One of the most attractive ways to earn monthly income is by passively investing in dividend shares via a Stocks and Shares ISA. This method has two key benefits: regular dividend payouts and the tax relief offered by an ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

But results vary significantly from one investor to another. So what’s the best method to achieving reliable, long-term income?

Picking solid stocks

One of the biggest mistakes early investors make is picking high-yielding stocks without assessing sustainability. Dividends are set by the company, so any can essentially set the yield they want. But if they can’t afford to honour payments, dividends are soon cut and the yield diminishes.

Most companies try to offer realistic, sustainable dividends — but nobody can predict the future. Every company is at the whim of geopolitical, environmental and macroeconomic factors they can’t control.

However, by checking dividend track records and assessing a company’s financial history, we can get a better idea about reliability.

One example

The FTSE 100 insurance company Phoenix Group (LSE: PHNX) is one to consider. It’s delivered uninterrupted dividend payouts since 2009. It’s also increased its dividend every year since 2016, at an average rate of 3% a year. This means a shareholder’s passive income has grown in line with inflation.

But does it have the financial strength to keep that trajectory going? Let’s take a closer look.

First, the main risk: falling interest rates. This can increase annuity liabilities faster than asset returns, pressuring solvency and investment margins despite hedging. There’s also the threat of drawn-out annuity obligation costs, earnings volatility (from accounting mismatches) and revenue decline from run-off legacy books.

In its latest half-year results, the company generated £705m in operating cash flow, comfortably covering £274m in shareholder dividends. Plus, its Solvency II surplus of £3.6bn and a 175% capital coverage ratio provide strong regulatory buffers. Meanwhile, underlying profit grew 25% year on year to £451m, driven by strong asset growth and improved operational efficiency.

Encouragingly, the board takes a conservative dividend approach. The recent interim dividend rose just 2.6%, following a realistically sustainable strategy. With consistent cash generation, growing profitability and strong capital reserves, I believe Phoenix could sustain and grow dividends in line with inflation for years ahead.

Targeting £2k monthly

The amount invested in a Stocks and Shares ISA would need to be fairly large to accrue £24,000 a year in dividends (£2k a month).

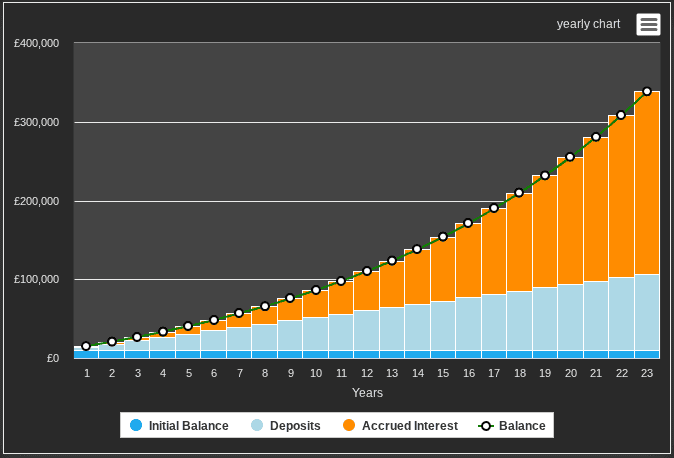

Even with a high average yield of around 7%, the portfolio would need to be worth £342,850. But when broken down over several decades, this is an achievable sum for a retirement-focused investor.

For example, with an initial £10,000 lump sum and a £350 monthly contribution, it could take around 23 years. Push the monthly contributions up to £500 and it could take only 20 years (with dividend reinvested).

For investors hoping to follow this strategy, don’t get blinded by high yields. When aiming for reliable, long-term returns, it’s worth considering sustainable dividend stocks like Phoenix Group. Other promising dividend stocks I’ve been considering lately include Imperial Brands, Land Securities Group and Schroders.

As always, a diversified mix of shares from various sectors is a good way to reduce risk while capturing industry-specific benefits.