Looking for the best UK shares to think about buying and holding for the long-term in a Stocks and Shares ISA? Here are two I think could supercharge a well-balanced portfolio over the next 10 years.

Copper giant

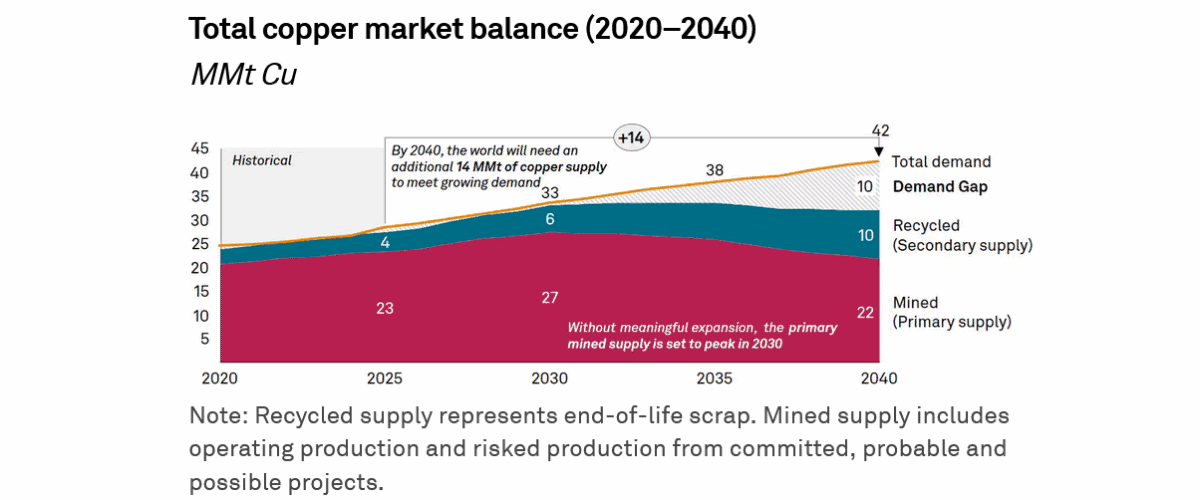

There seems to be little doubt about it. A massive supply deficit in copper is looming that could supercharge prices of the red metal over the next decade — it recently hit new peaks above $13,000 a tonne.

Investing in copper stocks could be a great way for investors to monetise this. As one of the world’s biggest copper miners, as well as a major trader of the industrial metal, I feel Glencore (LSE:GLEN) could be a great stock to consider.

Holding copper stocks over an exchange-traded fund (ETFs) that tracks metal prices is a riskier strategy. However, the FTSE 100 company’s enormous scale can reduce the impact of operational issues at any one or two assets significantly.

It has eight red metal projects spanning North America, South America and Africa. This is in addition to its dozens of other assets spanning other high-demand metals and minerals. Be mindful, though, that Glencore’s share price could endure short-term volatility in the event of an economic downturn.

Still, at current prices I think the miner deserves serious attention. Its price-to-earnings growth (PEG) ratio for 2026 sits at a bargain-basement 0.1. Any reading below 1 suggests stunning value.

Another ISA contender

Global power generation is tipped to explode over the next decade. A rising population, combined with soaring energy demand from sectors like data centres and electric vehicles, is set to push energy demand through the roof.

Greencoat UK Wind (LSE:UKW) is one star stock to consider for this upswing. As the name indicates, it operates in the renewable energy sector which is set for strong growth as the transition from fossil fuels accelerates.

Conditions are especially favourable in the UK where the FTSE 250 company operates. Last week the government dished out offshore wind farm contracts for 8.4GW of new capacity, a record-breaking auction putting it closer to its goal of generating 95% of the country’s energy from green sources.

Given their essential operations, renewable energy stocks can enjoy strong and reliable cash flows they can then distribute in dividends. This isn’t always the case, though: during unfavourable weather conditions, power generation can fall off a cliff.

However, Greencoat UK’s wide portfolio helps protect (if admittedly not eliminate) this threat. The 49 assets on its books span all four corners of Britain, which reduces the impact of calm conditions in one or two areas on overall performance.

Today, the company trades at a 30% discount to its net asset value (NAV) per share. This reflects the impact of higher interest rates in recent years that have eaten into profits.

With the Bank of England steadily cutting rates though, I expect Greencoat UK’s share price to rebound sooner rather than later.