After years in the doldrums, the Aviva (LSE: AV.) share price has come alive in 2025, making it one of the best-performing stocks in the FTSE 100. With the Direct Line integration progressing at pace and a continued shift toward a capital-light model, the key question is whether this momentum can carry into 2026.

Diversified business model

One aspect many investors miss is that Aviva is both a life and non-life insurer. That distinction matters when judging performance over time.

Life insurance is long term and investment-heavy, while non-life insurance is short term and underwriting-driven. Blending the two makes headline profits harder to interpret.

That’s why I focus on a single metric that cuts through the noise: group adjusted operating profit (GAOP). It doesn’t appear directly on the balance sheet or income statement.

GAOP strips out swings in bond yields and equity markets that can distort asset values. Instead, it assumes steady long-term returns, allowing investors to see how well Aviva’s core business is actually performing, rather than how favourable markets happened to be in any given year.

Rising profits

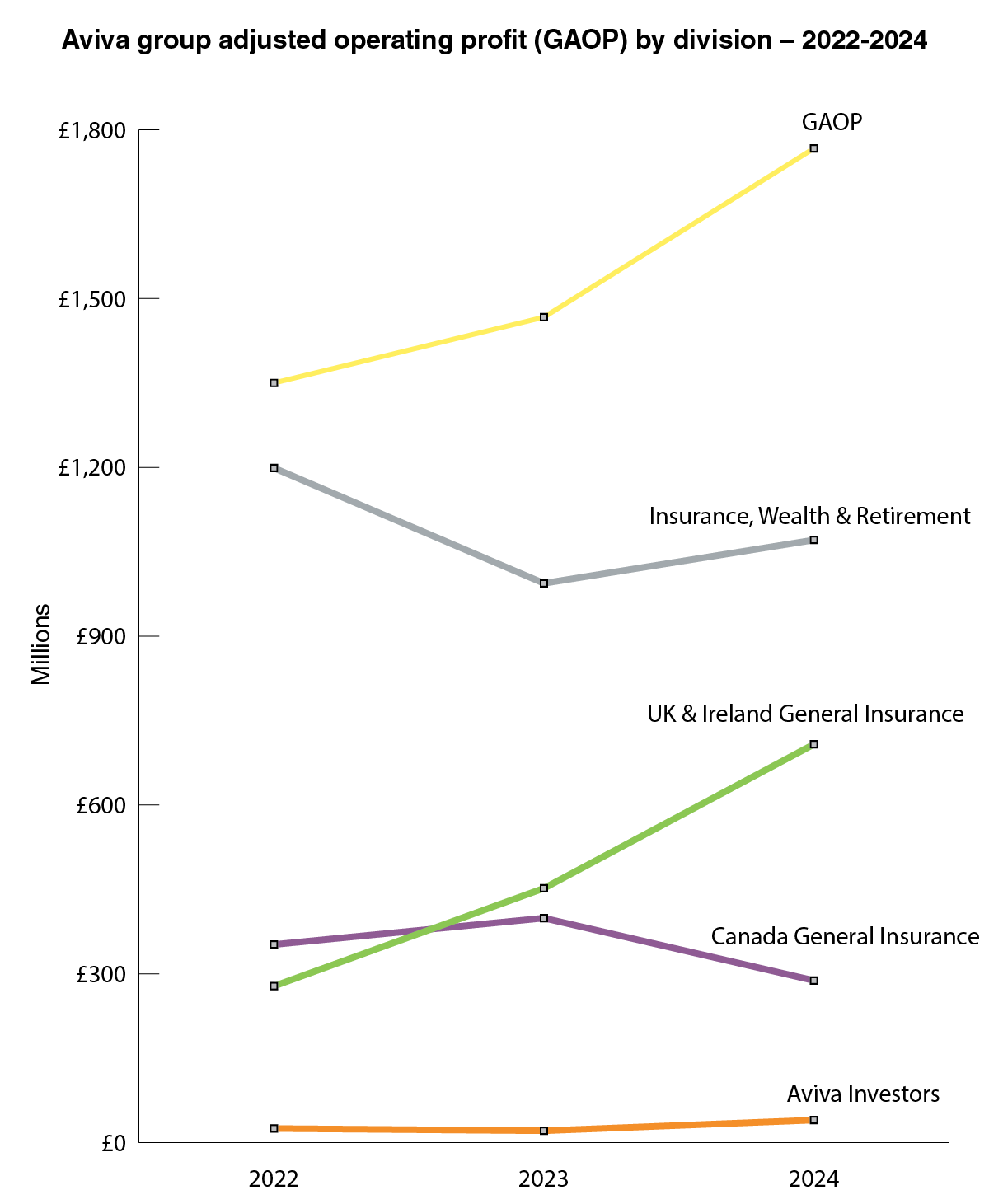

The chart below shows GAOP rising sharply over the past few years, and highlights which divisions contribute the largest share to the total.

Chart generated by author

The key to judging whether GAOP will keep rising is the contractual service margin (CSM).

Under accounting rules, insurers split the value of a policy into two parts:

- Expected future cash flows – premiums in, claims and expenses out

- The CSM – essentially unearned profit, recognised gradually as the insurer provides coverage

Think of the CSM as a profit reservoir: Aviva can’t book all the profit when a policy is sold. Instead, it releases it steadily over the life of the policy as the service is delivered.

The impact of the CSM on GAOP is clear. In 2023, CSM stood at £1,170m, rising to £1,852m in 2024. This growth shows the company has a larger reservoir of unearned profits to release in the coming years, providing a strong boost to GAOP and underlying earnings.

Risks

One risk for Aviva’s Direct Line purchase is the broader softening in UK insurance premiums.

Recent industry data shows quoted motor and home insurance premiums have continued to trend lower year on year. Average motor premiums are down around 16% compared with early 2025 levels, with declines across other personal lines as competition intensifies.

If falling premiums continue into 2026, Direct Line’s motor and home insurance profits could be squeezed, limiting the contribution Aviva expects from the acquisition. High competition and ongoing claims costs may mean the company has to lower its prices further or struggle to raise them, which could weigh on future earnings.

Bottom line

For me, Aviva remains a core holding in my Stocks and Shares ISA for passive income. The company’s 5.3% dividend yield, supported by GAOP dividend cover of 1.92 times, provides a reliable income stream that compounds tax-free over time.

GAOP growth, a rising CSM, and disciplined capital-light execution all point to sustainable long-term earnings. I’ve recently added to my holding, reflecting my confidence in how the business is performing.

Combined with the diversified mix of life and non-life insurance, I expect the business to continue generating steady dividends, while capital growth in the stock could further boost my ISA over time.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.