Tesco (LSE:TSCO) shares are up 97% over three years, 50% over two years, and 18% over one. However, some of that momentum has stalled in recent months.

In fact, the stock’s now down 2.2% over three months. That’s not a big deal, but a £10,000 investment made three months ago would now be worth less than £9,800.

However, the investor would have just qualified for the interim dividend at 4.8p per share. That’s a dividend yield just a little over 1% — £100 in this case.

Clearly, the total return isn’t great, but it’s nothing to worry about. Us Fools typically invest with time horizons measured in years, not months, and short-term share price movements rarely tell us much about the underlying health of a business.

Why I’m not surprised

I’m a big fan of Tesco, as a stock rather than a supermarket. In fact, I’ve regularly noted how I thought the stock was worth considering over the past few years, but I never added it to my portfolio that’s been more focused on other sectors with stronger secular and structural drivers.

However, I recently suggested the company’s bull run was coming to an end. And I stand by that. The reason is the valuation. It’s trading around 15.6 times forward earnings (FY2026). That might not sound like a lot, but it’s certainly not as cheap as it once was and I believe the operating environment’s as tricky as ever.

On a rolling one-year basis — 12 months from now (which includes FY2026 and FY2027) — it’s trading around 14.1 times forward earnings. That’s more expensive than both Marks & Spencer (10.4 times) and J Sainsbury (12.8 times).

The other peers are also growing earnings at a faster pace.

| Metric | Tesco | Marks & Spencer | J Sainsbury |

|---|---|---|---|

| Forward P/E (2026E) | 15.6x | 14.2x | 14.3x |

| Forward P/E (2027E) | 14x | 9.6x | 12.6x |

| Dividend Yield (forward) | 3.2% | 1.3% | 4.7% |

| Net Debt (£bn) | £10bn | £2.5bn | £5.1bn |

| Operating Margin | 3.8% | 1.7% | 2.8% |

| Market Cap (approx) | £28bn | £6.8bn | £7.5bn |

The bottom line

There’s plenty of nuance here. These companies have different business models and varying degrees of exposures to ancillary sectors such as clothing.

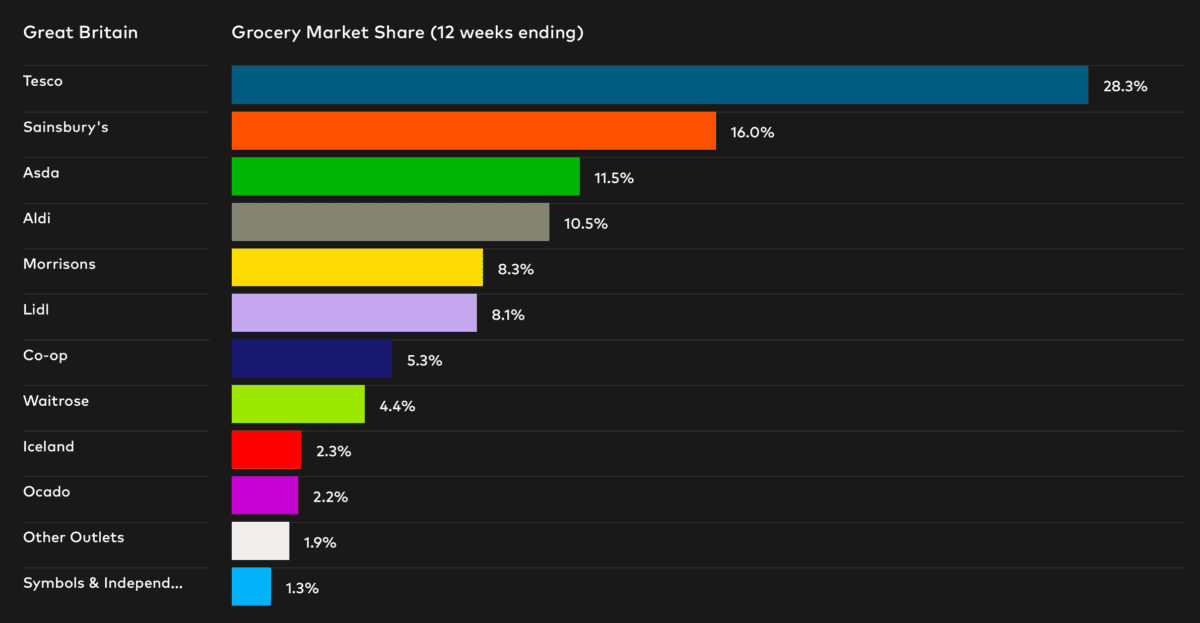

One thing that’s undeniable is that Tesco deserves to trade at a premium to its peers — on a growth-adjusted basis, of course. Why’s that? Simply, its size. With 28.3% of the grocery market, it has huge economies of scale, allowing it achieve stronger margin and cut prices when peers become aggressive.

That’s exactly what has happened in recent years. Aldi and Lidl took market share off incumbents like Morrisons, but Tesco remained firm. It’s miles ahead of its peers. That’s counts for a lot.

However, I believe the current valuation discrepancy suggests Tesco shares won’t go much higher in the near term. Any appreciation will have to be driven by earnings surprises, and not re-ratings.

It’s still worth considering, but I believe there are better options out there for 2026.