I’m always looking for new stocks to put in my Self-Invested Personal Pension (SIPP). That’s why, in early December, I decided to add RELX (LSE:REL) to my portfolio.

Since buying my shiny new shares, they’re up in value. OK, not by very much. But as well as this, Deutsche Bank has just lifted its 12-month price target for the stock by approximately 10%. Of course, savvy investors know that shares should be for life, not just for Christmas, but I find it encouraging when my journey as a new shareholder in a company starts on a positive note.

So why did I buy?

Potentially undervalued

The first thing that brought the company to my attention was the near-20% drop in its share price since December 2024. At first glance, this might seem a bit odd. Why buy something that others don’t appear to want? But sometimes a stock falls out of fashion for no obvious reason. In these circumstances, rational investors should eventually see an opportunity to pick up a bit of a bargain. Clearly, I hope this is the case with RELX.

While it’s true that the group could be impacted by others using artificial intelligence (AI) to take away some of its business, either legitimately or by more dubious means, the group appears relaxed. Instead, it sees the technology as an opportunity. Indeed, it says it’s been using AI tools for over a decade to establish itself as one of the world’s leading providers of information-based analytics and decision tools to professionals and commercial customers.

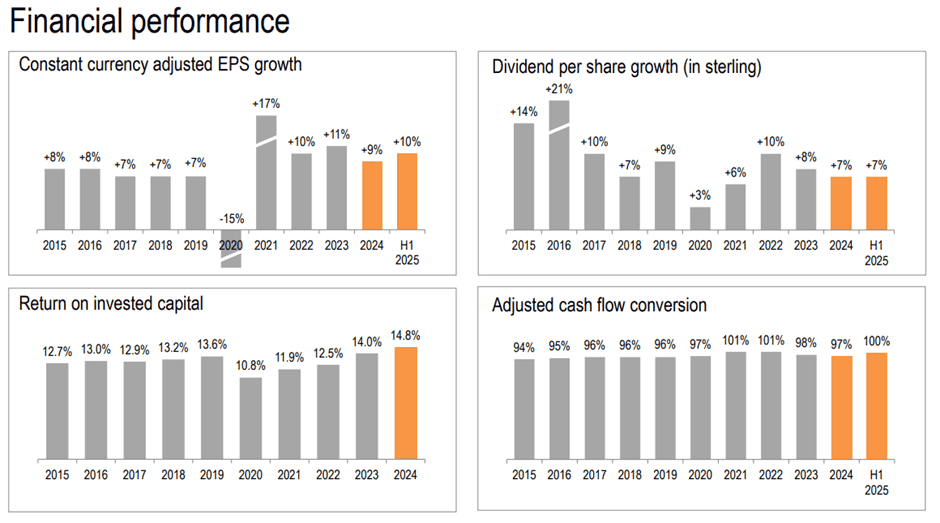

And it appears to be good at what it does. A look at the improvement in some key financial measures over the past 10 years demonstrates this.

Despite being relatively unknown, it’s the UK’s 13th most valuable listed company. It’s share price has increased by around two-thirds since December 2020.

Things to keep an eye on

Like any business, RELX faces a number of challenges. With a large share in its key markets, the opportunity to gain more customers is limited.

Also, in recent years, it’s moved away from printed material to providing its content online. A breach of IT security is therefore a major threat. The recent cyber attacks at Marks & Spencer and Jaguar Land Rover show how costly – both reputationally and financially – systems weaknesses can be.

However, for the first nine months of 2025, the group reported a 7% increase in underlying revenue compared to the same period a year earlier. It claimed an “improving long-term growth trajectory” and “positive momentum across the group”.

I’m not expecting RELX to go gangbusters over the next few years. I reckon it’s more of a slow burner. But that’s the type of stock that, I think, is ideal for a pension pot. Having said that, analysts have set a 12-month share price target that’s over 40% higher than its current value.

So that’s why I decided to put RELX in my SIPP, and why others could consider doing the same. Of course, there are plenty of other UK shares to choose from but, for the time being at least, I’m happy with my selection.