I’m investing just £50 a week with one clear goal: to earn passive income of up to £3,000 a month! It’s an ambitious target, I’ll admit, but nothing worth doing was ever easy.

So how will I go about turning my meagre £50 weekly savings into an income I can comfortably retire on?

Doubling down on dividends

For those who don’t know, dividends are small percentages of an investment paid back to the shareholder as a kind of reward. For example, £1,000 invested in a company with a 7% yield would return £70 annually as a ‘thank you’. You still own your £1,000 worth of shares and now have some extra cash as a bonus.

But the real trick to making dividends work for you is by reinvesting them back into the stock. In this way, you harness the power of compounding returns and skyrocket your portfolio value.

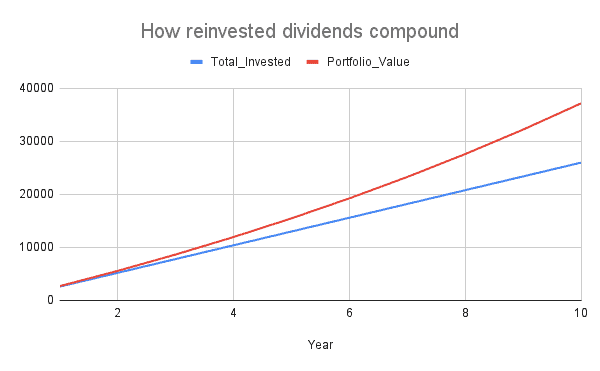

The chart below illustrates how a 7%-returning portfolio can balloon to over £37k in 10 years, with just £26k invested.

This powerfully demonstrates why Einstein allegedly called compound interest “the eighth wonder of the world“. The gains represent a 43% return on invested capital over 10 years — and crucially, the gains will accelerate over time.

This is why it’s so important to start investing as early as possible.

Sadly, for my goal, I may be a bit late. By my calculations, it would take around 40 years to compound to over £500,000 — the amount needed to return £3,000 a month (at 7%). If my stock picks perform better than expected, I may be lucky — but chances are I’ll need to settle for less.

However, anybody 30 years’ younger could realistically hit this target by retirement.

Long-term risk reduction

I picked a 7% average because I believe it’s a realistically achievable yield. While higher returns may be possible, it increases risk – and I prefer to err on the side of caution. This also applies to my stock picks. Rather than gamble on speculative AI hype stories, I opt for tried-and-tested companies backed by decades of solid performance.

A good example for investors to consider is Smith & Nephew (LSE: SN). Having paid dividends continuously since 1937, its 88 years of uninterrupted payments is one of the longest track records in the UK. The company’s older than the NHS and has stuck to its dividend policy through every market stress since the Great Depression, spanning multiple recessions, wars and economic downturns.

Still, it’s not immune to risk. Facing multiple hip implant lawsuits across the US, it may be hit by unexpected cash settlements, potentially disrupting dividend-supporting earnings growth.

Encouragingly, it enjoys 81% institutional ownership (as of Q2 2025) from big names such as BlackRock (6.5%), Cevian Capital (5.1%) and Vanguard (4.7%). These are not fly-by-night buyers — they’re deep-value investors with rigorous due diligence processes. Their commitment signals extraordinary confidence in the business.

The importance of diversification

While Smith & Nephew exhibits long-term reliability, its yield seldom rises above 3% (doing little to support my 7% average). That’s why it’s important to diversify, balancing low-risk options with some sustainable high-yielders.

Legal & General, M&G, Investec and British American Tobacco are some examples of high-yielders with long track records of reliable returns. And they’re just a few of the options that look appealing this month.