Once again, Rolls-Royce‘s (LSE:RR.) share price was one of the FTSE 100‘s best-performing shares in 2025. It more than doubled in value as it benefitted from robust airline industry conditions and further gains from its ongoing transformation strategy.

Rolls-Royce shares have now risen a stunning 1,051% over a five-year horizon. Can the FTSE company keep the momentum going though? City analysts aren’t so sure.

£12.64 price target

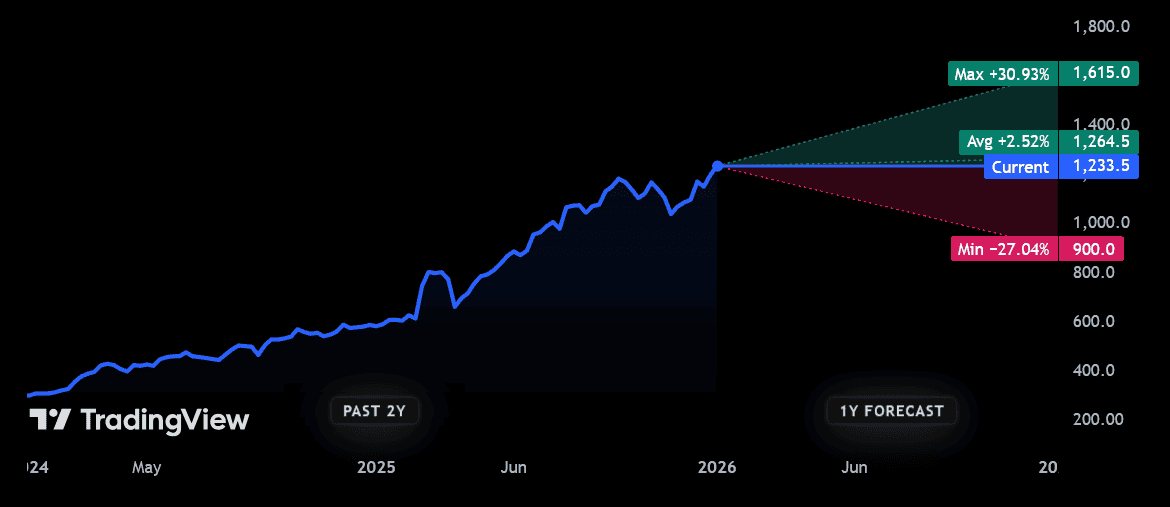

In fact, analysts reckon the company’s share price might be about to hit a wall. Currently, 14 of them have ratings on Rolls-Royce, providing a decent range of opinions. And the average 12-month share price target among them is £12.64 per share.

That suggests an uplift of less than 3% from current levels. If correct, it would — adding in predicted dividends too — provide a meagre total shareholder return of roughly 4%.

However, I believe Rolls’ share price could well shock us all.

A 31% rise?

I’m not alone in thinking the engineer’s shares might defy broker consensus in 2026. One especially bullish broker believes the engine builder will rise roughly 31% from today’s £12.33 per share.

But what could drive Rolls-Royce shares skywards again? Perhaps the most obvious answer is further growth in the airline industry, boosting demand for the company’s plane engines and servicing capabilities.

The outlook here at the moment remains rock solid. The International Air Transport Association (IATA) expects global air passenger numbers to rise 4.4% in 2026. Meanwhile, cargo volumes are tipped to rise 2.4%.

Rolls could also see defence revenues rise as geopolitical volatility — as illustrated by recent US action in Venezuela — grows. It may also enjoy fresh interest in its small modular reactors (SMRs), as countries continue switching from fossil fuels, giving shares an extra bounce.

Finally, the FTSE company could rise if its long-running streamlining programme keeps outperforming. Margins keep rising, and Rolls now packs a healthy balance sheet that’s supporting share buybacks.

What could go wrong?

Yet despite all this, I have a major problem with Rolls-Royce shares. And it all comes down to valuation. At 36.8 times, the company’s forward price-to-earnings (P/E) ratio sails above the 10-year average of roughly 15. It’s the sort of premium that some (myself included) would argue reflects all of the above assumptions.

And by extension, it means Rolls’ share price could plummet if even the slightest sign of weakness creeps in. In my view, the risk of that happening is higher than I’d personally be comfortable with as an investor.

The possibility of a slowdown in the civil aerospace sector’s possible given enduring pressure on consumer spending. Then there’s massive supply chain problems that are still pushing up costs and may well impact project delivery.

Then there’s other typical threats such as failed contract wins, project setbacks, and extreme cost overruns. Rolls has been no stranger to problems like these in years gone by.

My view then, is that Rolls-Royce’s share price could well shock us all in 2026. But right now, I feel the chances of a correction are greater than the business building on its impressive gains.

I might be wrong though. So while I won’t be buying the FTSE firm, it may be worth a close look from more risk-tolerant investors.