While dividends are never guaranteed, with the right strategy it’s possible to generate a second income that supports a comfortable retirement.

In fact, thanks to the enormous dividends UK shares often pay, retirees can realistically expect financial freedom by buying dividend stocks. This is comforting in an age when the future of the State Pension comes under increased scrutiny.

Yet setting up a passive income portfolio takes some preparation and regular attention. Want to know how to get started?

Falling yields

Dividend yields on FTSE 100 and FTSE 250 shares have historically ranged between 3% and 4%. Unfortunately from a passive income perspective, surging share prices in 2025 have driven yields to the bottom end of this range.

The average dividend yield on Footsie shares is now 3.1%. In dividend terms, that means a £20,000 investment in an index tracker would provide an income of £620.

That’s not terrible, and especially when compared to the yields on overseas shares. But it’s hardly the sort of return that will give most people the financial freedom they’re seeking in retirement — unless you have a million pounds or more invested.

Check out this dividend hero

Yet dropping index yields don’t mean it’s time to panic. The UK stock market remains full of quality stocks that can deliver a strong and sustained income.

Let’s look at the example of Phoenix Group (LSE:PHNX). At 8%, its dividend yield is more than double the FTSE 100 average.

At this rate, a £20k lump sum would provide a much tastier £1,600 income.

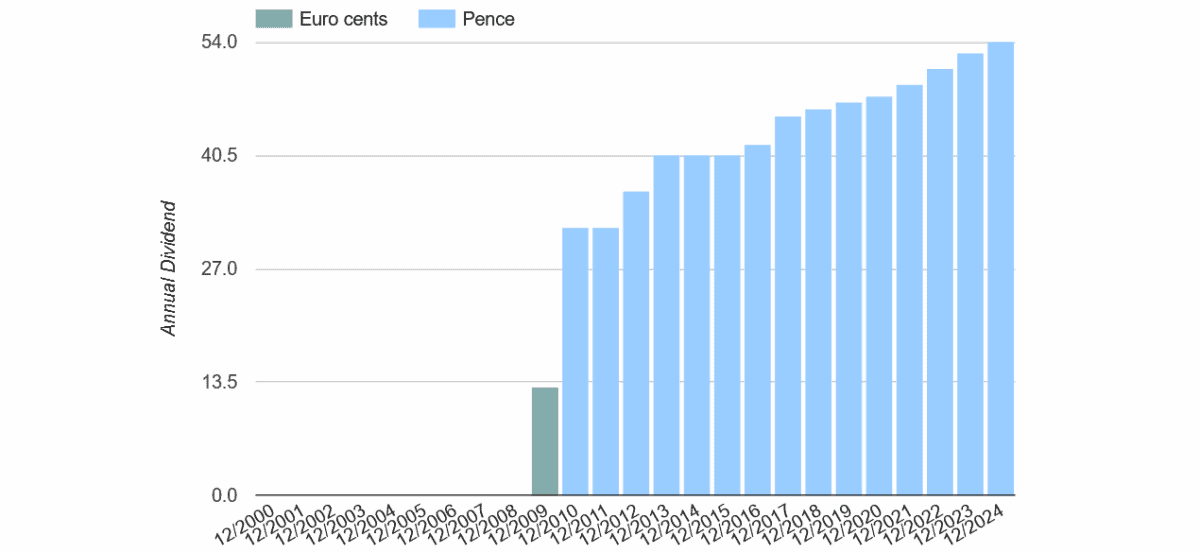

But can Phoenix sustain payouts at this level? The answer’s an emphatic ‘yes,’ as the company’s long record of large and growing dividends demonstrates:

The pensions and insurance firm benefits from enormous cash flows, supported by the regular premiums it collects from policyholders. This gives it plenty of surplus capital to return to shareholders.

It’s churning out money at such pace, in fact, that in 2024 the firm hit its operating cash generation (OCG) target of £1.4bn two years early. Encouragingly for future dividends, cumulative OCG is now expected at £5.1bn between 2024 and 2026, up from £4.4bn previously.

The risk for dividend chasers is that Phoenix may decide to use more of its extra cash in other areas. This could include organic investments, funding acquisitions, or deleveraging.

Even so, I think the company will remain one of the FTSE’s best dividend payers.

Generating a £49k second income

Naturally I wouldn’t put all of my cash into Phoenix shares for dividends. I’d diversify across 15-20 different shares, trusts, and funds to reduce risk and provide a smoother return over time.

With a portfolio of shares including Phoenix, I think an investor could realistically achieve an average yield of 7%. At this rate, a £700,000 investment would throw off a healthy £49,000 a year in passive income. That’s the sort of windfall that could fund a comfortable retirement even without the State Pension.