Finding shares to buy is all about identifying opportunities that other investors are missing. And I think National Grid (LSE:NG) is one to take very seriously right now.

The stock doesn’t look exciting. But the company might be on the verge of the kind of boost it hasn’t had in the last 10 years – and the market hasn’t obviously fastened on to this.

Growth and value

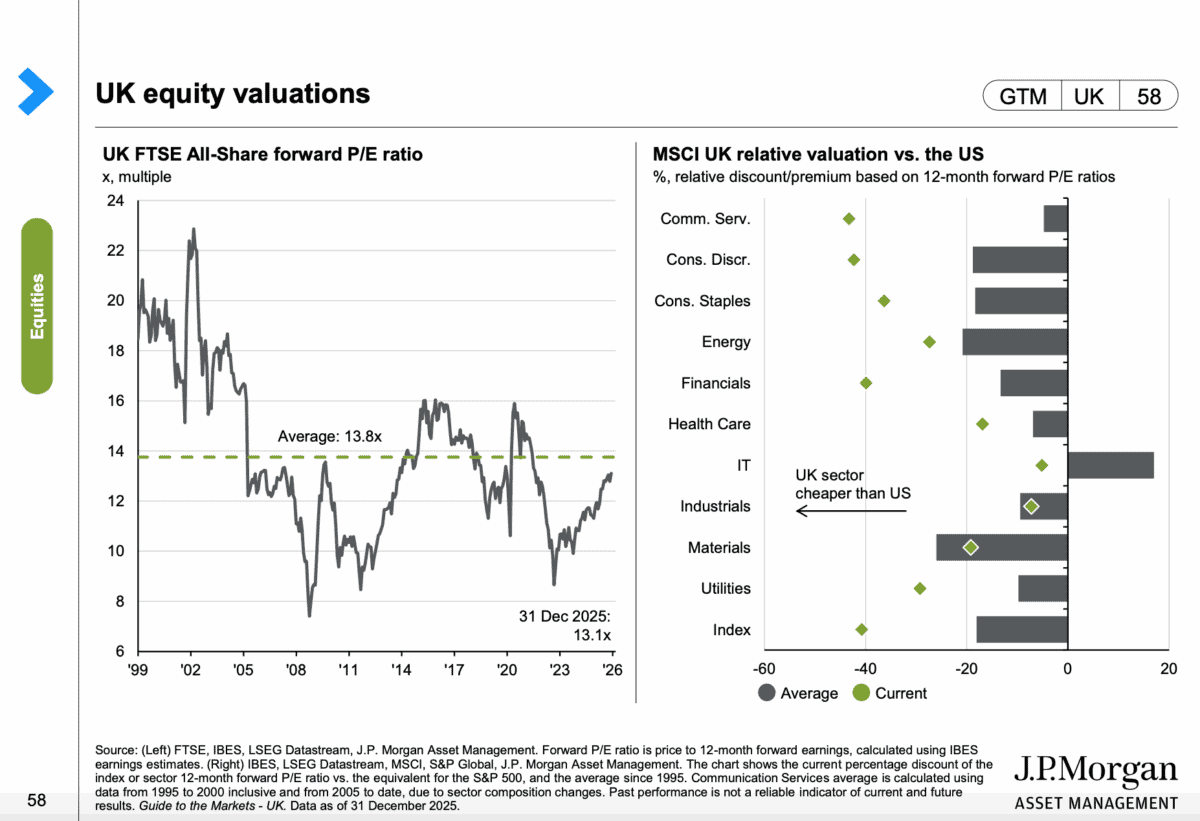

Despite the FTSE 100 outperforming the S&P 500 in 2025, UK shares still generally trade at lower price-to-earnings (P/E) multiples than their US counterparts. That’s true for almost every sector at the moment.

Source: JP Morgan Guide to the Markets UK Q1 2026

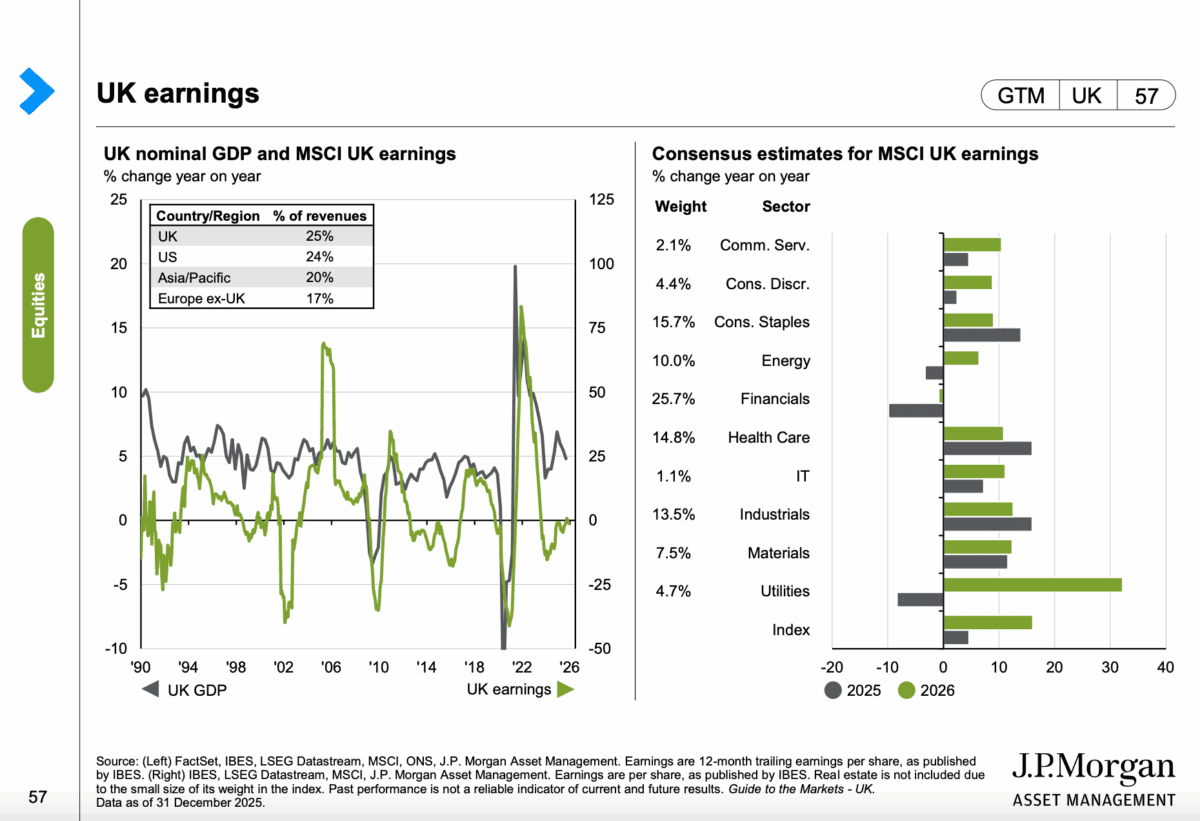

This makes a decent argument for investing across UK equities. But in terms of growth forecasts for 2026, there’s one sector in particular that stands out.

Unusually, it’s the utilities sector. The regulated nature of their businesses often makes them reliable income investments, but an inability to raise prices restricts their growth potential.

Source: JP Morgan Guide to the Markets UK Q1 2026

Analysts, however, are expecting a big increase in earnings from UK utilities in 2026. And there are good reasons for this, coming from the regulatory framework.

RIIO-T3

The big boost is set to come from the transition from RIIO-T2 to RIIO-T3 at the start of April. In other words, Ofgem’s previous regulatory framework is replaced by a new one.

These frameworks specify the returns utilities businesses are allowed to generate on their assets going forward. And importantly for National Grid, things are set to look up.

The return on its electric distribution assets is set to increase from around 4.55% to 6.12%. That’s a significant shift that should result in a substantial boost to profits.

To some extent, the stock market has been able to see this coming. But the company hasn’t had a boost like this in the last 10 years and valuations are still below their historic averages.

Long-term investing

National Grid plans to invest up to £35bn over the next five years. And while that’s likely to involve debt, as long as the cost of that is below the allowed return, the firm should do well.

There is, however, a longer-term risk. Regulatory changes can take returns down as well as up and there are no guarantees about what might happen beyond 2031.

If the next framework reduces the allowed return (which happened in 2021) things could become much trickier. And that’s the big risk investors looking at the stock have to weigh up.

Ultimately, National Grid shareholders need to think in five-year cycles. So it’s worth noting that while the outlook until 2031 is positive, things become uncertain after that.

A once-in-a-decade opportunity?

Investors haven’t had a chance to buy National Grid shares before a more favourable rate framework in the last 10 years. That’s worth paying attention to.

On top of this, UK shares are still trading at an unusual discount to their US counterparts – even after last year’s performance. And this includes utilities.

Regulation means competition is a non-issue, but it also limits returns. So while there’s an interesting opportunity right now, ambitious investors might consider looking elsewhere.