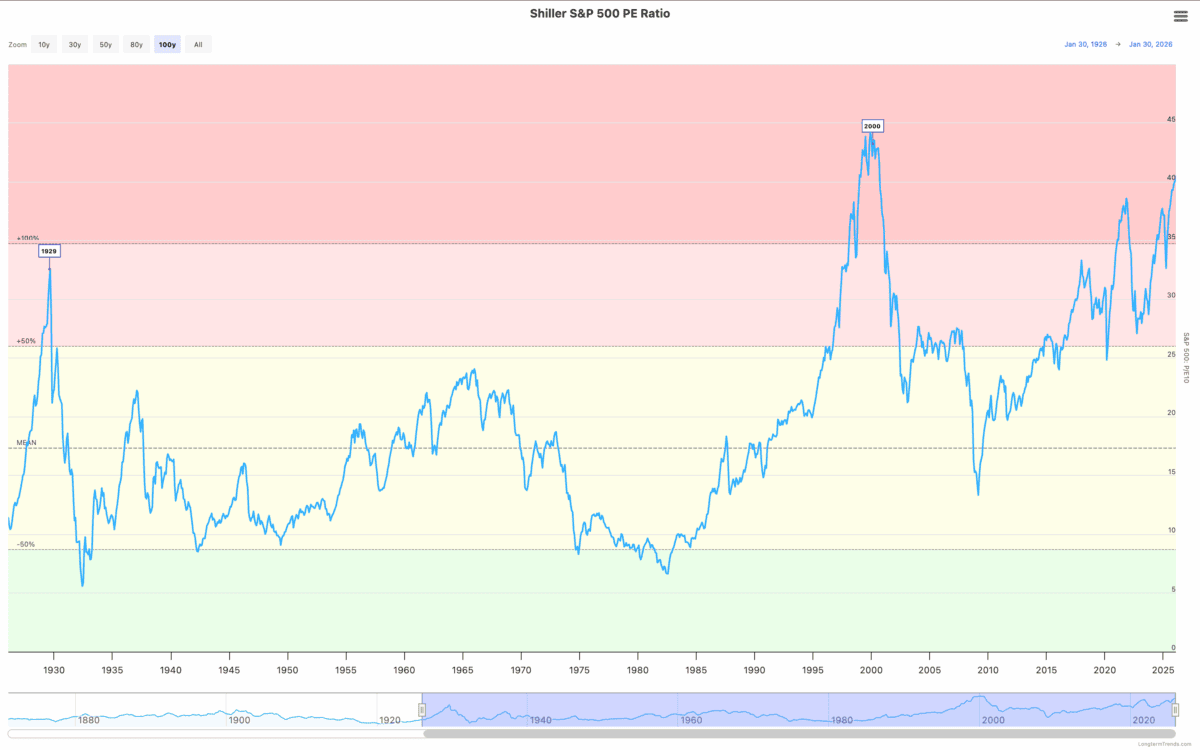

Adjusting for cyclicality, the only time the S&P 500 has been more expensive than it is right now was in 2000. Right before the dotcom crash saw tech stocks plunge.

Source: Longtermtrends

Investors can’t ignore this, but the issue is what they should do about it. And the answer isn’t necessarily to start selling shares – or even to stop buying.

Stock market crash

It’s almost impossible to ignore the similarities between the stock market in 2000 and today. The rise of artificial intelligence looks a lot like the emergence of the internet.

The casualties from the dotcom crash were huge. Some stocks fell more than 90% and investors who bought them at their peaks are still waiting for them to recover.

Outside of tech, there were shares that didn’t just hold their value, but actually went up as investors looked for safety. These were stocks in sectors such as consumer defensives and utilities.

One strategy for investors looking for US stocks in the current market is therefore to look outside of AI for potential stability. But I think this is a risky approach that needs handling with care.

Going defensive

One of the stocks that fared well in the 2000 crash was Procter & Gamble (NYSE:PG). There are obvious reasons why – it has a strong position in a market where demand is steady.

The stock could hold up well if the market sells off again. But it’s underperformed the S&P 500 since 2000 and investors need to decide whether this is a true long-term opportunity.

Revenue growth over the last decade has been below 2% a year. And the stock trades at a price-to-earnings (P/E) ratio of 22, which isn’t exactly cheap.

That’s not a criticism – growth opportunities just haven’t been there in recent years. But investors need to think about the stock as a long-term investment not just short-term speculation.

Staying the course

When thinking about the crash of 2000, it’s easy to forget that the best move for a lot of investors was to stay put. Amazon (NASDAQ:AMZN) is a great illustration of this.

The company’s share price fell over 95% when the dotcom bubble burst. But even investors who bought at the very top are up more than 14,000% on their investment just by holding on since then.

There’s a good reason for this. Amazon has taken a disciplined approach to value creation for shareholders. Its online platform has created a dominant position by focusing on the long term.

By aggressively focusing on customers, it’s established a scale that makes it almost impossible for other businesses to compete with. And the rest has followed from there over time.

What I’m doing

I hold Amazon stock and the company is right in the thick of the AI spending. And there’s a real risk that this might not pay off if demand doesn’t materialise as expected.

In that situation, the share price might go down. But I’m a buyer, rather than a seller, at today’s levels – even with the S&P 500 at historically high valuation levels.

To my mind, the lesson of history is pretty clear. Investors who can identify businesses with long-term competitive advantages don’t need to worry about short-term stock market crashes.