The Stocks and Shares ISA allows us to invest in assets such as shares, funds, and investment trusts, while sheltering any returns from income tax and capital gains tax.

Any dividends received and any growth in the value of the investments can be kept in full, provided contributions remain within the annual ISA allowance.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

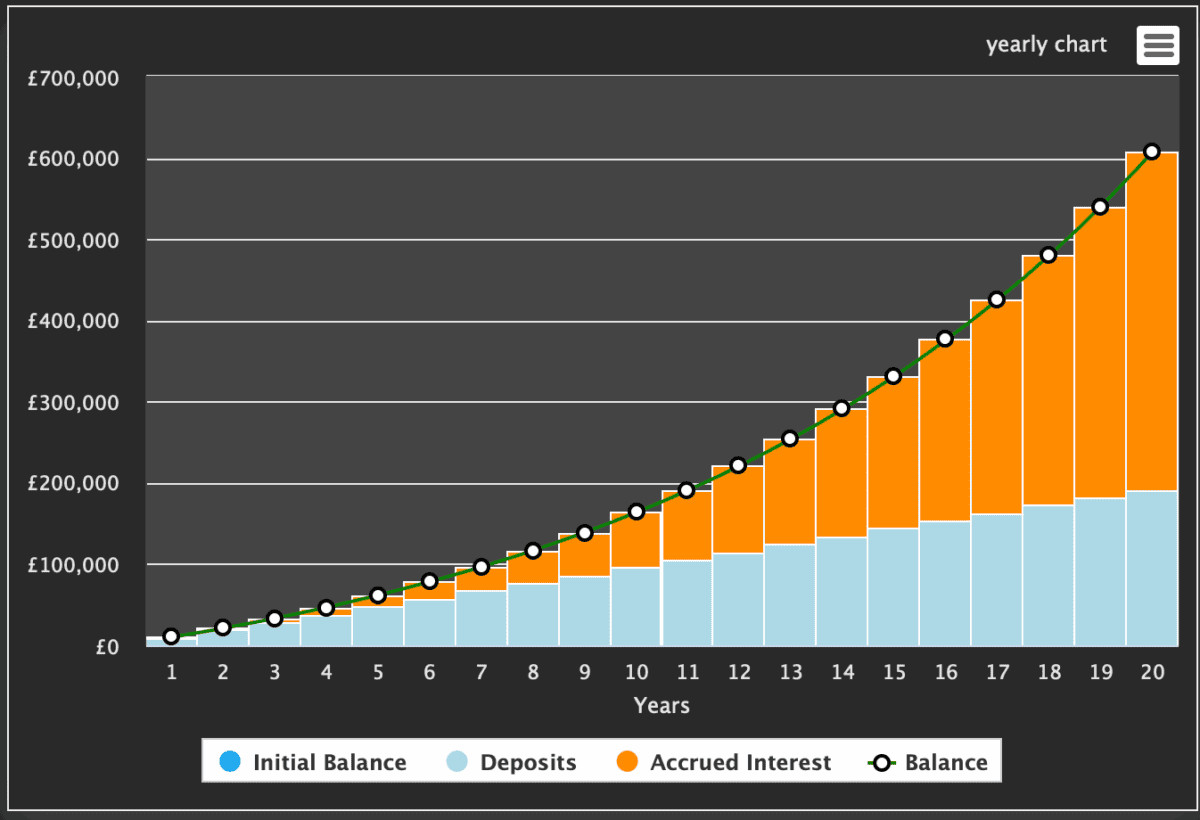

So, this makes it a fairly simple equation. The £2,500 per month of my headline is £30,000 per year. Assuming a 5% drawdown — possible for a ISA, probably not advisable for a SIPP — this means an investor would need £600k in an ISA.

It’s not daunting, it just takes time

If you’re starting from nothing, the idea that you’d need £600,000 to achieve £2,500 a month in passive income might sound daunting.

The key is consistency and the power of compounding. Regularly investing, even small amounts, allows your money to grow exponentially over time as returns generate their own returns.

By contributing steadily — whether monthly or quarterly — and reinvesting dividends, the investment snowball gains momentum.

Patience is also essential: growth may feel slow initially, but over years and decades, the effect becomes significant. Even modest contributions, when combined with disciplined saving and a long-term approach, can add up to substantial wealth.

The goal isn’t instant results. Instead, it’s about building habits that let compounding work quietly and consistently in your favour.

Below we can see how £800 per month would compound into £600k in 20 years with a 10% annualised growth rate.

Where to invest?

Of course, this is all great in theory but the big question is where to invest? The best performance typically comes from a handful of carefully chosen stocks. That’s what I do.

But that doesn’t mean funds, trusts, and bonds, shouldn’t be part of the equation — quite the opposite.

Scottish Mortgage Investment Trust (LSE:SMT) is a core part of my portfolio, and I think it’s one growth-focused investors should consider.

The investment trust has become a flagship growth-focused trust on the FTSE 100, known for backing high-potential companies worldwide.

Its top holdings include SpaceX, TSMC, and Mercadolibre, as well as Nvidia and Amazon.

Scottish Mortgage investors have recently seen the valuation of their holdings soar, with SpaceX now representing 15.3% of total assets, up from 8.2% just two weeks earlier.

This follows a “trigger event” (SpaceX’s valuation moving to $800bn) and a manager-led reappraisal of the trust’s net asset value (NAV). The NAV stood at 1,297.23p per share as of 15 December 2025, reflecting this uplift.

However, the trust does carry leverage risk. This means it borrows to invest, which can amplify both gains and losses. But for long-term growth investors, I think it remains compelling.

The discount to the NAV is currently 10.7%. This suggests where get shares in Nvidia and SpaceX for less than 90p on the pound.