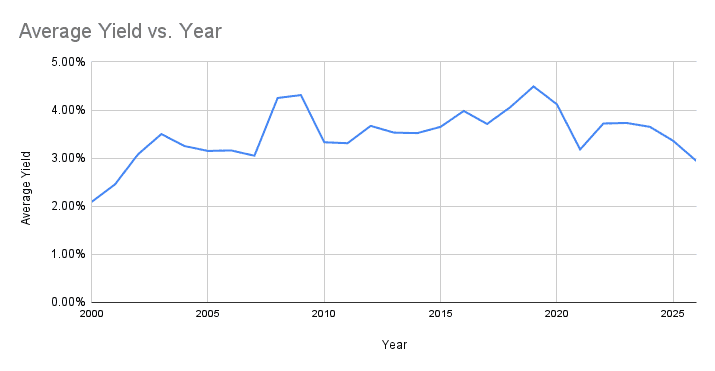

The FTSE 100‘s average dividend yield has dipped below 3% for the first time since Covid, according to data from dividenddata.co.uk. For short periods in 2020 and 2021, the yield fell below 3% — but has largely remained above that average since 2002.

That’s a wake-up call for income-hungry retirement investors. With the Consumer Prices Index (CPI) at 3.4%, interest rates at 3.75%, and the FTSE at highs over 10,200, is it the end of UK stocks as reliable income machines? Or is it a healthy sign of capital growth?

Why yields are falling

Low yields don’t signal weakness – they’re actually a sign of strength. When share prices rise faster than dividends grow, the yield naturally compresses. In 2025, mining, defence and finance helped the Footsie surge nearly 20%, ramping up valuations. While payouts remain robust (forecast 3.4% in 2026), index yields shrink as prices climb.

Zooming out, the macro picture is encouraging. The OECD just upgraded UK growth to 1.2% for 2026, retail sales surprised to the upside (+0.4%), and consumer confidence hit its highest level since August 2024. Inflation sits at 2.1%, the Bank of England base rate is 3.75% (with cuts expected through the year), and gilts yield around 3.5%.

Most importantly, total returns (dividends plus price growth) have historically beat inflation by a country mile. So anyone still holding cash savings is probably losing purchasing power.

So is income dead?

I wouldn’t give up on dividend investing just yet. Even with index yields compressed, individual UK stocks still offer mouth-watering income. Consider Admiral Group (LSE:ADM), the insurance and price comparison giant. It yields around 6.7% with dividend cover of 1.8 times — meaning payouts are safely covered by earnings. Better yet, it boasts over 20 years of uninterrupted dividend payouts.

A £100,000 holding in Admiral would generate £5,500 annually, 100% tax-free inside an ISA. So it’s still an appealing stock to consider for long-term dividend income. Plus, the company’s digital moat keeps costs competitive, adding defensive prospects for an income-focused portfolio.

My only concern would be regulatory scrutiny. In the past, the Financial Conduct Authority (FCA) has flagged concern around premium finance products — a key source of revenue for Admiral. If the FCA tightens regulation, or bans these practices outright, insurers could take a profit hit, threatening dividend coverage.

Balance it with growth

For retirement savers with a 20-25-year outlook, growth could compound harder than income. For example, a 1%-yielder with 12% annual NAV growth beats a 6%-yielder with no growth, full stop.

Dividend shares still hold a critical place in a portfolio aimed at passive income but growth stocks could speed up the journey. Those hoping to capture the best of both worlds may consider a tech-heavy growth vehicle like Scottish Mortgage Investment Trust.

This highly-diversified trust invests in companies around the world, including top S&P 500 names, private equity firms and emerging market leaders.

So while yields may look low these days, my strategy remains the same: accumulate quality dividend stocks supported by defensive plays and powered by compounding growth.