There’s something fitting about the idea of earning a grand a week of passive income in a Stocks and Shares ISA. Especially when the dividends would be tax-free.

But turning that into reality is going to need regular contributions and a fair amount of patience. Here’s how it could work.

Compounding returns

The first thing to note is that dividends are not paid weekly. So, when I say a grand a week, that would be the equivalent of £52,000 paid in dividends every year.

To reach this figure, someone would need an ISA portfolio worth roughly £867,000. This assumes their dividend shares are collectively paying a 6% yield at this point.

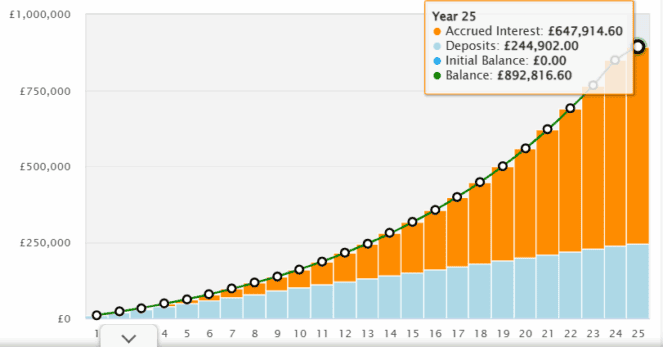

Someone investing just half the annual £20,000 ISA allowance at a 9% average return would get there inside 25 years. Half the ISA limit, by the way, works out at about £833 each month.

For someone who can afford £500 a month, it would take approximately 30 years to get to the target.

I think these returns and timeframes are realistic and achievable for most investors, given the right mindset and consistency.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

FTSE 100 blue-chip

As for investments, the London Stock Exchange is packed with dividend payers. And according to AJ Bell, the most popular share on its investment platform this year has been Legal & General (LSE:LGEN).

The share price is down 1.6% over five years. But when we include the meaty dividends dished out by the financial services company, the five-year annualised return comes in at 7.1%.

That’s actually below the FTSE 100‘s 12.1%. So, why have retail investors been scooping up Legal & General shares this year?

Basically, it’s all about the dividends, with the yield at 8.7%. That’s the highest in the blue-chip index!

Looking ahead to next year, the forecast yield rises to a stunning 9%.

But is the payout sustainable? I think it is. In October, the company said full-year core operating earnings per share growth would likely come in at the higher end of its 6%-9% range, along with 3%+ growth in operational surplus generation.

Legal & General only intends to grow the dividend by 2% per year through to 2027 (from a previous 5%). But the firm also intends to undertake share buybacks, building on the £200m it repurchased in 2024. This might support a gradual rise in the share price.

Of course, events could derail progress, especially a UK economic crisis. The pension risk transfer (PRT) market is also becoming highly competitive.

Longer term though, management says its retail business (workplace pensions, annuities, lifetime mortgages and protection insurance) will replace PRT as the growth driver of its UK annuity asset portfolio. And it expects average portfolio growth of 5%-6% per year for the next two decades.

Given Legal & General’s ultra-high dividend yield and established business model, I think the stock is worth considering.

Bottom line

For someone buying and holding income stocks for 25-30 years, their effective yield would likely be higher than 6%. That’s because quality companies regularly increase their payouts as profits grow (thereby increasing our investor’s yield on cost).

Inevitably, some individual stocks will disappoint with dividend cuts and poor performance. That’s why I think Legal & General would be one to consider inside a diversified portfolio of 15-20 stocks.