Passive income is the dream, but it only becomes real when you put a number on it.

Real-world modelling

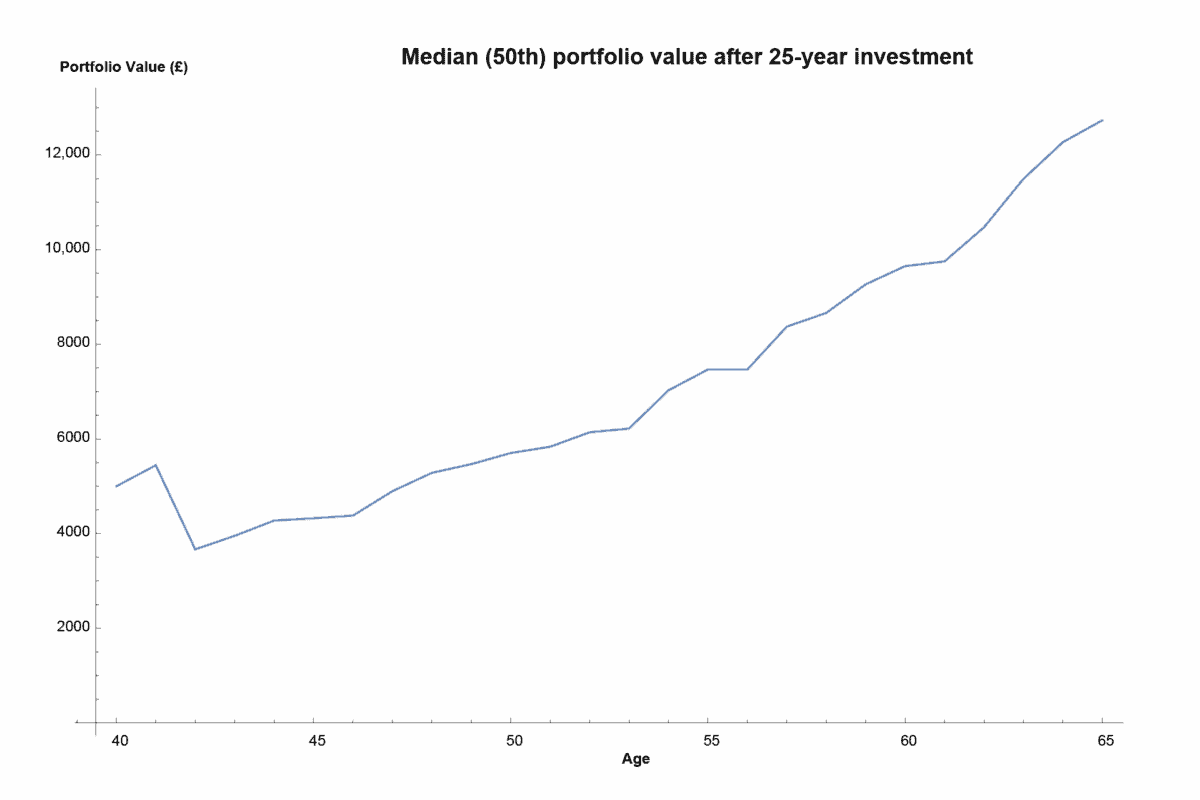

The following chart doesn’t claim to be a prediction – it’s a reminder of what can happen when you invest in a resilient business like Aviva (LSE:AV.) and stay invested for the long term. It shows the median outcome across 100 simulations, not one lucky path or a worst-case scenario.

Chart generated by author

I modelled a stock market crash just two years into the 25-year timeline. That’s the moment every long-term investor fears: the portfolio drops sharply and the urge to sell becomes loud.

The model assumes a realistic, 30% share-price drop during the crash year, and dividends are reduced too. Yet the crash isn’t a fixed event. The model builds in volatility, so outcomes vary – sometimes better, sometimes worse, just like real markets.

Across all 100 simulations, the median value of the portfolio after 25 years is around £12,000. Of course, some simulations were higher and some lower. But the median result is what matters here.

Dividend engine

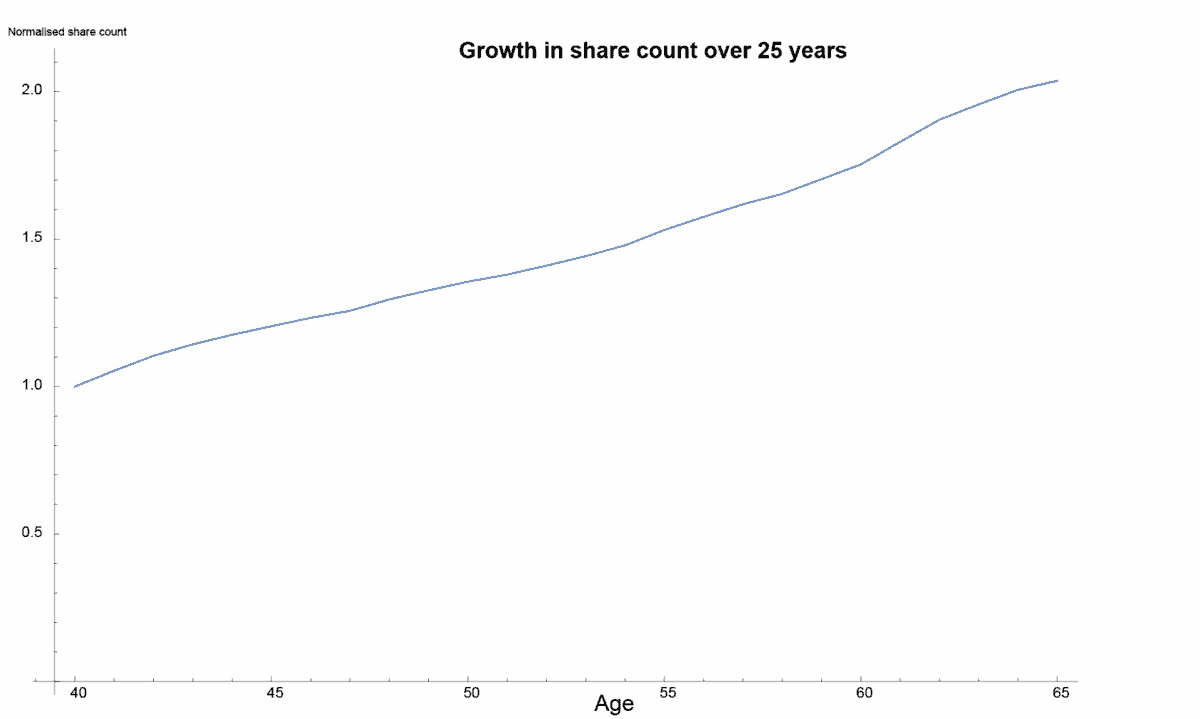

What matters isn’t the occasional outlier, but the steady trend: dividends continue, are reinvested at lower prices, and buy more shares when the market is down. That’s compounding in action.

The following chart highlights how that £7,000 gain is created. The vast majority comes from dividends collected and reinvested, with a small amount from modest price growth baked into the model. The chart is normalised to 1, so over 25 years the typical run doubles the number of shares owned – meaning reinvested dividends buy roughly twice as many shares as were started with.

Chart created by author

Dividend sustainability

Last year was the insurer’s best since the global financial crisis, with the stock up about 42%. But for income investors like me, the bigger question is whether the dividend can stay reliable once the market stops paying attention.

In the last financial year, earnings didn’t cover the dividend, but cash flow certainly did – by over nine times. That matters because cash flow is what actually funds the payout. Still, accounting metrics like earnings and cash flow aren’t the only lens I use when looking at an insurer.

Most of Aviva’s future profits are tied up in the CSM (contractual service margin). Think of it as a reserve of future profits built into the business. As policies mature, that profit is released gradually, which helps smooth earnings over time. And it’s been growing fast: year on year, the CSM is up about 58%.

That’s important because it suggests the company has a steady pipeline of profits to support the dividend, even when markets wobble.

Of course, there are risks. Motor and home premiums have been falling recently, and if that continues it could squeeze margins at Direct Line. High competition and persistent claims costs could force further price cuts, which would pressure future earnings and the dividend.

Even so, Aviva remains a stock I’m happy to hold for passive income. The dividend yield is attractive, the cash flow cover looks solid, and the business has a steady profit engine beneath it. 2025 may have been a standout year, but the company’s core ability to generate cash and pay dividends feels more durable than its ‘boring’ reputation suggests.