Quantum computing growth stocks were on fire for most of 2025, making some investors an absolute fortune. However, the wheels have come off over the past couple of months, with huge 40%-50% pullbacks in these type of shares.

That hasn’t deterred one leading broker, though, which this week slapped a huge price target on the current leading quantum computing stock.

Let’s take a closer look to see if this offers a buying opportunity for my Stocks and Shares ISA.

$100 target

The Wall Street broker in question is Jefferies and the stock is IonQ (NYSE:IONQ). Jefferies is super-bullish and initiated coverage with a Buy rating and $100 price target.

That’s a whopping 113% above the current share price of $47!

IonQ is a leader in trapped-ion quantum computing. Without getting into the weeds, these systems don’t need the ultra-cold deep-freeze that other quantum computers require. And that could give the firm a significant scaling advantage.

Jefferies thinks the company’s trapped-ion architecture offers superior coherence and fidelity (lower error rates) compared to competing technologies. And it highlights how IonQ is moving from pure computing research into real-world applications.

Aggressive roadmap

This all sounds very promising, but investors need to take a leap of faith by looking out to what might come in 2030. By then, IonQ reckons its machines could support 80,000 logical qubits.

Put simply, that’s how many useful and reliable qubits the machine could run a complex algorithm on. And this level of quantum computing power would presumably unlock massive commercial use cases across multiple industries.

For context, IonQ aims for approximately 800 logical qubits by 2027. This shows how ambitious the firm’s technological roadmap is.

What about revenue growth?

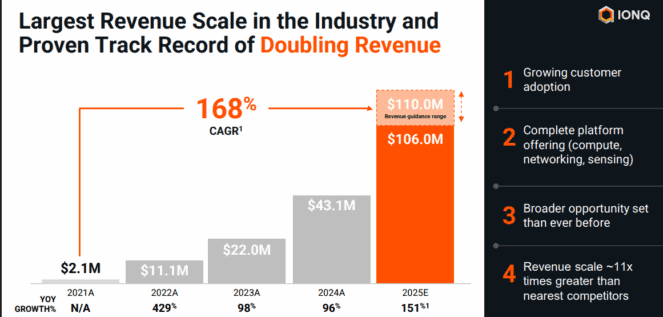

In 2025, IonQ’s revenue is expected to jump more than 150% to around $108m. Then another 78% to nearly $200m, and potentially $1bn+ by 2030.

Clearly then, this is a high-flying company in a potentially revolutionary industry. So, with the stock down 43% since October, should I snap it up for my portfolio?

My move

Unfortunately, IonQ looks too pricey to me today, with its $16.5bn market cap. It puts the stock on 153 times 2025’s expected sales.

Meanwhile, profits are expected to take a backseat for some time, as the firm invests in the significant commercial opportunity ahead. In Q3, the net loss was $1.1bn!

The company recently raised $2bn, bringing its cash position to $3.5bn. However, due to ongoing losses, further cash might be needed, potentially diluting shareholders.

Another concern I have is whether IonQ’s quantum computing approach is really far superior to rivals. Will it really scale up rapidly and reach huge commercial scale (as the valuation suggests)?

With the industry still largely in research and development mode, I still find it impossible to say whether IonQ will emerge as a huge winner.

That said, quantum computing is an industry that I find fascinating. I would like to find a way to invest in its explosive potential, without taking on excessive risk by paying 153 times sales.

IonQ could be a future buy for my ISA portfolio, but its price would have to drop a lot first.