Finsbury Growth & Income Trust (LSE:FGT), from the FTSE 250, was founded in 1926, so it’s approaching its centenary.

As part of this milestone, the annual general meeting tomorrow (15 January) will include the trust’s first-ever continuation vote. This is a shareholder vote on whether the company should keep operating under its current strategy and structure.

Might this be a good time for me to invest in this underperforming FTSE 250 stock in case it bounces back strongly?

Disappointing five years

While this is a continuation vote, it can also be viewed as a referendum on manager Nick Train following five years of very disappointing underperformance.

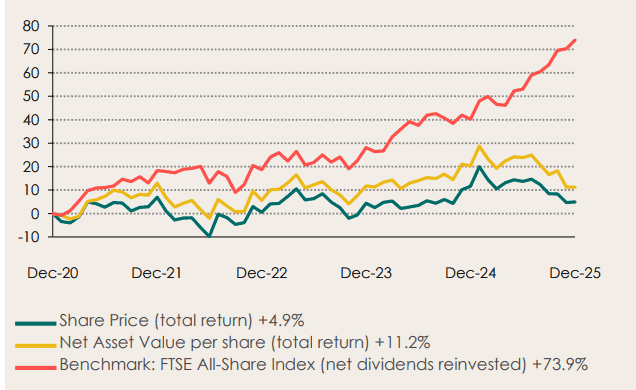

As we can see below, the £978m investment trust has languished since 2020 while the FTSE All-Share Index (the red line) has taken off.

Obviously, this is the complete opposite of what shareholders would have wanted.

If this week’s vote passes, the trust will continue under its current strategy. However, if it fails, Finsbury could be restructured with new management, merged with another trust, or even wound up to return cash to shareholders.

What’s gone wrong?

The manager employs a ‘quality’ investing style, particularly focusing on what he considers durable brands or franchises.

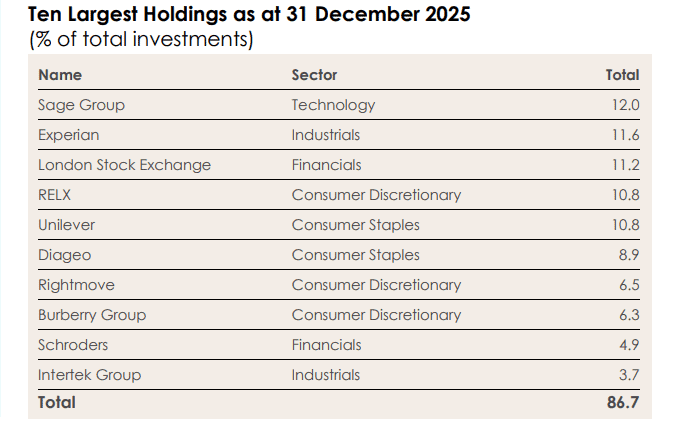

Unlike many fund managers who hold 50-100 stocks to manage risk, Train runs an extremely concentrated portfolio, with the 10 largest holdings making up a whopping 86.7% of assets.

When the selection is this concentrated, the stock picks need to be good. Unfortunately, this is where things have come unstuck. Key holdings Diageo and Burberry are down 55% and 41% respectively in just three years.

To increase his exposure to technology, Train loaded up on stocks like London Stock Exchange, Rightmove, and Auto Trader. However, these three names (along with Sage Group) all fell by double digits in 2025, badly damaging performance.

In 2024, Train admitted the trust “really should be able to do better than this and if we can’t, then I absolutely share shareholders’ growing impatience”. He said he was “frustrated” by the “malaise gripping the UK equity market”.

There was no malaise in 2025 though, with the FTSE 100 returning around 25% with dividends. Yet the trust managed to post negative returns, which will have left many shareholders questioning the strategy.

Should I invest?

Of course, I have no idea what will happen at tomorrow’s vote, but I doubt the trust will disappear. After all, Train’s performance record over 25 years is still impressive (roughly a 706% share price gain).

One thing I like is he’s apologetic about the underperformance, saying he’s run out of ways to say sorry to shareholders. In contrast, some other fund managers try to blame the market rather than their own stock selection.

Also, Train has significant skin in the game, having ploughed another £206,000 in earlier this month to take his stake to almost 5%. This shows he has faith in the turnaround prospects of the trust, which is trading at a 5.3% discount to net asset value.

It’s entirely possible Finsbury’s portfolio makes a roaring comeback in 2026 (I hope it does). Unfortunately though, I’m not confident enough to invest here due to the persistent underperformance.

Overall, I see better potential in other investment trusts right now.