Worries of an AI bubble wasn’t enough to derail Nvidia‘s (NASDAQ:NVDA) stunning share price story last year. Ending 2025 at $186.50 per share, the S&P 500’s most valuable stock soared an impressive 37% over 12 months.

More strong gains at the start of 2026 mean that — over a five-year horizon — Nvidia shares have risen an incredible 1,343% to $191.10 today. Can the chipmaker print further impressive returns this year?

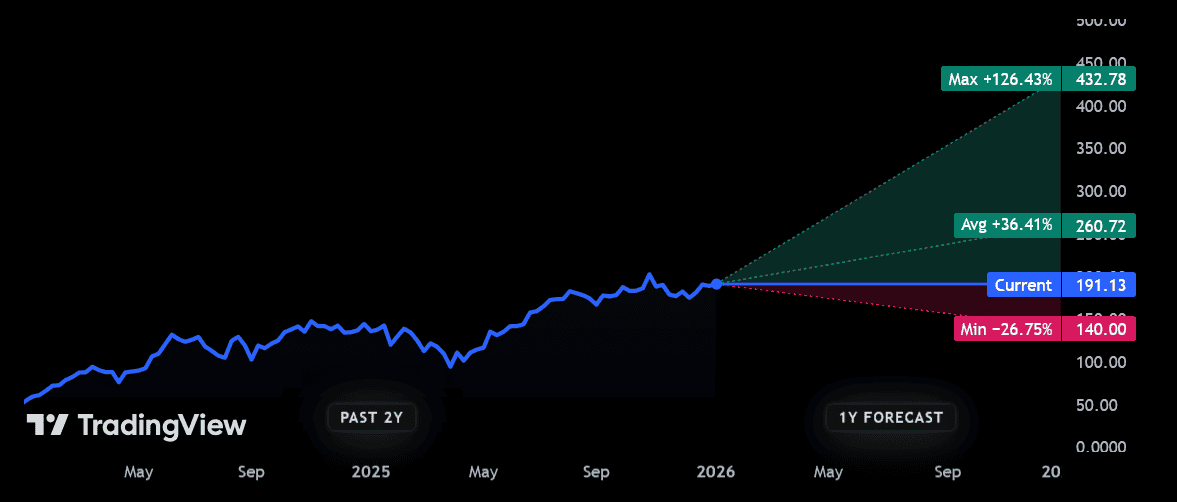

$260.72 price target

If analyst forecasts are accurate, 2026 could be another blockbuster year for the tech giant. A whopping 57 analysts currently have ratings on the company. The average 12-month price target among them is around $260.70 per share.

That suggests an uplift of roughly 36% between now and early 2027.

It’s important to remember, though, that predicting near-term price movements is notoriously difficult. Even if Nvidia performs strongly, other factors could cause its share price to undershoot forecasts. Of course the company could also perform better than expected.

What’s more, there are also some wild differences of opinion among forecasters right now. One especially bullish broker reckons the share price could more than double over the next year, to nearly $433.

Could Nvidia shares really shock the market and deliver this sort of return? I wouldn’t rule it out, given its market-leading products and the rapid pace of growth in key end markets.

Latest financials showed sales up 62% in Q3, again smashing forecasts. A string of new product releases (like the groundbreaking Vera Rubin AI data centre platform) from this year could herald a hot new growth phase for the company.

What could go wrong?

Yet while there’s a lot to like, I still have a major issue with Nvidia shares. With a price-to-earnings (P/E) ratio of 40.2 times, it looks mighty expensive, even for the famously pricey tech sector.

I don’t just think this could limit the scale of any further price gains. It might also lead to a sharp pullback if trading news begins to worsen.

And in my view, Nvidia faces more uncertainty today than it has in recent history. Sure, sales of its chips are explosive. But this has opened up a massive (and growing) supply chain problem that means it’s struggling to meet orders.

Other threats to the company include rising competition from both US and Chinese rivals, escalating trade tariffs that hit chip exports, and an economic slowdown that could damage the entire tech sector.

Finally, fears over an AI bubble are unlikely to go away any time soon too. Following vendor financing deals with the likes of OpenAI — where Nvidia is effectively helping customers to but its chips — concerns have in fact only grown over the last year.

The bottom line

I don’t think these dangers are properly reflected in Nvidia’s elevated share price. For this reason, I won’t be buying the company myself. Having said that, for more risk-tolerant investors, I think the firm could be worth serious consideration.