Warren Buffett’s investing approach shows how someone hitting 40 with little or no savings could still start building a second income that might reach £12,000 a year by retirement. With steady growth and the power of compounding on their side, an investor’s capital can begin working in ways that could reshape their financial future.

Compounding wealth

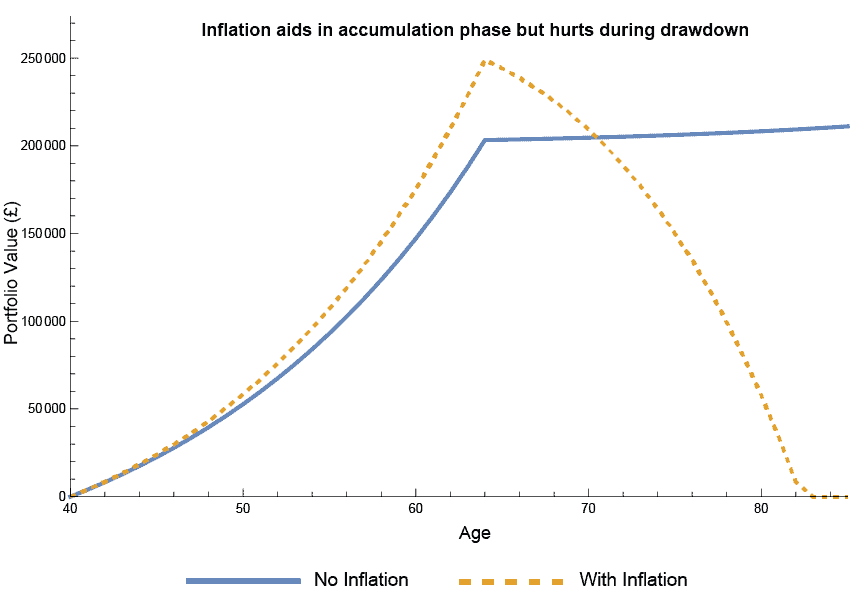

The chart below tells a story many overlook. It shows how a simple, steady plan can grow into a second income – and also the hidden danger that appears later in retirement.

Contribute £4,000 a year. Reinvest every dividend. Earn 6% annually. Over 25 years, the pot could reach around £200,000. On paper, that supports roughly £12,000 a year from age 65, even leaving the capital intact.

But there’s a catch: inflation. Money loses purchasing power quietly but relentlessly. £12,000 today won’t feel the same at 65 — and far less at 85. Once a modest 2% inflation rate is added, the picture shifts. Contributions rise gradually, but inflation-adjusted withdrawals rise faster. In today’s terms, that £12,000 ‘income’ becomes closer to £20,000 at retirement, and the pot can be depleted by age 85.

Chart generated by author

The good news? A 6% annual return is a reasonable long-term aim for a diversified, dividend-focused portfolio. But the chart shows the real challenge isn’t hitting 6% – it’s ensuring those returns keep their value over time. That’s why choosing reliable companies and investing with discipline matters when trying to build a second income that lasts.

High yield stock

With the FTSE 100 sitting near record highs, the number of stocks paying headline-grabbing dividend yields north of 8% has come down.

But then again I don’t just rely on yields to determine whether a stock is worthy of addition to my portfolio, anyway. I look for a history of increasing payouts and a clear path for future payments.

Phoenix (LSE: PHNX) is a company that pairs strong dividend growth with a high yield. Its forward yield sits at 8%, and dividends per share have risen 32% since 2015, from 40.8p to 54p. That covers the track record – but what about the sustainability of future payments?

Future Dividends

The company looks at three main metrics when considering dividend increases: operating cash generation (OCG), shareholder capital coverage, and distributable reserves. Of these, OCG is the easiest to track and understand.

At its H1 results in September, OCG rose 9% to £705m, enough to cover dividends and recurring costs like interest and operations.

For the full year, the company expects around £300m in excess cash after all outlays. That level of cash flow suggests the potential for dividends to grow over time – though of course, no payouts are ever guaranteed.

Despite a strong track record and solid cash generation, there are always risks. Economic downturns, regulatory changes, or unexpected operational costs could limit future dividend growth. Interest rate changes and market volatility may hit the value of its large bond portfolio, thereby affecting its ability to maintain high payouts.

Bottom Line

Building a second income takes patience, planning, and disciplined investing – exactly what Warren Buffett preaches. Stocks like Phoenix, with strong cash generation and growing dividends, illustrate how compounding can work over time. It’s not guaranteed, but focusing on long-term growth, sustainability, and careful stock selection can turn modest contributions into a meaningful retirement income.