Down 67% over five years, my easyJet (LSE: EZJ) shares are one of the worst-performing holdings in my portfolio. It seems the long-suffering budget airline can’t catch a break.

Just last month, it had to recall all its Airbus A320 aircrafts for a software update. Fortunately, the issue didn’t cause any disruptions but it was just one hiccup in a litany of troubles affecting the company.

Still, analysts expect the stock to rise an average of 28% in the coming 12 months. Let’s have a look at why it’s so beaten-down and if the issues really can be resolved in 2026.

Strong financials

To either validate or negate the prospect of a recovery, it’s important to figure out whether the price declines are justified or not.

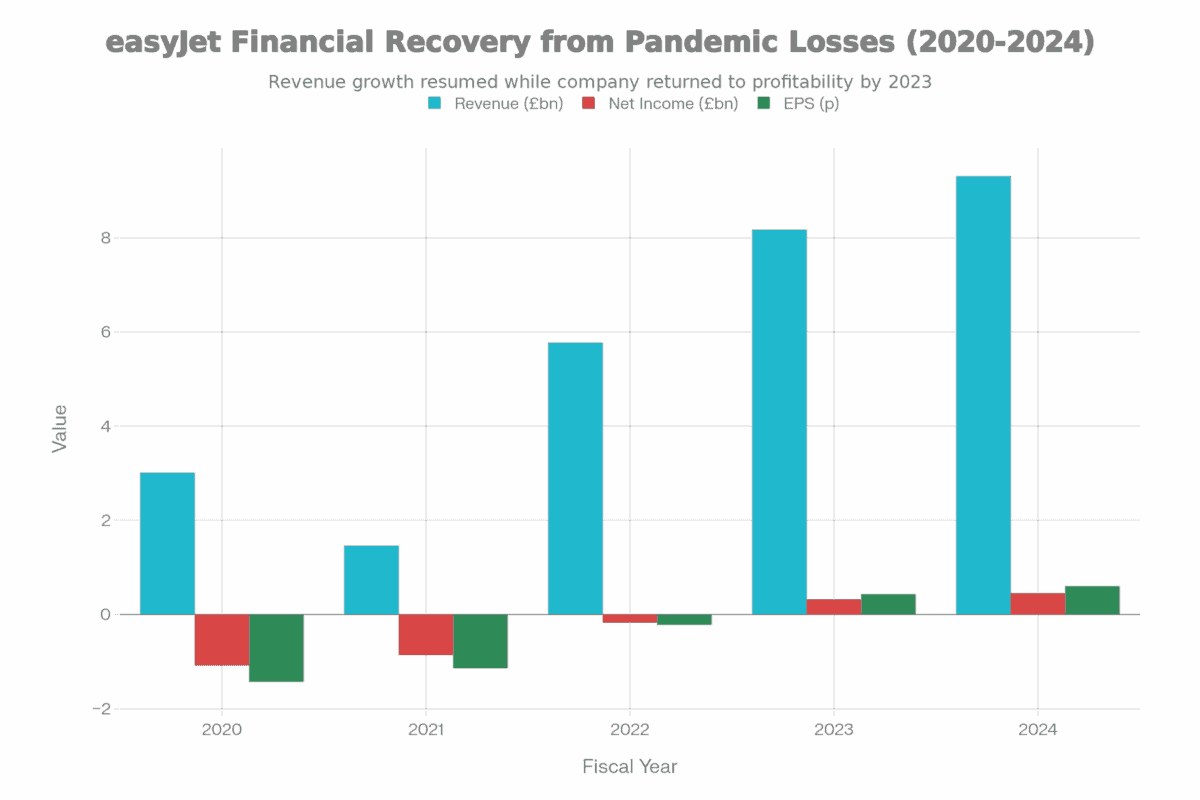

On the plus side, easyJet’s financials look good. The airline has posted three consecutive years of earnings growth, with revenue more than doubling from £3bn in 2020 to £9.3bn in 2024. At the same time, profitability has improved from a £1.1bn loss to a £450m gain.

So why does the price keep falling amid strong financial results? There may be a few reasons.

Debt and dilution

The pandemic wreaked unprecedented damage to the airline during 2020 and 2021, leading to almost £2bn in cumulative losses.

A £1.2bn rights issue and debt restructuring in September 2021 helped alleviate the losses somewhat. However, the resulting share dilution may have caused irrevocable damage to investor sentiment.

Since then, the shares have never recovered, with the strongest rally coming within 14% of the 2020 high.

On top of that, its balance sheet took a hit with rising debt levels and diminishing cash. Between 2023 and 2024, cash dropped 54% from £2.9bn to £1.34bn. Meanwhile, debt rose from £2.88bn to £3.28bn.

But signs of a recovery are already showing, with debt dropping back below £3bn in 2025, and cash rising slightly to £1.5bn. Meanwhile, revenue and earnings have been fairly flat, with net margins improving less than 1% since 2023.

Challenges ahead

Despite the more recent improvements, it may be difficult for easyJet to achieve significant growth in 2026 due to cost pressures. While revenue’s expected to grow 7%, this will likely be insufficient to outpace rising costs, wage inflation, maintenance, and airport charges.

Subsequently, JPMorgan recently downgraded its rating for easyJet, citing risks related to rising costs. Rival Wizzair reportedly faces similar issues, suggesting a sector-wide problem rather than company-specific.

My verdict

easyJet has come close to breaching the critical 600p price level three times in the past two years. Considering the cyclical nature of its earnings, it will probably make another attempt in 2026.

However, the ongoing sector-wide risks combined with oil price volatility make it a risky stock to consider at the moment. Even though the underlying business appears to be operating efficiently, the factors prohibiting a recovery are out of its control.

For now, I’ll keep holding my shares to avoid selling at a loss — but I don’t plan to buy more. A recovery may happen eventually but considering the challenges it faces in 2026, I think some analysts are being over-optimistic.

Fortunately, I’ve recently covered several FTSE 100 stocks that are in a much better position, so British investors are not without options.