When discussing Stocks and Shares ISAs, I’m often reminded of Guns N’ Roses’ acoustic masterpiece Patience. Investing in one of these popular products gives long-term investors considerable scope to grow their money over time, thanks to the generous tax breaks on offer.

Like that 1989 smash hit, the stocks ISA has stayed the course and rewarded those who invest for the long haul. Markets rise and fall, but over time they tend to rise considerably. And patient investors who invest what they’ve saved on capital gains and dividend taxes can harness the wealth-boosting effect of compounding even more effectively.

The typical investor is unlikely to make the sort of cash Guns N’ Roses’ frontman Axl Rose has amassed. His wealth is put at around $200m. However, a comfortable retirement is well within reach, with a large ISA income supplementing the State Pension.

But how large would your portfolio need to be to generate a £3,333 monthly passive income?

Building a nest egg

Having an income target is a good idea, as it allows for better investment planning. I think a figure of £3,333 a month is a sensible one to aim for — that equates to just under £40k a year.

It’s a sum that, combined with the State Pension, could fund a very comfortable lifestyle in retirement in my view.

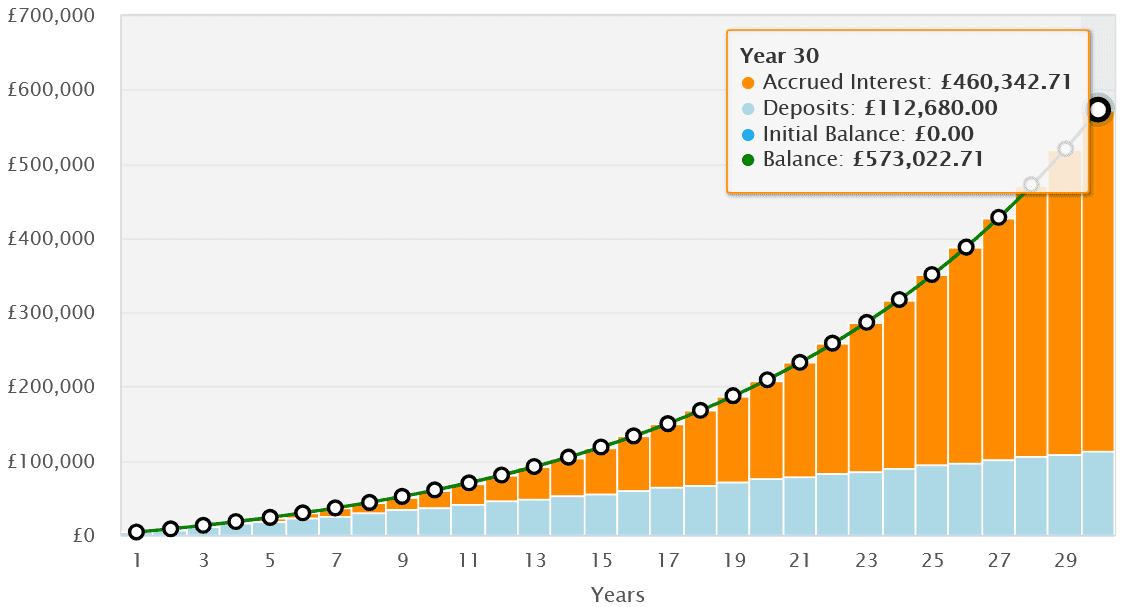

To hit that figure, someone would need an ISA worth £572,000. This assumes our investor puts their money in 7%-yielding dividend stocks and lives off the cash rewards.

But how easy is it to achieve a half-a-million-pound shares portfolio? It won’t be simple, but with the right strategy and (here’s that word again) patience, it’s more than possible.

Someone investing just £313 monthly could reach that £572k target after less than 30 years. That’s based on them achieving an average yearly stock market return of 9%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Dividend star

I love the idea of investing in dividend shares for an income in retirement. A diversified portfolio can deliver a steady flow of cash, as well as providing scope for further portfolio growth over time.

Phoenix Group (LSE:PHNX) is one top share I feel dividend investors should consider. Dividends have risen consistently since 2016, reflecting the company’s robust operating model and deep cash reserves.

As a result, its dividend yield has consistently beaten the long-term FTSE 100 average of 3% to 4%. For 2026, its forward yield is a brilliant 8.2%.

Rumours has it Phoenix may be lining up acquisitions, starting with a takeover bid for Aegon‘s UK operations. Acquisition activity is always risky, and can come at great expense, which can impact dividends.

Yet I’m confident the insurer will remain one of the FTSE’s best payers. Its Solvency II capital ratio of 175% illustrates just how deep its pockets are. This also provides a cushion for dividends in the event earnings come under pressure.

Final thoughts

I think Phoenix Group would be a great addition to a dividend-generating Stocks and Shares ISA. A broad portfolio of 15-plus shares like this could deliver a large and steady passive income over time.