Another year, another spectacular performance from Rolls-Royce (LSE:RR.) and its share price.

Up 89% since 1 January, the FTSE 100 company’s left global rivals like RTX Corporation (+46%), General Electric (+71%) and Safran (+37%) firmly in its wake. Closer to home, it’s also outstripped the UK’s biggest pureplay defence company BAE Systems (+48%).

At £11.12, Rolls-Royce shares are now up 847% over five years. Considering these staggering gains, could we see the engineer double in value in 2026?

Great news!

There are good reasons to expect further strength next year, including continued growth in the civil aerospace sector. This is Rolls’ single largest market, where it’s a major player in supplying airplane engines and delivering aftermarket services.

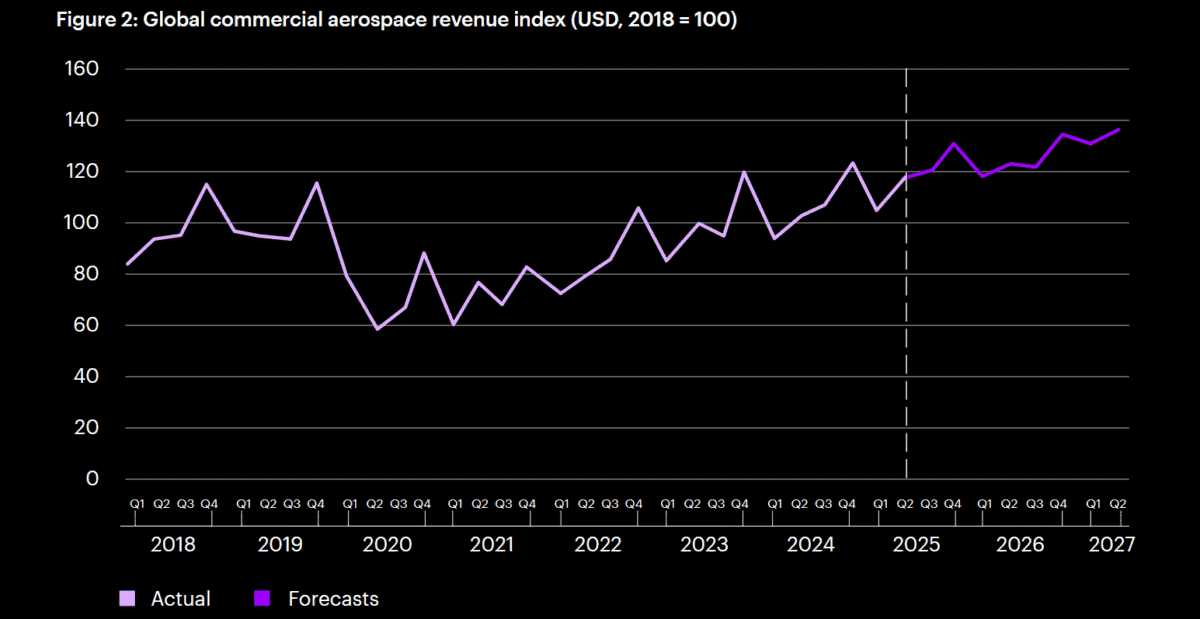

Analysts at Accenture note that “the commercial aerospace market enters 2026 with renewed momentum,” adding that a “projected 25% rise in aircraft deliveries and sustained aftermarket demand are powering this rebound.”

Given Rolls-Royce’s enormous competitive advantages and huge global base, it’s well placed to capitalise on this continued upswing. But that’s not the only reason for optimism — rising defence budgets, and increasing interest in its small modular reactors (SMRs), bode well for other bits of the business.

There could also be more fireworks to come from its ongoing streamlining drive. Cost-cutting and efficiency measures are sending margins and cash flows through the roof.

What might go wrong?

Yet there are some potential stormclouds on the horizon for Rolls and its share price. Supply chain issues remain a problem for the company, and a possible worsening of conditions isn’t out of the question.

Rolls warned of “continued supply chain challenges” as recently as last month’s trading update. Labour and parts shortages threaten its engine deliveries and servicing capabilities, not to mention its progress in reducing costs.

That’s not all. With the global economy facing ongoing challenges (from trade tensions to lumpy inflation), the airline industry’s post-Covid recovery might also be in danger.

And finally, while Rolls is making huge strides with SMRs, huge competition here means success is by no means guaranteed. Project development problems could also scupper future revenues hopes and confidence in the company.

Are Rolls-Royce shares a Buy?

Taking everything into account, is Rolls a possible Buy to think about for the New Year?

I’m not so sure. And particularly when I consider how expensive its shares currently are.

Rolls now trades on a forward price-to-earnings (P/E) ratio of 39.2 times. That enormous valuation is triple the broader FTSE 100‘s corresponding reading of 12.3.

Not only could this high valuation limit further price rises. I’m fearful it could prompt a price collapse if the engineer begins to run out of steam.

That said, I was wrong when assessing Rolls-Royce’s share price prospects in 2025. I may be incorrect again, though I still highly doubt it will double.

I won’t buy the stock myself, but I feel it could be worth considering.