Lots of people have invested in property as means of increasing their long-term wealth. But I reckon real estate investment trusts (REITs) are a great alternative. And in some cases, they are currently (30 January) offering a yield greater than a typical buy-to-let (BTL).

According to Eddisons, a BTL rental yield in excess of 6% is “very good”, although it says this varies by region. For example, in the north of England and parts of Scotland, it might be possible to get something closer to 8%. However, this is a gross figure. It doesn’t take into account letting fees, repairs, and mortgage interest.

And then there’s tax to consider. Remember, holding a REIT in a Stocks and Shares ISA means any dividends and capital gains can be earned tax free.

I know from personal experience that being a landlord isn’t easy. That’s why I now prefer stocks and shares to bricks and mortar.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Shopping around

In fact, one of my shareholdings is Supermarket Income REIT (LSE:SUPR). Based on amounts paid over the past 12 months, it’s yielding 7.1%. This is far superior to anything that I’ve ever earned on my BTL.

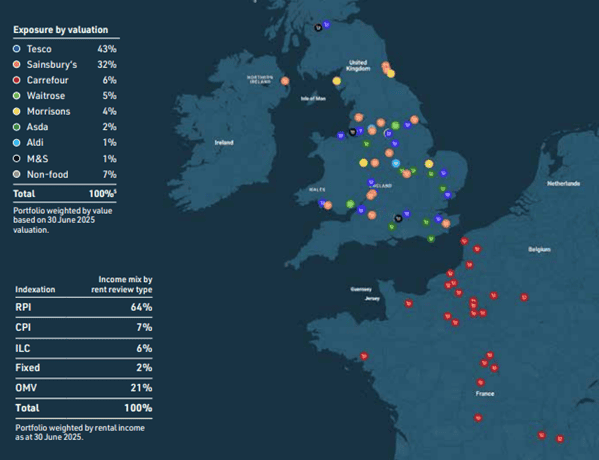

The REIT invests in omnichannel supermarkets in the UK and France, which are used for in-store shopping, click and collect services, and home deliveries.

One of the things that I like about REITs is that, generally speaking, they have very simple business models. For example, Supermarket Income employs just 15 people to look after its portfolio worth close to £2bn.

Towards the end of 2025, the trust went on a bit of a shopping spree buying more stores for its own portfolio as well as some for a joint venture with Blue Owl Capital. Latest figures show that this partnership now owns 23 assets with a value of £833m.

Impressively, for the 12 months to 30 June 2025, the trust had 100% occupancy and a perfect record of rent collection. Given that it claims it has a 75% exposure to “investment grade clients”, this is probably not surprising.

Looking ahead, 77% of its tenancy agreements provide for inflation-linked rent increases. And its weighted average unexpired lease term (WAULT) is 12 years. Both these factors give it a relatively high degree of certainty over its future revenue.

Buyer beware

Of course, there are risks. Dividends can never be guaranteed, especially in the commercial property sector, which can be volatile.

Larger properties are also facing significant increases in their rates bills. And in common with most REITs, Supermarket Income usually borrows to buy more properties. This means its earnings are vulnerable to a higher interest rate environment.

Also, due to the nature of its business, I’m not expecting its share price to take off any time soon. Slow and steady capital growth is probably the best that can be hoped for.

Supermarket Income is my favourite REIT. I like the sector that it operates in as well as its blue-chip tenants. And, of course, there’s the attractive dividend. For these reasons, I think it’s worth considering. And with each share costing approximately 84p, a lot less cash is needed to get a foothold in the real estate market than with a BTL property.