Scottish Mortgage Investment Trust (LSE:SMT) shares have endured a fairly turbulent five years. Retail investors ploughed into the investment trust — which invests in high-potential growth stocks — during the pandemic, sending the share price surging.

However, when the tech bubble popped in late 2021, shares in the trust plummeted. From peak to trough, it lost around 70% of its value. That’s quite incredible for a trust as these are supposed to be diversified investment vehicles.

However, shares in the investment trust have slowly been rising since mid-2023. I’ve been lucky enough to be part of that recovery, with the share up 90% since then.

What does it do exactly?

Scottish Mortgage isn’t a typical diversified trust. Instead, it’s a high-conviction growth vehicle that invests in some of the world’s most ambitious companies, often before they are fully listed or widely known. Its portfolio focuses on structural trends such as artificial intelligence (AI), digital commerce, semiconductors, fintech, and space technology, rather than short-term profits or broad market coverage.

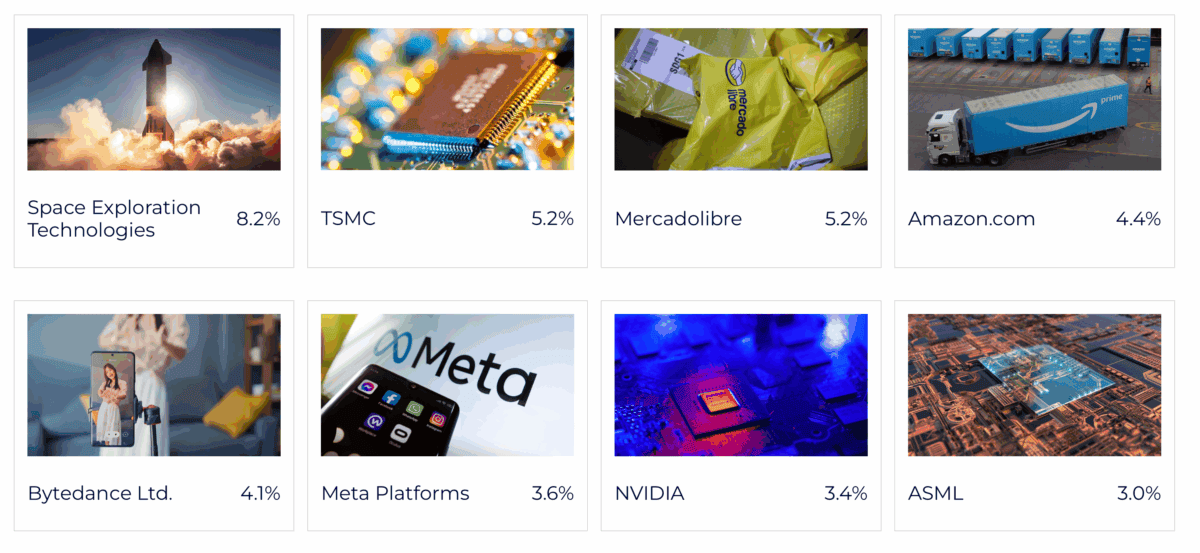

As of 30 November 2025, its largest positions included SpaceX (8.2%), TSMC (5.2%), MercadoLibre (5.2%), Amazon (4.4%), ByteDance (4.1%), Meta (3.6%) and Nvidia (3.4%). Other notable holdings were ASML and Shopify. The top positions carry significant weight, meaning the trust’s performance is highly influenced by its largest bets.

In short, Scottish Mortgage aims to identify the transformative businesses of tomorrow and hold them over the long term. That strategy explains both its outsized gains in boom years and the sharp drawdowns when high-growth tech falters.

Discounted stocks?

As suggested up top, the trust offers investors a discounted way to buy shares in top growth companies. That’s simply because the trust’s share price infers a 9% discount to its stated net asset value. In other words, the trust’s holdings are worth more than the shares of the trust itself.

Now, there are reasons for this, but they don’t always adequately account for the discount. One is risk. That’s because Scottish Mortgage uses debt to buy shares in other companies. So it’s leveraged. This can magnify gains when its holdings go up in value but it also magnifies losses when the market goes in the other direction.

What’s more, many retail investors will remember the trust’s falling share price in 2021/2022. Worried that it could happen again, they choose to stay away.

It’s also true that investors may worry about the valuations attributed to unlisted shares. SpaceX likely represents around 12% of the portfolio today following an update to the valuation in December. Investors are right to ask whether the Elon Musk company is really worth as much as $800bn. For the record… I can see how it is.

The bottom line

Personally, I believe Scottish Mortgage shares are worth considering for the long run. I have no doubt that it could be choppy, but it’s a core part of my long-term plans.