Will the State Pension still exist when I retire — and if so, how much will it pay, and at what age will I be able to claim it?

These are questions that I frequently ask myself. I’m not certain it’ll support me when I’m ready to retire two-to-three decades from now, given the UK’s growing debt burden and exploding elderly population.

But I’m not panicking, and I don’t think you should either. With a wide range of investment trusts to choose from, even Brits with little-to-no investing experience have a great chance of achieving a comfortable retirement, irrespective of future State Pension changes.

Three top trusts

Take the Allianz Technology Trust (LSE:ATT), F&C Investment Trust, and Fidelity Special Values trust. Combined, they’ve delivered an average annual return of 13.7% over the last five years.

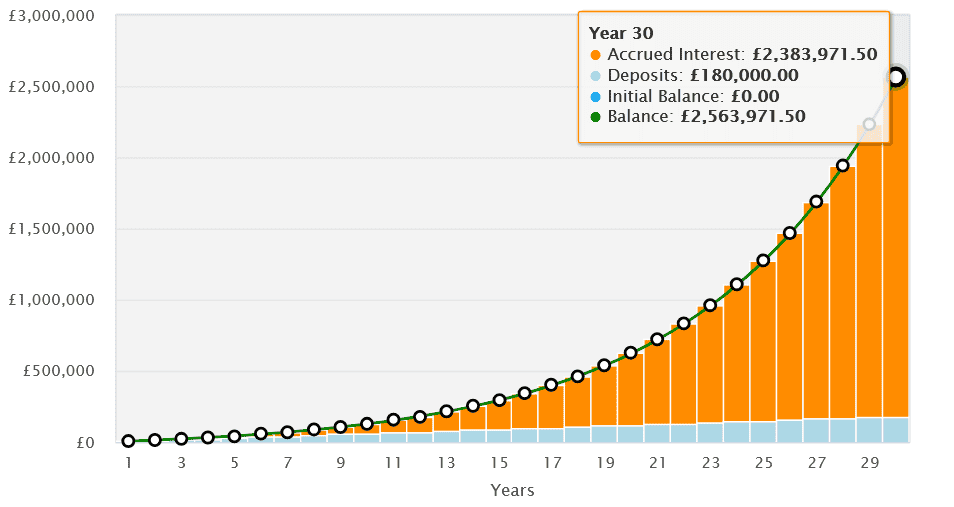

Past performance isn’t always a reliable guide to future returns. But if these investment trusts keep delivering at recent rates, they’d turn a £500 monthly investment spread out equally into a £2.6m retirement fund after 30 years.

Here’s why I expect them to keep outperforming.

Tech trust

Since late 2020, the Allianz Technology Trust’s provided a stunning 14.7% average annual return. This reflects the stunning performance of high-growth shares including Nvidia, Apple, and Microsoft stock.

More recently, its stunning returns have been driven by excitement over the artificial intelligence (AI) revolution. Over the long term, its performance has benefitted from a plethora of hot tech trends, from the growth of social media and e-commerce, to cloud computing and cybersecurity.

In total, the Allianz Technology Trust provides exposure to 50 different technology provides. Spreading itself like this reduces concentration risk, a key strategy in a sector where today’s stars can quickly become outdated.

Be mindful, though, that the trust’s focus on cyclical stocks can harm its performance during economic downturns.

Strength through diversification

F&C Investment Trust’s proved an excellent trust for both capital gains and passive income. Helped by 54 straight years of dividend growth, it’s delivered an average annual return of 11.5% since late 2020.

A large weighting of US tech shares has underpinned that stunning performance. Today, technology stocks account for roughly 30% of the trust’s whole portfolio.

That said, the 359 stocks F&C holds are spread across multiple sectors, including defensive ones like healthcare and utilities. This way the trust offers an excellent balance of growth and security for investors.

Remember, though, that a focus on stocks can still leave it vulnerable to broader market downturns.

Value star

At 15%, the Fidelity Special Values trust’s delivered some of the best sector returns since late 2020. This reflects its focus on UK shares “which the Investment Manager believes to be undervalued or where the potential has not been recognised by the market“.

As demand for cheaper shares in Britain and Mainland Europe heats up, I’m confident it can continue outperforming.

Though a focus on UK stocks creates additional regional risk, the trust’s 150 holdings are really well spread out by sector. Around 46% of the portfolio is dedicated to cyclical shares, with equities in economically sensitive and defensive sectors making up 29% and 25% respectively.

I’m confident a portfolio containing these three trusts could fund a comfortable retirement, even if the State Pension falls short.